McDonald’s McTricks Aren’t Working

Turns out warm buns aren’t the solution to McDonald’s financial woes.

The burger giant announced Thursday that its sales slide continued in the second quarter, with same store sales falling 0.7 percent globally and by 2 percent in the U.S. Quarterly revenues dropped 10 percent to $6.5 billion, though without currency effects from a strong dollar they would have climbed 1 percent.

The results were good enough to top Wall Street’s expectations, but they showed again just how far McDonald’s has to go to win back customers.

Related: The 11 Worst Fast Food Restaurants in America

The fast food chain blamed the admittedly “disappointing” results on the failure of its products and promotions to draw customers to its stores as anticipated.

New CEO Steve Easterbrook, who took over in March, has promised to revamp the restaurant chain and improve sales by catering to consumers who prefer fresh, high quality food.

McDonald’s continues to try a variety of promotions and menu changes to win back diners. It recently started offering a double cheeseburger and fries for $2.50 as a summer deal and rolled out an “artisan grilled chicken sandwich.” It has also, among other things, enlarged its quarter pounder, tested a new breakfast bowl full of kale, rolled out flavored hot coffee in some locations and even tested a lobster roll in New England restaurants. And it upped the toasting time for its hamburger buns by 5 seconds.

So far, though, the new deals and menu options have failed to entice diners.

Related: 9 Ways McDonald’s Wants to Get You Excited About Its Food Again

Easterbrook did acknowledge that changing McDonalds’ image would take time, but he said Thursday that the company is “seeing early signs of momentum.”

The company will begin to offer all-day breakfast, which already accounts for 25 percent of the company’s sales. And it is continuing to simplify its menu options to lower costs.

Analysts wonder if such changes will be enough to boost consumer appetites for McDonald’s and how the company is going to reposition its brand. As Thursday earnings report made clear, introducing a younger, hip hamburglar isn’t going to cut it.

Economists See More Growth Ahead

Most business economists in the U.S. expect the economy to keep chugging along over the next three months, with rising corporate sales driving additional hiring and wage increases for workers.

The tax cuts, however, don’t seem to be playing a role in hiring and investment plans. And the trade conflicts stirred up by the Trump administration are having a negative influence, with the majority of economists at goods-producing firms who replied to the most recent survey by the National Association for Business Economics saying that their companies were putting investments on hold as they wait to see how things play out.

New Tax on Non-Profits Hits Public Universities

The Republican tax bill signed into law late last year imposed a 21 percent tax on employees at non-profits who earn more than $1 million a year. According to data from the Chronicle of Higher Education cited by Bloomberg, there were 12 presidents of public universities who received compensation of at least $1 million in 2017, with James Ramsey of the University of Louisville topping the list at $4.3 million. Endowment managers could also get hit with the tax, as could football coaches, some of whom earn substantially more than the presidents of their institutions.

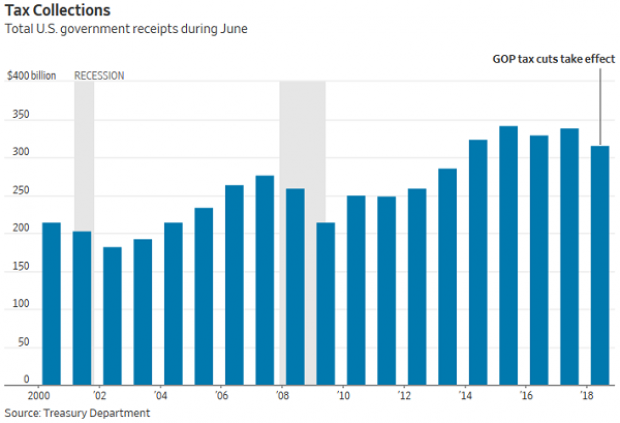

Government Revenues Drop as Tax Cuts Kick In

Corporate tax receipts in June were 33 percent lower than a year ago, according to data released by the Treasury Department Thursday, as companies made smaller estimated payments due to the reduction in their tax rates. Total receipts were down 7 percent, while payroll taxes were 5 percent lower compared to June 2017.

“June receipts to US government were our first mostly-clear look at the revenue effects of the new tax law, with lots of estimated payments and little noise from the 2017 tax year,” The Wall Street Journal’s Richard Rubin tweeted Friday.

Surprisingly, the deficit was smaller in June compared to a year ago, narrowing to $74.86 billion from $90.23 billion last year. The drop was driven by a 9 percent reduction in government outlays that reflected accounting changes rather than any real changes in spending, Rubin said in the Journal.

“More broadly, the federal deficit is swelling as government spending outpaces revenues,” Rubin wrote. “The budget gap totaled $607.1 billion in the first nine months of the 2018 fiscal year, 16% larger than the same point a year earlier.”

Kyle Pomerleau of the Tax Foundation pointed out that the drop in corporate tax receipts is a permanent feature of the Republican tax cuts, tweeting: “Even in a Trump dream world in which these cuts paid for themselves, corporate tax collections would remain below baseline forever. It would be higher income and payroll receipts that made up the difference.”

Deficit Jumps in Trump’s First Fiscal Year

The federal budget deficit rose by 16 percent in the first nine months of the 2018 fiscal year, which began last October. The shortfall came to $607 billion, compared to $523 billion in the same period the year before, according to a U.S. Treasury report released Thursday and reported by Bloomberg. Both revenue and spending rose, but spending rose faster. Revenues came to $2.54 trillion, up 1.3 percent from the same nine-month period in 2017, while spending came to $3.15 trillion, up 3.9 percent.

Where’s the Obamacare Navigator Funding for 2019, PA Insurance Commissioner Asks

Pennsylvania’s insurance commissioner sent a letter this week to Health and Human Services Secretary Alex Azar and Centers for Medicare and Medicaid Services (CMS) Administrator Seema Verma requesting that they “immediately release the funding details for the Navigator program for the upcoming open enrollment period for 2019.” Navigators are the state and local groups that help people sign up for Affordable Care Act plans.

“In years past, grant applications and new funding opportunities were released by CMS in April, CMS required Navigator organizations to apply by June and approved applications and new funding by late August,” Pennsylvania’s Jessica Altman wrote. “The current lack of guidance has put Navigator organizations – and states - far behind in their planning and creates an inability for the Navigator organizations to design a successful plan for helping people enroll during the 2019 open enrollment period.”