When It Comes to Fees, These Credit Cards Are the Worst

Two credit cards from First Premier Bank have the most fees of 100 cards researched for a CreditCards.com report released today.

The average number of fees per credit card analyzed was six, but the First Premier Bank Credit Card and the First Premier Bank Secured MasterCard carry 12 potential fees each. The PenFed Promise Visa Card was the only one in the survey that levied no fees at all.

A quarter of the cards surveyed charged an annual fee, although 10 percent waived that fee for a consumers’ first year. All cards except for the PenFed Promise Visa Card charged a late payment fee, which can run up to $25.

Related: What to Know Before Your Teen Gets a Credit Card

Penalty fees tend to be easier for consumers to avoid (don’t make late payments), and it’s worth shopping around for cards that don’t have fees for the transactions you need.

Most cards carry a cash advance fee, typically the greater of either $10 or 5 percent of each cash advance. Among cards that allow balance transfers, 90 percent charge a fee for doing so, typically $5 or 3 percent of the transfer.

Another common fee was the foreign transaction fee, typically about 3 percent per transaction, charged by 77 percent of cards. “If you travel internationally a lot, a credit card that doesn’t charge foreign transaction fees is a great value,” CreditCards.com senior industry analyst Matt Schulz said in a statement.

If you’re hit with an unexpected, one-time fee, try calling your issuer and asking them for a refund. Often customer service reps are authorized to do so on a case-by-case basis.

MOST POTENTIAL FEES

- First Premier Bank Credit Card (12)

- First Premier Bank Secured MasterCard (12)

- Credit One Visa Platinum (9)

- Fifth Third Bank Platinum MasterCard (9)

- Navy Federal Credit Union Platinum (9)

- Navy Federal Credit Union Cash Rewards (9)

- Regions Visa Platinum Rewards (9)

FEWEST POTENTIAL FEES

- PenFed Promise Visa Card (0)

- ExxonMobil SmartCard from Citi (3)

- Spark Classic from Capital One (3)

- Capital One Spark Cash Select for Business (3)

- Spark Miles Select by Capital One (3)

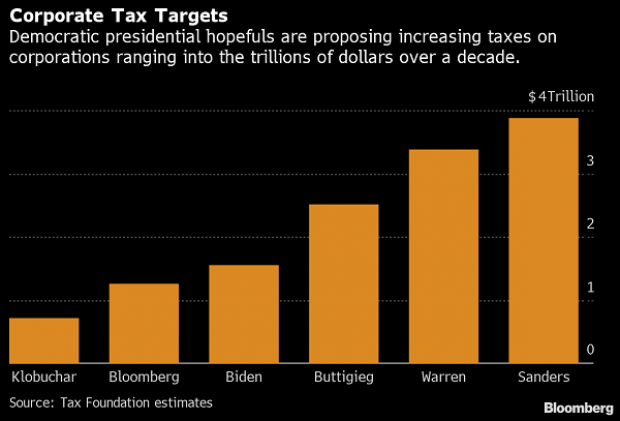

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

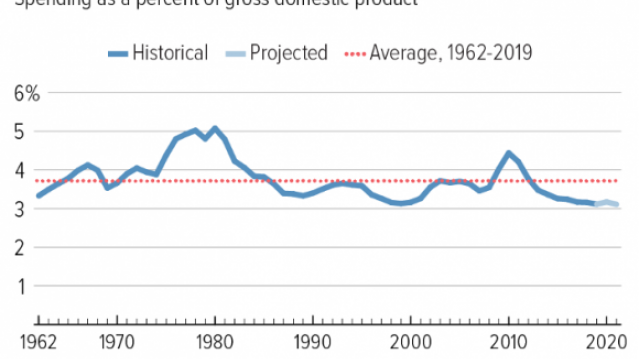

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

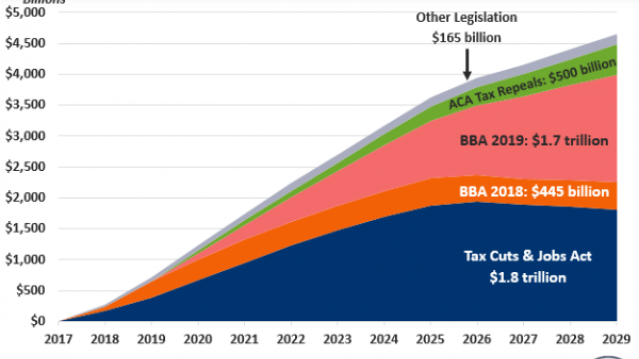

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

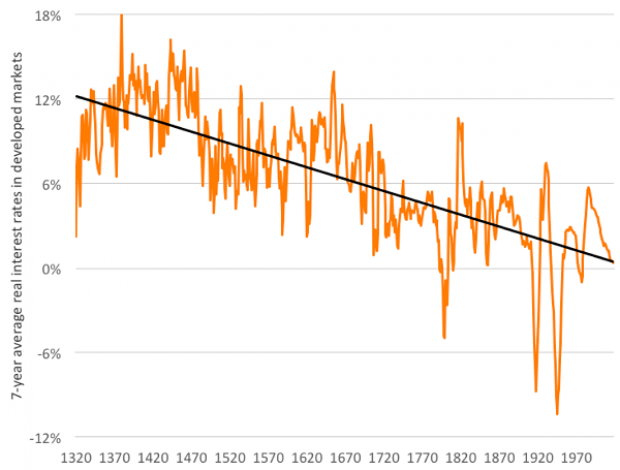

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

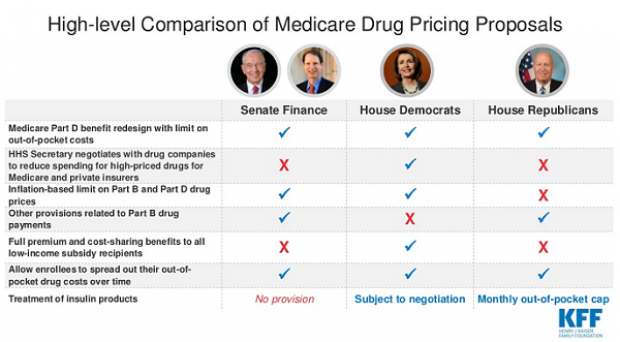

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.