The Weakest Economic Recovery Since World War II Putters Along

New GDP data released today shows an economy that continues to grow, though at a disappointingly moderate pace.

The good news is that GDP growth picked up after the weak, snow-encrusted first quarter of 2015, when the economy eked out a 0.6 percent growth rate. The bad news is that growth was expected to hit a 2.5 percent rate or better in the second quarter, but initial estimates arriving today pegged that rate at 2.3 percent. Over the first six months of the year, the economy has expanded at an annual rate of 1.5 percent.

The U.S. recession officially ended in the second quarter of 2009. Since then, growth has been relatively steady but lackluster. Compared to other recoveries since the end of World War II, the current recovery is notably weak – without question the weakest of the bunch. The average annual growth rate from 2011 through 2014 was 2.0 percent, based on updated figured released today.

Economists have argued about the causes — a glut of capital, excessive regulation, the domination of finance, low wages driving weak demand — but the simple fact remains: This is a feeble recovery.

This graphic we produced on the Federal Reserve Bank of Minneapolis’s website tells the story – look for the bright red line:

Top Reads from The Fiscal Times:

- The Kids Aren't Alright: More Millenials Are Living with Their Parents

- How Millenials Could Damage the U.S. Economy

- The Pain the Job Numbers Don’t Show

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

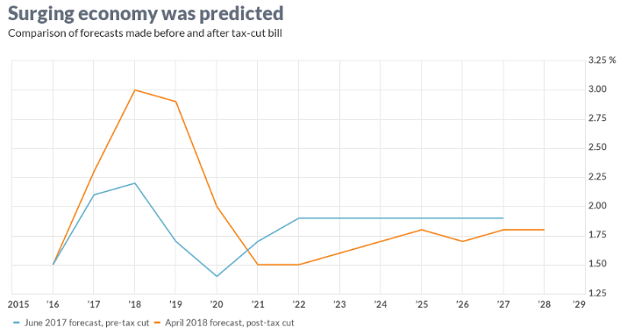

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

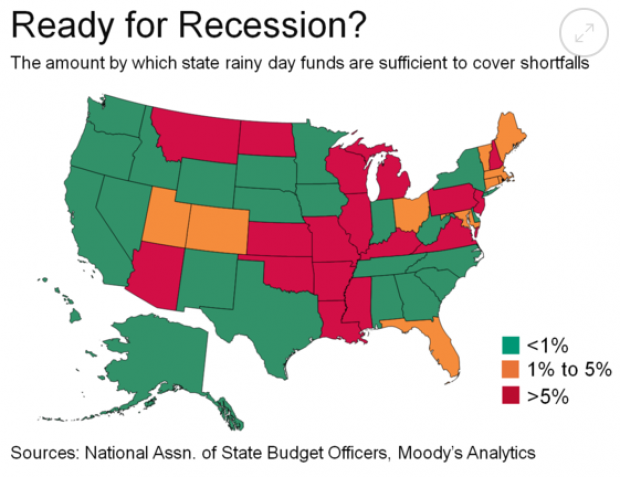

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

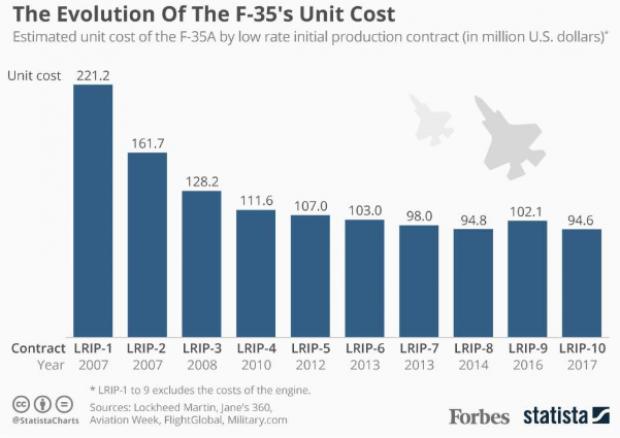

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.