How the Emmys Made Netflix’s Very Good Week Even Better

When the Emmy nominations were announced on Thursday, there were any number of people who were hoping Netflix’s already excellent week would end with a fizzle.

The old school broadcast networks (ABC, CBS, NBC and Fox), HBO, Amazon, Hulu, AMC, BBC America and FX all had shows that were widely admired and due for recognition at the annual awards extravaganza.

Netflix, on the other hand, was coming off the widely panned season of “House of Cards,” the critically admired but little-seen “Bloodline” and “Unbreakable Kimmy Schmidt,” and the domestic flop of its $90 million historical epic, “Marco Pollo.” Additionally, “Orange Is the New Black,” which had a strong third season both in terms of reviews and ratings, was forced by a change in the Emmy rules to submit as a drama rather than a comedy, putting it up against more hard-hitting dramatic programs.

Related: How the Video Game Industry Is Failing Its Fans

As it turns out, Netflix’s very good week would keep going with a record setting 34 nominations. This is dwarfed by HBO’s 127 nominations, but this is a remarkable number for the streaming service nevertheless.

The shower of nominations came on the end of a week in which Netflix stock price continued to climb at a rapid pace, making it the single best performing stock in the S&P 500 this year. Netflix continues to grow rapidly, adding 900,000 domestic users in Q2 and a staggering 2.4 million users internationally, widely exceeding expectations of 6000,000 and 1.9 million, respectively.

If there is a downside, it is that Netflix is unlikely to actually WIN in any of the major Emmy categories. The beloved series “Mad Men” and “Parks and Recreation” should have a lock on the comedy and drama awards (and if Jonathan Banks of “Better Call Saul” doesn’t win besting supporting actor in a drama, there will be riots!). But for Netflix, it is still an honor just to be nominated.

The streaming giant will not be resting on its laurels. Coming on the back of its critically-acclaimed and bone-crunching adaptation of “Daredevil,” the company will be teaming up with Marvel again for three more shows. Netflix will also be amping up its feature film division with debuts from “True Detective” director Cary Fukunaga and an action movie starring Brad Pitt.

The company may walk away empty handed when they hand out the golden statues on September 20th, but for the time being, everything is coming up Netflix.

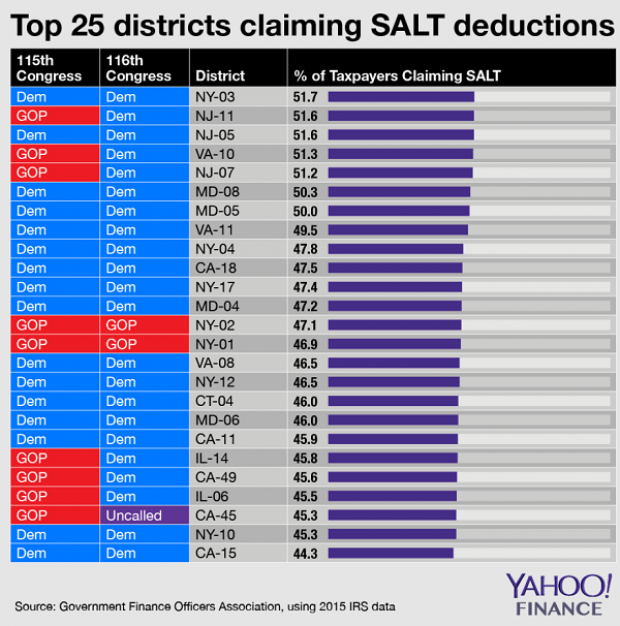

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

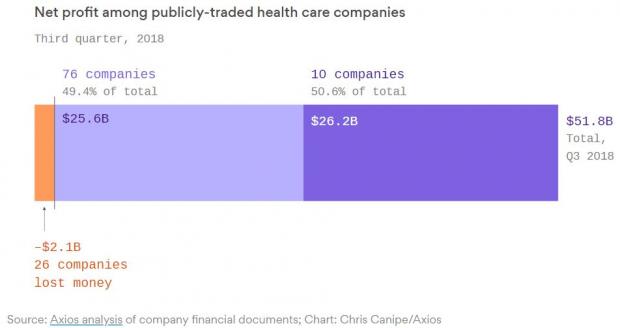

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

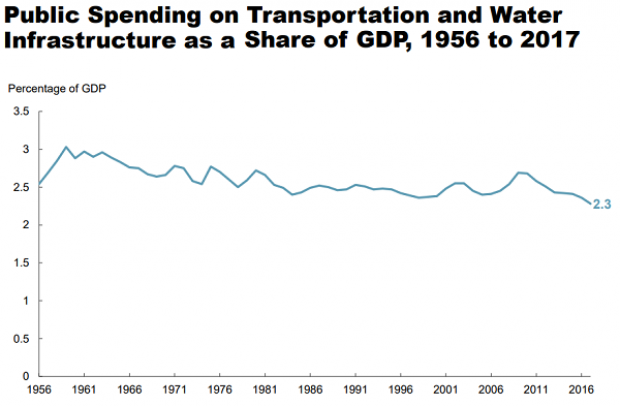

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.