Sweet, Sour, Salty and...Fat? Scientists Add a New Basic Taste

The thousands of taste buds on a human tongue each contain as many as 100 taste receptors. The interaction between those receptors and the chemicals in our food determine the taste of that hamburger or salad you’re having for lunch.

Our sense of taste has long been broken into four basic categories — sour, sweet, salty and bitter. A fifth basic taste was added more recently: umami, which means “delicious” in Japanese but refers to a meaty or savory flavor sensation. Now researchers claim there’s a sixth basic taste.

Scientists at Purdue University have published a new study in the journal Chemical Sense that they say provides evidence that chemicals called nonesterified fatty acids (NEFA) — in other words, fat — causes a taste sensation that is different from the other five tastes. The researchers have proposed that the new taste be referred to as “oleogustus.” “Oleo” is the root word for oily or fatty in Latin and “gustus” means taste.

Related: The 11 Worst Fast Food Restaurants in America

The researchers emphasize that they are talking about a taste, not just the creamy mouth feel you get from eating a rich piece of meat or a dish loaded in butter.

The fat that delivers that creamy, smooth feeling is a triglyceride, made up of three different fatty acids, they explain. Oleogustus — a gag-inducing taste on its own, but much more appetizing in combination with other flavors — comes from only one of those fatty acids that breaks off from the larger molecule in the food or as you’re chewing.

This finding has the potential to generate big changes in the food industry. Understanding the taste component of fat can do more than add to our knowledge of how our brain and digestive system interact. It may also help the food industry create more appealing, and potentially healthier, products.

Top Reads from The Fiscal Times:

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- You’re Richer Than You Think. Really.

- The New Generation of ‘Genuinely Creepy’ Electronic Devices

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

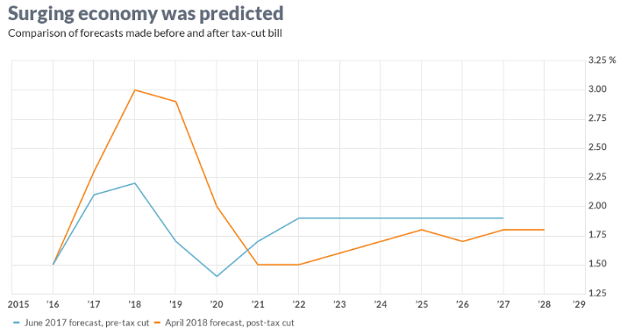

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

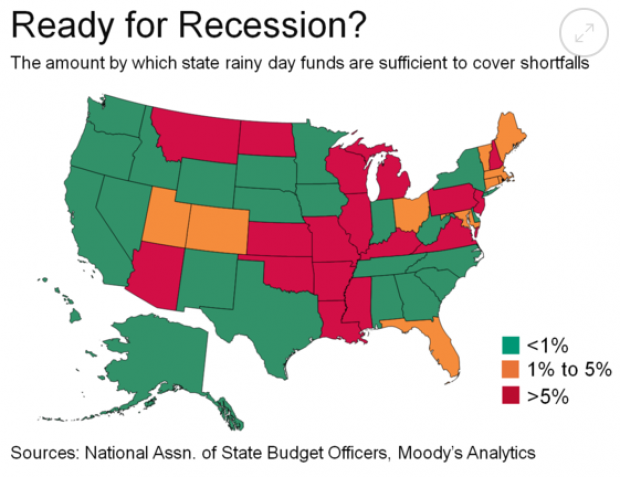

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

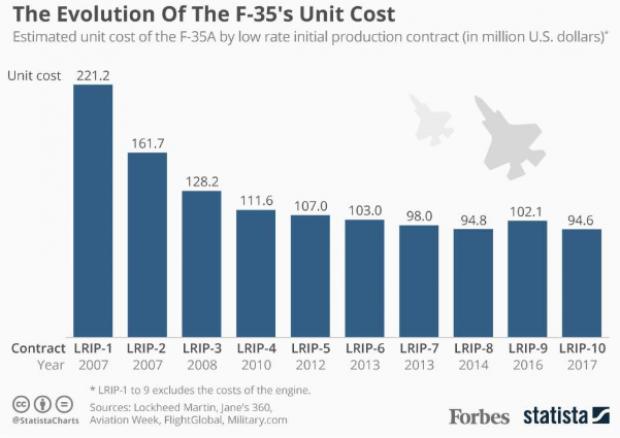

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.