How the Emmys Made Netflix’s Very Good Week Even Better

When the Emmy nominations were announced on Thursday, there were any number of people who were hoping Netflix’s already excellent week would end with a fizzle.

The old school broadcast networks (ABC, CBS, NBC and Fox), HBO, Amazon, Hulu, AMC, BBC America and FX all had shows that were widely admired and due for recognition at the annual awards extravaganza.

Netflix, on the other hand, was coming off the widely panned season of “House of Cards,” the critically admired but little-seen “Bloodline” and “Unbreakable Kimmy Schmidt,” and the domestic flop of its $90 million historical epic, “Marco Pollo.” Additionally, “Orange Is the New Black,” which had a strong third season both in terms of reviews and ratings, was forced by a change in the Emmy rules to submit as a drama rather than a comedy, putting it up against more hard-hitting dramatic programs.

Related: How the Video Game Industry Is Failing Its Fans

As it turns out, Netflix’s very good week would keep going with a record setting 34 nominations. This is dwarfed by HBO’s 127 nominations, but this is a remarkable number for the streaming service nevertheless.

The shower of nominations came on the end of a week in which Netflix stock price continued to climb at a rapid pace, making it the single best performing stock in the S&P 500 this year. Netflix continues to grow rapidly, adding 900,000 domestic users in Q2 and a staggering 2.4 million users internationally, widely exceeding expectations of 6000,000 and 1.9 million, respectively.

If there is a downside, it is that Netflix is unlikely to actually WIN in any of the major Emmy categories. The beloved series “Mad Men” and “Parks and Recreation” should have a lock on the comedy and drama awards (and if Jonathan Banks of “Better Call Saul” doesn’t win besting supporting actor in a drama, there will be riots!). But for Netflix, it is still an honor just to be nominated.

The streaming giant will not be resting on its laurels. Coming on the back of its critically-acclaimed and bone-crunching adaptation of “Daredevil,” the company will be teaming up with Marvel again for three more shows. Netflix will also be amping up its feature film division with debuts from “True Detective” director Cary Fukunaga and an action movie starring Brad Pitt.

The company may walk away empty handed when they hand out the golden statues on September 20th, but for the time being, everything is coming up Netflix.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

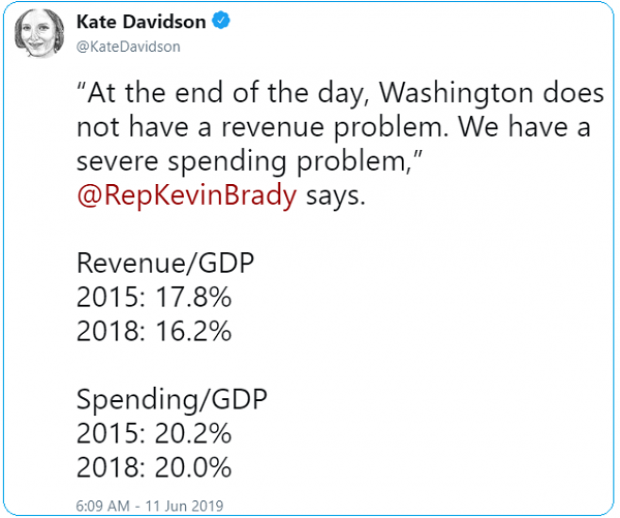

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

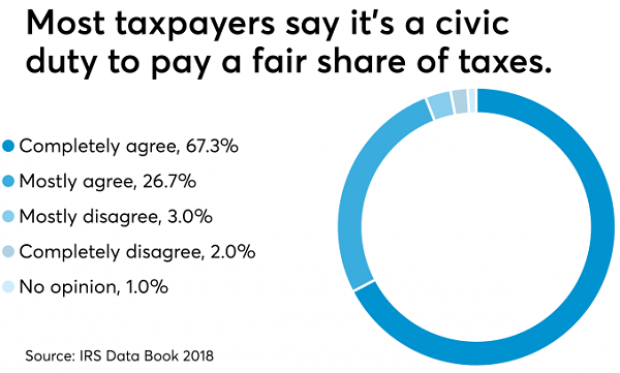

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.