The Crazy Reason Treasury Department Officials Can’t Get Their Work Done

Treasury Department officials are being driven to distraction these days, but it’s not because of the expiring debt ceiling or other pressing financial controversies.

Instead, loud music from a New Orleans-style street band known as Spread Love has reportedly driven some officials and employees at the Treasury building to wear earphones to block out the noise and even move meetings to other parts of the building to find some peace and quiet.

Related: The Next Debt Crisis Could Be Much Worse than in 2013, GAO Warns

“We have to relocate our conference calls,” one Treasury employee told The Washington Post. “We can’t have meetings in that corner of the building anymore. It’s like they’re playing music in the building.”

Members of Spread Love have become fixtures of downtown Washington’s street scene and are collecting generous donations for playing their drums, trombone and other brass instruments. Tourists and other office workers out during their lunch hour appear to love the group, but not so the serious-minded economists and bean counters at the Treasury – especially when the band moves within easy shouting distance at the corner of 15th and G Streets NW.

Treasury Secretary Jack Lew’s staff members aren’t the only ones complaining about the jarring music. Partners and associates at the law firm of Skadden, Arps, Slate, Meagher & Flom find it hard to concentrate on their cases with daily interruptions. It got to the point that the firm dispatched a security guard to offer band members $200 a week if they would play somewhere else. Lonnie Shepard, one of the trombonists, told the newspaper that he laughed at the offer because “We can make that in an hour.”

Related: End of Sanctions Worth Hundreds of Billions to Iran

Rob Runyan, a spokesperson for the Treasury Department, said that employee complaints have made their way to the office of the assistant secretary for management, Brodi Fontenot, but there really wasn’t much that could be done.

“The band and other street noise are part of the distractions of working in downtown D.C.,” Runyan said in an interview Friday.

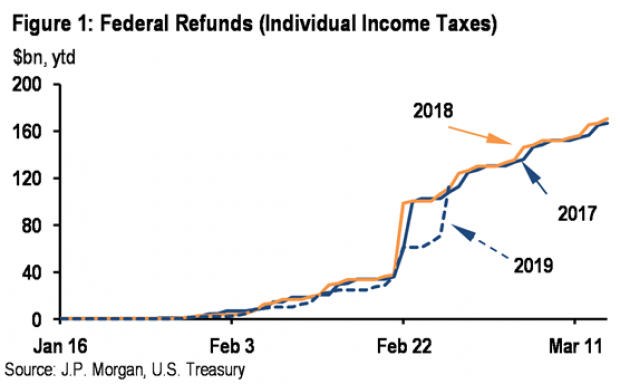

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

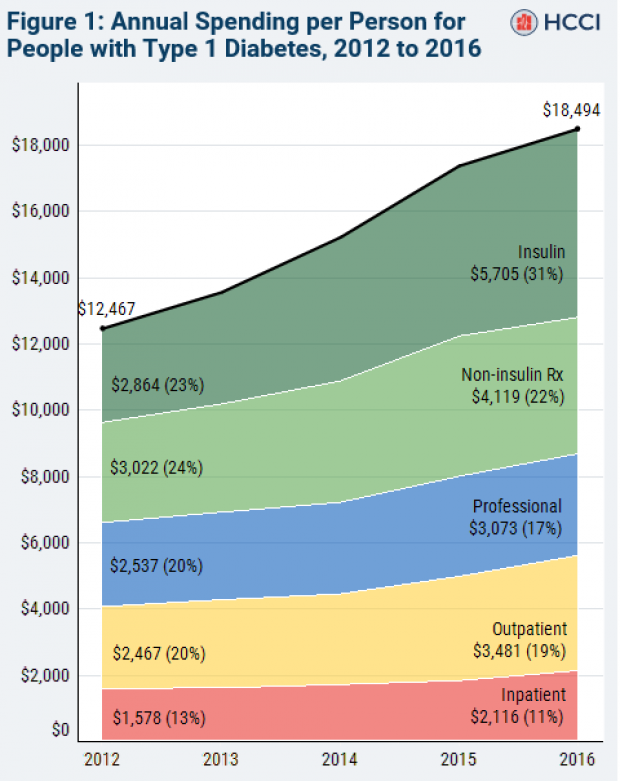

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

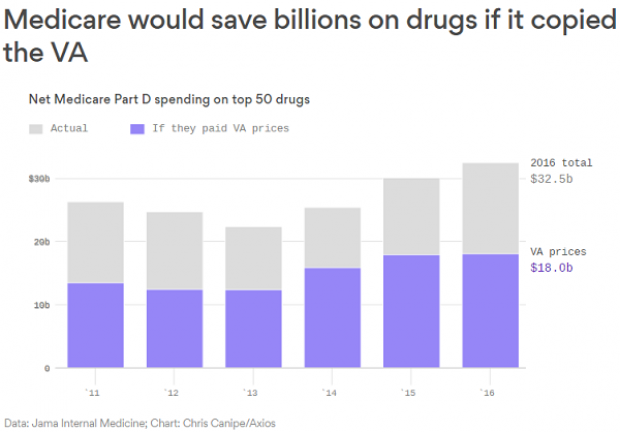

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.