Feeling Flush, More Parents Open Their Wallets for College Spending

As lingering financial fears from the recession fade, more parents are willing and able to open their wallets to pay for their children’s educations.

Parents have become the top source of college funding for the first time since 2010. According to a new report from private student loan lender Sallie Mae’s, parental income and savings covered 32 percent of college costs in the academic year 2014-15, while scholarships and grants covered 30 percent.

Families spent an average of $24,164 on college this year, a 16 percent rise in spending from the previous year and the largest increase since 2009-10. The money spent covers costs of tuition, books, and living expenses.

Related: Average Family Has Saved Enough to Send One Kid to College for Half a Year

The report details how fewer parents fear the worst when it comes to the risks associated with college. Fewer parents are worried that their child won’t find a job after graduation, that their income will decline because of layoffs, and that there will be an increase in student loan rates. As confidence has increased, fewer families are using cost-saving techniques, such as having students live at home.

Another factor contributing to the willingness of parents to spend on education is the improving stock market. The average size of a 529 account, the popular college savings investment plan, continues to grow after the recession caused a downturn, hitting a balance of $20,474 as of December 1, 2014. That figure tumbled to $10,690 at the end of 2008, according to data from the College Savings Plan Network.

Although parents may be feeling better about paying for college, the basic trend of increasing prices continues, and loans are still a big part of the funding picture. Between 2001 and 2012, average undergraduate tuition almost doubled, causing an average real rate increase of 3.5 percent each year. Nearly 71 percent of college graduates left school with student loan debt this year, up from 54 percent 20 years prior. The average debt was $35,000 in 2015, an increase of 34 percent from 2010, student loan-tracker Edvisors has found.

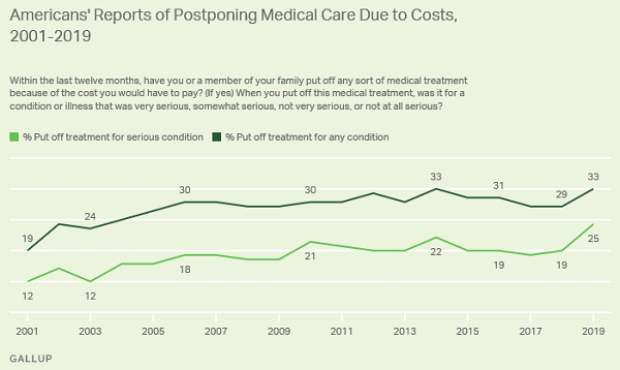

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

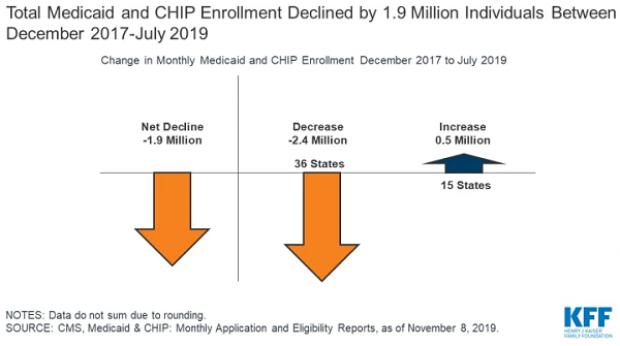

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.