How the Emmys Made Netflix’s Very Good Week Even Better

When the Emmy nominations were announced on Thursday, there were any number of people who were hoping Netflix’s already excellent week would end with a fizzle.

The old school broadcast networks (ABC, CBS, NBC and Fox), HBO, Amazon, Hulu, AMC, BBC America and FX all had shows that were widely admired and due for recognition at the annual awards extravaganza.

Netflix, on the other hand, was coming off the widely panned season of “House of Cards,” the critically admired but little-seen “Bloodline” and “Unbreakable Kimmy Schmidt,” and the domestic flop of its $90 million historical epic, “Marco Pollo.” Additionally, “Orange Is the New Black,” which had a strong third season both in terms of reviews and ratings, was forced by a change in the Emmy rules to submit as a drama rather than a comedy, putting it up against more hard-hitting dramatic programs.

Related: How the Video Game Industry Is Failing Its Fans

As it turns out, Netflix’s very good week would keep going with a record setting 34 nominations. This is dwarfed by HBO’s 127 nominations, but this is a remarkable number for the streaming service nevertheless.

The shower of nominations came on the end of a week in which Netflix stock price continued to climb at a rapid pace, making it the single best performing stock in the S&P 500 this year. Netflix continues to grow rapidly, adding 900,000 domestic users in Q2 and a staggering 2.4 million users internationally, widely exceeding expectations of 6000,000 and 1.9 million, respectively.

If there is a downside, it is that Netflix is unlikely to actually WIN in any of the major Emmy categories. The beloved series “Mad Men” and “Parks and Recreation” should have a lock on the comedy and drama awards (and if Jonathan Banks of “Better Call Saul” doesn’t win besting supporting actor in a drama, there will be riots!). But for Netflix, it is still an honor just to be nominated.

The streaming giant will not be resting on its laurels. Coming on the back of its critically-acclaimed and bone-crunching adaptation of “Daredevil,” the company will be teaming up with Marvel again for three more shows. Netflix will also be amping up its feature film division with debuts from “True Detective” director Cary Fukunaga and an action movie starring Brad Pitt.

The company may walk away empty handed when they hand out the golden statues on September 20th, but for the time being, everything is coming up Netflix.

Why Craft Brewers Are Crying in Their Beer

It may be small beer compared to the problems faced by unemployed federal workers and the growing cost for the overall economy, but the ongoing government shutdown is putting a serious crimp in the craft brewing industry. Small-batch brewers tend to produce new products on a regular basis, The Wall Street Journal’s Ruth Simon says, but each new formulation and product label needs to be approved by the Treasury Department’s Alcohol and Tobacco Tax and Trade Bureau, which is currently closed. So it looks like you’ll have to wait a while to try the new version of Hemperor HPA from Colorado’s New Belgium Brewing, a hoppy brew that will include hemp seeds once the shutdown is over.

Number of the Day: $30 Billion

The amount spent on medical marketing reached $30 billion in 2016, up from $18 billion in 1997, according to a new analysis published in the Journal of the American Medical Association and highlighted by the Associated Press. The number of advertisements for prescription drugs appearing on television, newspapers, websites and elsewhere totaled 5 million in one year, accounting for $6 billion in marketing spending. Direct-to-consumer marketing grew the fastest, rising from $2 billion, or 12 percent of total marketing, to nearly $10 billion, or a third of spending. “Marketing drives more treatments, more testing” that patients don’t always need, Dr. Steven Woloshin, a Dartmouth College health policy expert and co-author of the study, told the AP.

70% of Registered Voters Want a Compromise to End the Shutdown

An overwhelming majority of registered voters say they want the president and Congress to “compromise to avoid prolonging the government shutdown” in a new The Hill-HarrisX poll. Seven in ten respondents said they preferred the parties reach some sort of deal to end the standoff, while 30 percent said it was more important to stick to principles, even if it means keeping parts of the government shutdown. Voters who “strongly approve” of Trump (a slim 21 percent of respondents) favored him sticking to his principles over the wall by a narrow 54 percent-46 percent margin. Voters who “somewhat approve” of the president favored a compromise solution by a 70-30 margin. Among Republicans overall, 61 percent said they wanted a compromise.

The survey of 1,000 registered voters was conducted January 5 and 6 and has a margin of error of 3.1 percentage points.

Share Buybacks Soar to Record $1 Trillion

Although there may be plenty of things in the GOP tax bill to complain about, critics can’t say it didn’t work – at least as far as stock buybacks go. TrimTabs Investment Research said Monday that U.S. companies have now announced $1 trillion in share buybacks in 2018, surpassing the record of $781 billion set in 2015. "It's no coincidence," said TrimTabs' David Santschi. "A lot of the buybacks are because of the tax law. Companies have more cash to pump up the stock price."

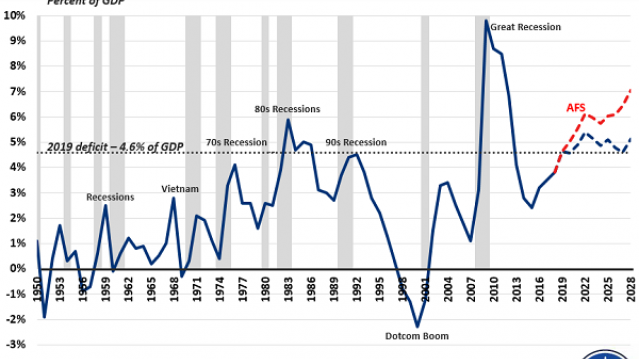

Chart of the Day: Deficits Rising

Budget deficits normally rise during recessions and fall when the economy is growing, but that’s not the case today. Deficits are rising sharply despite robust economic growth, increasing from $666 billion in 2017 to an estimated $970 billion in 2019, with $1 trillion annual deficits expected for years after that.

As the deficit hawks at the Committee for a Responsible Federal Budget point out in a blog post Thursday, “the deficit has never been this high when the economy was this strong … And never in modern U.S. history have deficits been so high outside of a war or recession (or their aftermath).” The chart above shows just how unusual the current deficit path is when measured as a percentage of GDP.