Donald Trump Isn’t as Rich as He Says…but He’s Still Pretty Rich

“I’m really rich,” Donald Trump boasted last month when he announced he was running for president. A new analysis by Bloomberg confirms that claim, but finds that the real estate mogul and presidential candidate is worth about $7 billion less than he claims.

When he announced his presidential bid, Trump touted a net worth of about $8.7 billion, a figure that soon ballooned to $10 billion. But Bloomberg calculates his wealth closer to around $2.9 billion. The Bloomberg Billionaires Index, a daily ranking of the world’s biggest fortunes, arrived at the value using both prior-known information and a 92-page personal disclosure form that Trump filed with the Federal Election Commission.

Related: 7 Revelations from Donald Trump’s Financial Disclosure

The federal form that all presidential candidates are required to submit asks only for broad ranges in asset values, not specific sums. Anything above $50 million in value is lumped together in one category, which in Trump’s case left plenty of room for questions about just how valuable some of his assets are. The federal report also doesn’t require candidates to list personal property like art, clothing or real estate that’s for his own use.

The Bloomberg analysis went into much more depth, using figures such as purchase dates, square footage, rental rates and more.

The disclosure form revealed that most of Trump’s fortune comes from real estate holdings, such as the Trump Doral resorts in Florida and Trump Tower on Fifth Avenue in New York City. Other lucrative properties include premier golf courses in the U.S., Ireland and Scotland.

Related: Donald Trump Just Showed Why His Campaign Is Doomed

Trump had valued his golf and resort properties at $2 billion. Bloomberg, using price-to-sales ratios for similar properties, put the value at a combined $570 million.

The Bloomberg methodology also doesn’t put much value in the Trump brand, counting only the cash being held as part of licensing or other business deals. “Trump’s own estimations,” Bloomberg noted, “include much higher values for his brand.”

Top Reads from The Fiscal Times:

- Huckabee Trounces Trump in the Shameless Shock Game

- You’re Richer Than You Think. Really.

- 15 Facts You Didn’t Know About Donald Trump

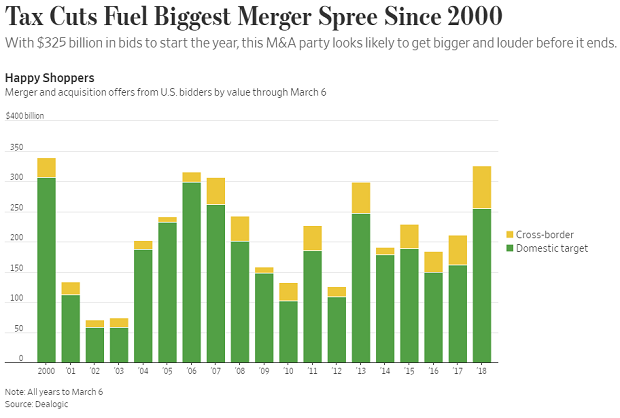

Chart of the Day: A Buying Binge Driven by Tax Cuts

The Wall Street Journal reports that the tax cuts and economic environment are prompting U.S. companies to go on a buying binge: “Mergers and acquisitions announced by U.S. acquirers so far in 2018 are running at the highest dollar volume since the first two months of 2000, according to Dealogic. Thomson Reuters, which publishes slightly different numbers, puts it at the highest since the start of 2007.”

Number of the Day: 5.5 Percent

Health care spending in the U.S. will grow at an average annual rate of 5.5 percent from 2017 through 2026, according to new estimates published in Health Affairs by the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS).

The projections mean that health care spending would rise as a share of the economy from 17.9 percent in 2016 to 19.7 percent in 2026.

Trump Clearly Has No Problem with Debt and Deficits

A self-proclaimed “king of debt,” President Trump has produced a budget that promises red ink as far as the eye can see. With last year's $1.5 trillion tax cut reducing revenues, the White House gave up even trying to pretend that its budget would balance anytime soon, and even the rosy economic projections contained in the budget couldn’t produce enough revenues, however fanciful, to cover the shortfall.

The Trump budget spends as much over 10 years as any budget produced by President Barack Obama, according to Jim Tankersley of The New York Times. And it projects total deficits of more than $7 trillion over the next decade — "a number that could double if the administration turns out to be overestimating economic growth and if the $3 trillion in spending cuts the White House has floated do not materialize in Congress,” Tankersley says.

Trump — who once promised to both balance the budget and pay down the national debt — isn’t the only one throwing off the shackles of fiscal restraint. Republicans as a whole appear to be embracing a new set of economic preferences defined by lower taxes and higher spending, in what Bloomberg describes as a “striking turnabout” in attitudes toward deficits and the national debt.

But some conservatives tell Tankersley that the GOP's core beliefs on spending and debt remain intact — and that spending on Social Security and Medicare, the primary drivers of the national debt, are all that matters when it comes to implementing fiscal restraint.

“They know that right now, a fundamental reform of entitlements won’t happen," John H. Cochrane, an economist at Stanford University’s Hoover Institution, tells Tankersley. "So, they have avoided weekly chaos and gotten needed military spending through by opening the spending bill, and they got an important reduction in growth-distorting marginal corporate rates through by accepting a bit more deficits. They know that can’t be the end of the story.”

Democrats, of course, have warned that the next chapter in the tale will involve big cuts to Social Security and Medicare. Even before we get there, though, Tankersley questions whether the GOP approach stands up to scrutiny: "This is a bit like saying, only regular exercise will keep America from having a fatal heart attack, so, you know, it's ok to eat a few more hamburgers now."

Part of the Shutdown-Ending Deal: $31 Billion More in Tax Cuts

Margot Sanger-Katz and Jim Tankersley in The New York Times: “The deal struck by Democrats and Republicans on Monday to end a brief government shutdown contains $31 billion in tax cuts, including a temporary delay in implementing three health care-related taxes.”

“Those delays, which enjoy varying degrees of bipartisan support, are not offset by any spending cuts or tax increases, and thus will add to a federal budget deficit that is already projected to increase rapidly as last year’s mammoth new tax law takes effect.”

IRS Paid $20 Million to Collect $6.7 Million in Tax Debts

Congress passed a law in 2015 requiring the IRS to use private debt collection agencies to pursue “inactive tax receivables,” but the financial results are not encouraging so far, according to a new taxpayer advocate report out Wednesday.

In fiscal year 2017, the IRS received $6.7 million from taxpayers whose debts were assigned to private collection agencies, but the agencies were paid $20 million – “three times the amount collected,” the report helpfully points out.

Like what you're reading? Sign up for our free newsletter.