How the Emmys Made Netflix’s Very Good Week Even Better

When the Emmy nominations were announced on Thursday, there were any number of people who were hoping Netflix’s already excellent week would end with a fizzle.

The old school broadcast networks (ABC, CBS, NBC and Fox), HBO, Amazon, Hulu, AMC, BBC America and FX all had shows that were widely admired and due for recognition at the annual awards extravaganza.

Netflix, on the other hand, was coming off the widely panned season of “House of Cards,” the critically admired but little-seen “Bloodline” and “Unbreakable Kimmy Schmidt,” and the domestic flop of its $90 million historical epic, “Marco Pollo.” Additionally, “Orange Is the New Black,” which had a strong third season both in terms of reviews and ratings, was forced by a change in the Emmy rules to submit as a drama rather than a comedy, putting it up against more hard-hitting dramatic programs.

Related: How the Video Game Industry Is Failing Its Fans

As it turns out, Netflix’s very good week would keep going with a record setting 34 nominations. This is dwarfed by HBO’s 127 nominations, but this is a remarkable number for the streaming service nevertheless.

The shower of nominations came on the end of a week in which Netflix stock price continued to climb at a rapid pace, making it the single best performing stock in the S&P 500 this year. Netflix continues to grow rapidly, adding 900,000 domestic users in Q2 and a staggering 2.4 million users internationally, widely exceeding expectations of 6000,000 and 1.9 million, respectively.

If there is a downside, it is that Netflix is unlikely to actually WIN in any of the major Emmy categories. The beloved series “Mad Men” and “Parks and Recreation” should have a lock on the comedy and drama awards (and if Jonathan Banks of “Better Call Saul” doesn’t win besting supporting actor in a drama, there will be riots!). But for Netflix, it is still an honor just to be nominated.

The streaming giant will not be resting on its laurels. Coming on the back of its critically-acclaimed and bone-crunching adaptation of “Daredevil,” the company will be teaming up with Marvel again for three more shows. Netflix will also be amping up its feature film division with debuts from “True Detective” director Cary Fukunaga and an action movie starring Brad Pitt.

The company may walk away empty handed when they hand out the golden statues on September 20th, but for the time being, everything is coming up Netflix.

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

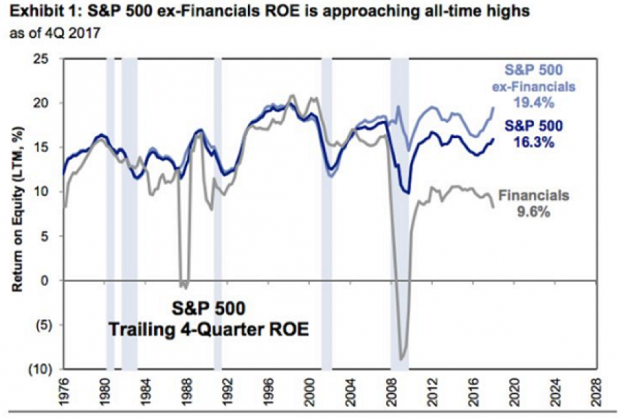

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.