DOJ Indicts Democratic Lawmaker for Corruption

Martin Matishak, The Fiscal Times

The Justice Department has indicted Rep. Chaka Fattah (D-PA) on almost 30 federal counts of political corruption.

The 11-term congressman and four associates were indicted on 29 federal charges, including bribery, money laundering, falsification of records, and multiple counts of bank and mail fraud, the department announced Wednesday.

Related: Billions in Unfinished Business as Congress Heads Out for Vacation

The charges against Fattah and his associates stem from his failed run for Philadelphia mayor in 2007.

Fattah and the others "embarked on a wide-ranging conspiracy involving bribery, concealment of unlawful campaign contributions and theft of charitable and federal funds to advance their own personal interests,” according to Assistant Attorney General Leslie R. Caldwell.

Justice alleges that Fattah borrowed $1 million from a wealthy donor during his mayoral bid and that he returned $400,000 in unused funds and developed a scheme to repay the remaining $600,000 by tapping charitable and federal grants through a local non-profit the Pennsylvania lawmaker created.

Federal officials also allege that the Fattah sough to repay supporters by offering federal grants and used funds from both his mayoral and congressional campaigns to pay down his son's student loan debts of around $23,000.

"Public corruption takes a particularly heavy toll on our democracy because it undermines people’s basic belief that our elected leaders are committed to serving the public interest, not to lining their own pockets,” she said in a statement.

House Minority Leader Nancy Pelosi (D-CA) said that Fattah has stepped down as the top Democrat on the House Appropriations Commerce, Justice, Science and Related Agencies subcommittee.

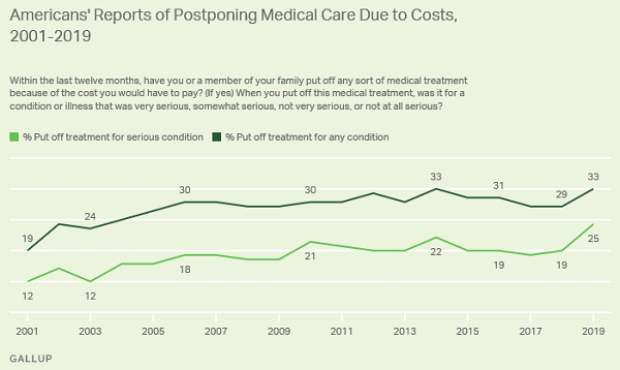

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

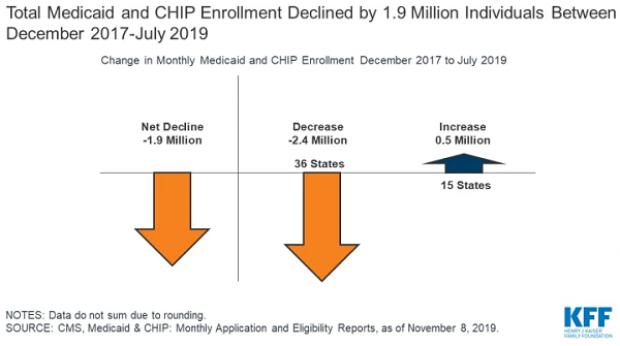

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.