Here’s the Scoop: Fun Facts for National Ice Cream Day

When President Ronald Reagan in 1984 designated the month of July as National Ice Cream Month and declared the third Sunday of July as National Ice Cream Day, he probably never could have foreseen a time when flavors of the treat included Pork Rind, Strawberry Durian or Squid.

Ice cream shops around the country will be celebrating their special day again this Sunday, July 19. Carvel stores will be offering a buy-one-get-one-free deal on any size or flavor of soft-serve cones. Friendly’s is celebrating its 80th birthday this weekend, with participating stores also offering buy-one-get-one-free deals. Baskin-Robbins is offering a free upgrade to waffle cones with double scoops during the entire month of July. It also will offer 31 percent off all its ice cream sundaes on Friday, July 31.

Related: Born in the USA: 24 Iconic American Foods

Those chains offer a wide variety of flavors, but probably nothing quite as exotic as the OddFellows Ice Cream Co. in New York City, known for formulations loaded with unusual ingredients: Edamame, Chorizo Caramel Swirl, Cornbread and Maple Bacon Pecan. OddFellows co-owner Mohan Kumar says National Ice Cream Day will be just a regular Sunday for him and his stores: “It’s a beautiful day for ice cream every day.”

As you consider indulging in a frozen snack, here are some fun facts to fuel our red hot passion for ice cream:

Who Screams for Ice Cream: California, Indiana, Pennsylvania, Texas and New York are the states that consume the most ice cream. California also produces the most ice cream—over 142,000 gallons every year. About 10.3 percent of all the milk produced by U.S. dairy farmers is used to make ice cream. The five most popular brands in the U.S. are private labels, followed by Blue Bell, Haagen-Dazs, Breyers and Ben & Jerry’s. According to the International Dairy Foods Association, vanilla is America’s favorite flavor of ice cream, followed by chocolate. And how’s this for being ice cream crazy? Ben & Jerry’s employees get three free pints a day. They also get a free gym membership.

Hard Facts About Soft Serve: Despite many headlines to the contrary, it does not look like former British Prime Minister Margaret Thatcher invented soft-serve ice cream before she became known as the Iron Lady. The honor instead goes to Tom Carvel of Carvel ice cream or Dairy Queen co-founder J. F. McCullough. In Carvel’s case, his ice cream truck got a flat tire in Hartsdale, New York, in 1934. As the ice cream started to melt, he noticed its soft, creamy consistency and began selling it right from the truck. Two years later, he opened his first Carvel shop at the site where the truck first broke down.

Related: The 9 Most Expensive Junk Foods

Why We’re All Coneheads: Italo Marchiony, an Italian immigrant, was granted a patent for waffle-like ice cream cups in New York City in December 1903. But he may not be the father of the cones we enjoy today. As the story goes, Arnold Fornachou, an ice cream vendor at the 1904 World’s Fair in St. Louis, ran out of dishes. His neighbor, a Syrian man, was selling crisp, Middle Eastern pastries called Zalabias. When rolled up, the waffle-like Zalabias made a perfect cone to hold the ice cream. The International Association of Ice Cream Manufacturers and the International Dairy Foods Association credit Ernest A. Hamwi, the pastry maker, with creating the cone, but others have also claimed credit — including Abe Doumar, another Syrian immigrant at the 1904 fair who would go on to produce the first machine to mass-produce ice cream waffle cones.

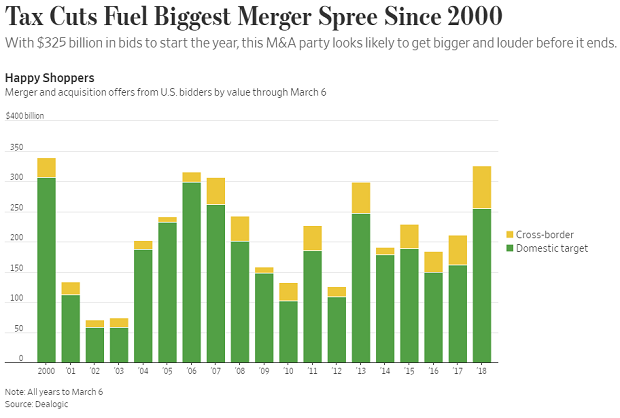

Chart of the Day: A Buying Binge Driven by Tax Cuts

The Wall Street Journal reports that the tax cuts and economic environment are prompting U.S. companies to go on a buying binge: “Mergers and acquisitions announced by U.S. acquirers so far in 2018 are running at the highest dollar volume since the first two months of 2000, according to Dealogic. Thomson Reuters, which publishes slightly different numbers, puts it at the highest since the start of 2007.”

Number of the Day: 5.5 Percent

Health care spending in the U.S. will grow at an average annual rate of 5.5 percent from 2017 through 2026, according to new estimates published in Health Affairs by the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS).

The projections mean that health care spending would rise as a share of the economy from 17.9 percent in 2016 to 19.7 percent in 2026.

Trump Clearly Has No Problem with Debt and Deficits

A self-proclaimed “king of debt,” President Trump has produced a budget that promises red ink as far as the eye can see. With last year's $1.5 trillion tax cut reducing revenues, the White House gave up even trying to pretend that its budget would balance anytime soon, and even the rosy economic projections contained in the budget couldn’t produce enough revenues, however fanciful, to cover the shortfall.

The Trump budget spends as much over 10 years as any budget produced by President Barack Obama, according to Jim Tankersley of The New York Times. And it projects total deficits of more than $7 trillion over the next decade — "a number that could double if the administration turns out to be overestimating economic growth and if the $3 trillion in spending cuts the White House has floated do not materialize in Congress,” Tankersley says.

Trump — who once promised to both balance the budget and pay down the national debt — isn’t the only one throwing off the shackles of fiscal restraint. Republicans as a whole appear to be embracing a new set of economic preferences defined by lower taxes and higher spending, in what Bloomberg describes as a “striking turnabout” in attitudes toward deficits and the national debt.

But some conservatives tell Tankersley that the GOP's core beliefs on spending and debt remain intact — and that spending on Social Security and Medicare, the primary drivers of the national debt, are all that matters when it comes to implementing fiscal restraint.

“They know that right now, a fundamental reform of entitlements won’t happen," John H. Cochrane, an economist at Stanford University’s Hoover Institution, tells Tankersley. "So, they have avoided weekly chaos and gotten needed military spending through by opening the spending bill, and they got an important reduction in growth-distorting marginal corporate rates through by accepting a bit more deficits. They know that can’t be the end of the story.”

Democrats, of course, have warned that the next chapter in the tale will involve big cuts to Social Security and Medicare. Even before we get there, though, Tankersley questions whether the GOP approach stands up to scrutiny: "This is a bit like saying, only regular exercise will keep America from having a fatal heart attack, so, you know, it's ok to eat a few more hamburgers now."

Part of the Shutdown-Ending Deal: $31 Billion More in Tax Cuts

Margot Sanger-Katz and Jim Tankersley in The New York Times: “The deal struck by Democrats and Republicans on Monday to end a brief government shutdown contains $31 billion in tax cuts, including a temporary delay in implementing three health care-related taxes.”

“Those delays, which enjoy varying degrees of bipartisan support, are not offset by any spending cuts or tax increases, and thus will add to a federal budget deficit that is already projected to increase rapidly as last year’s mammoth new tax law takes effect.”

IRS Paid $20 Million to Collect $6.7 Million in Tax Debts

Congress passed a law in 2015 requiring the IRS to use private debt collection agencies to pursue “inactive tax receivables,” but the financial results are not encouraging so far, according to a new taxpayer advocate report out Wednesday.

In fiscal year 2017, the IRS received $6.7 million from taxpayers whose debts were assigned to private collection agencies, but the agencies were paid $20 million – “three times the amount collected,” the report helpfully points out.

Like what you're reading? Sign up for our free newsletter.