Here’s the Scoop: Fun Facts for National Ice Cream Day

When President Ronald Reagan in 1984 designated the month of July as National Ice Cream Month and declared the third Sunday of July as National Ice Cream Day, he probably never could have foreseen a time when flavors of the treat included Pork Rind, Strawberry Durian or Squid.

Ice cream shops around the country will be celebrating their special day again this Sunday, July 19. Carvel stores will be offering a buy-one-get-one-free deal on any size or flavor of soft-serve cones. Friendly’s is celebrating its 80th birthday this weekend, with participating stores also offering buy-one-get-one-free deals. Baskin-Robbins is offering a free upgrade to waffle cones with double scoops during the entire month of July. It also will offer 31 percent off all its ice cream sundaes on Friday, July 31.

Related: Born in the USA: 24 Iconic American Foods

Those chains offer a wide variety of flavors, but probably nothing quite as exotic as the OddFellows Ice Cream Co. in New York City, known for formulations loaded with unusual ingredients: Edamame, Chorizo Caramel Swirl, Cornbread and Maple Bacon Pecan. OddFellows co-owner Mohan Kumar says National Ice Cream Day will be just a regular Sunday for him and his stores: “It’s a beautiful day for ice cream every day.”

As you consider indulging in a frozen snack, here are some fun facts to fuel our red hot passion for ice cream:

Who Screams for Ice Cream: California, Indiana, Pennsylvania, Texas and New York are the states that consume the most ice cream. California also produces the most ice cream—over 142,000 gallons every year. About 10.3 percent of all the milk produced by U.S. dairy farmers is used to make ice cream. The five most popular brands in the U.S. are private labels, followed by Blue Bell, Haagen-Dazs, Breyers and Ben & Jerry’s. According to the International Dairy Foods Association, vanilla is America’s favorite flavor of ice cream, followed by chocolate. And how’s this for being ice cream crazy? Ben & Jerry’s employees get three free pints a day. They also get a free gym membership.

Hard Facts About Soft Serve: Despite many headlines to the contrary, it does not look like former British Prime Minister Margaret Thatcher invented soft-serve ice cream before she became known as the Iron Lady. The honor instead goes to Tom Carvel of Carvel ice cream or Dairy Queen co-founder J. F. McCullough. In Carvel’s case, his ice cream truck got a flat tire in Hartsdale, New York, in 1934. As the ice cream started to melt, he noticed its soft, creamy consistency and began selling it right from the truck. Two years later, he opened his first Carvel shop at the site where the truck first broke down.

Related: The 9 Most Expensive Junk Foods

Why We’re All Coneheads: Italo Marchiony, an Italian immigrant, was granted a patent for waffle-like ice cream cups in New York City in December 1903. But he may not be the father of the cones we enjoy today. As the story goes, Arnold Fornachou, an ice cream vendor at the 1904 World’s Fair in St. Louis, ran out of dishes. His neighbor, a Syrian man, was selling crisp, Middle Eastern pastries called Zalabias. When rolled up, the waffle-like Zalabias made a perfect cone to hold the ice cream. The International Association of Ice Cream Manufacturers and the International Dairy Foods Association credit Ernest A. Hamwi, the pastry maker, with creating the cone, but others have also claimed credit — including Abe Doumar, another Syrian immigrant at the 1904 fair who would go on to produce the first machine to mass-produce ice cream waffle cones.

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

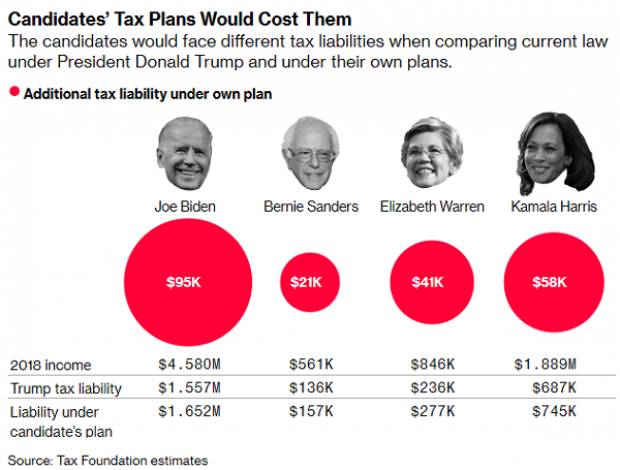

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.