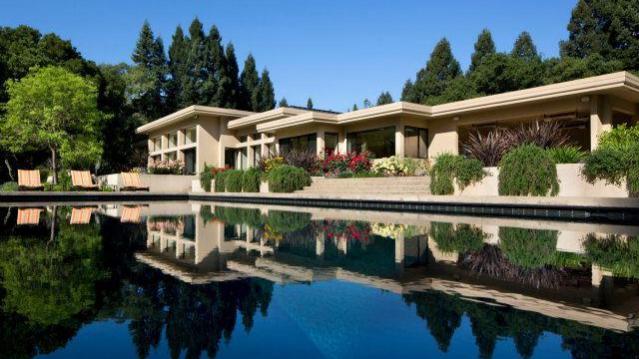

This Is What America’s 'Dream Home' Looks Like

The dream home for today’s American consumer is just over 2,000 square feet and located outside of a major city, according to a report out today by Trulia.

Consumers polled by the real estate Web site said the top features in their dream home were a backyard deck, a gourmet kitchen, and an open floorplan.

Owning a home is still part of the American dream for 70 percent of those polled, down from 77 percent five years ago. The portion of Americans who want to buy a home one day was highest—hitting almost 90 percent—among millennials.

Related: 10 Luxury Home Amenities that Are Trending Up

Those findings echo the results of a Wells Fargo poll in June, which found that nearly two-thirds of consumers say that home ownership is a “dream come true” and an accomplishment to be proud of.

Despite the desire for home ownership, only 14 percent of those surveyed by Trulia said they would buy a home this year. Nearly 70 percent said they planned on waiting at least two years to make a purchase.

The country’s home ownership rate fell to 63.7 percent in the first quarter, the lowest level since 1989. The rate peaked at 69.2 percent in the fourth quarter of 2004, right before the housing bubble burst.

Just 36 percent of millennials who want to buy a home are currently saving to purchase one. As rents in many cities continue to skyrocket, however, homeownership may become more appealing.

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

Why Craft Brewers Are Crying in Their Beer

It may be small beer compared to the problems faced by unemployed federal workers and the growing cost for the overall economy, but the ongoing government shutdown is putting a serious crimp in the craft brewing industry. Small-batch brewers tend to produce new products on a regular basis, The Wall Street Journal’s Ruth Simon says, but each new formulation and product label needs to be approved by the Treasury Department’s Alcohol and Tobacco Tax and Trade Bureau, which is currently closed. So it looks like you’ll have to wait a while to try the new version of Hemperor HPA from Colorado’s New Belgium Brewing, a hoppy brew that will include hemp seeds once the shutdown is over.

Number of the Day: $30 Billion

The amount spent on medical marketing reached $30 billion in 2016, up from $18 billion in 1997, according to a new analysis published in the Journal of the American Medical Association and highlighted by the Associated Press. The number of advertisements for prescription drugs appearing on television, newspapers, websites and elsewhere totaled 5 million in one year, accounting for $6 billion in marketing spending. Direct-to-consumer marketing grew the fastest, rising from $2 billion, or 12 percent of total marketing, to nearly $10 billion, or a third of spending. “Marketing drives more treatments, more testing” that patients don’t always need, Dr. Steven Woloshin, a Dartmouth College health policy expert and co-author of the study, told the AP.

70% of Registered Voters Want a Compromise to End the Shutdown

An overwhelming majority of registered voters say they want the president and Congress to “compromise to avoid prolonging the government shutdown” in a new The Hill-HarrisX poll. Seven in ten respondents said they preferred the parties reach some sort of deal to end the standoff, while 30 percent said it was more important to stick to principles, even if it means keeping parts of the government shutdown. Voters who “strongly approve” of Trump (a slim 21 percent of respondents) favored him sticking to his principles over the wall by a narrow 54 percent-46 percent margin. Voters who “somewhat approve” of the president favored a compromise solution by a 70-30 margin. Among Republicans overall, 61 percent said they wanted a compromise.

The survey of 1,000 registered voters was conducted January 5 and 6 and has a margin of error of 3.1 percentage points.

Share Buybacks Soar to Record $1 Trillion

Although there may be plenty of things in the GOP tax bill to complain about, critics can’t say it didn’t work – at least as far as stock buybacks go. TrimTabs Investment Research said Monday that U.S. companies have now announced $1 trillion in share buybacks in 2018, surpassing the record of $781 billion set in 2015. "It's no coincidence," said TrimTabs' David Santschi. "A lot of the buybacks are because of the tax law. Companies have more cash to pump up the stock price."

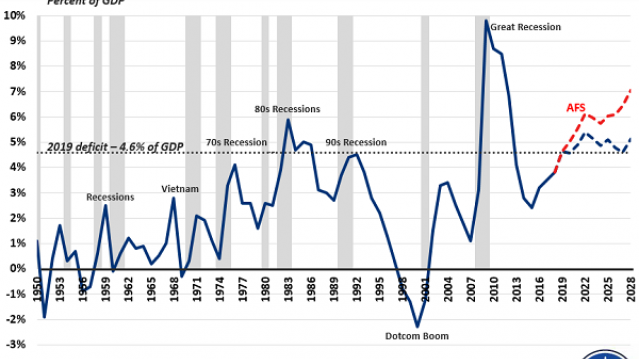

Chart of the Day: Deficits Rising

Budget deficits normally rise during recessions and fall when the economy is growing, but that’s not the case today. Deficits are rising sharply despite robust economic growth, increasing from $666 billion in 2017 to an estimated $970 billion in 2019, with $1 trillion annual deficits expected for years after that.

As the deficit hawks at the Committee for a Responsible Federal Budget point out in a blog post Thursday, “the deficit has never been this high when the economy was this strong … And never in modern U.S. history have deficits been so high outside of a war or recession (or their aftermath).” The chart above shows just how unusual the current deficit path is when measured as a percentage of GDP.