They’re Leaving Las Vegas: Fewer I Do’s in Last Decade

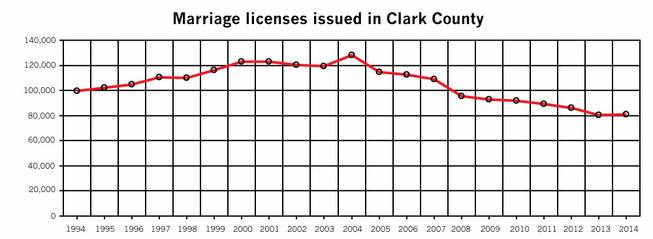

When it comes to destination weddings, Las Vegas has lost that loving feeling. The Las Vegas Sun reports that the wedding rate in Sin City has plummeted 37 percent in the past decade—nearly 47,000 fewer couples got married in 2014 than in 2004.

By comparison, 2004 was a boom year for weddings in Sin City. There were 128,000 weddings that year—including Britney Spears’ 55-hour marriage to Jason Allen Alexander at A Little White Wedding Chapel.

Related: Marriage?? Young Americans Aren’t Even Shacking Up

Who knows why gambling on love in Sin City has become a losing bet? Perhaps the dip reflects a national trend of millennials waiting to tie the knot or choosing to stay single. The marriage rate in the U.S. neared a record low in 2015 and is expected to drop further in 2016. Then there’s the expense. According to the TheKnot, the average wedding cost (excluding the honeymoon) is $31,213, with many couples looking for more unusual venues.

Clark County Clerk Lynn Goya, who took office in January, wants to change that trend in Vegas. The current fee for a marriage license in Las Vegas is $60, but Goya is asking for a $14 increase in the cost of wedding licenses to support marketing efforts targeting engaged couples. Last year 81,000 weddings happened in Las Vegas—and she’s hoping that wedding vow renewals and gay weddings will help boost those numbers even more. In New York, the legalization of gay marriage in 2011 led to an estimated $259 million in spending and $16 million in revenues for New York City.

Related: The $2.6 Billion Gay Wedding Boom

Then again it may be hard for Las Vegas to shake that quickie, drive-thru wedding image. Sin City has always had an illustrious history of celebrity weddings, with many more misses than hits: Cher’s nine-day union to rocker Gregg Allman in 1975, Mia Farrow and Frank Sinatra in 1966, Demi Moore and Bruce Willis in 1987, Richard Gere and Cindy Crawford in 1991, and Angelina Jolie and Billy Bob Thornton in 2000. On the bright side, there’s Paul Newman and Joanne Woodward’s marriage, which endured for 50 years, Jon Bon Jovi and his wife, Dorothea’s 1987 wedding day, and Kelly Ripa and Mark Consuelo’s union from 1996, which is still standing.

Economists See More Growth Ahead

Most business economists in the U.S. expect the economy to keep chugging along over the next three months, with rising corporate sales driving additional hiring and wage increases for workers.

The tax cuts, however, don’t seem to be playing a role in hiring and investment plans. And the trade conflicts stirred up by the Trump administration are having a negative influence, with the majority of economists at goods-producing firms who replied to the most recent survey by the National Association for Business Economics saying that their companies were putting investments on hold as they wait to see how things play out.

New Tax on Non-Profits Hits Public Universities

The Republican tax bill signed into law late last year imposed a 21 percent tax on employees at non-profits who earn more than $1 million a year. According to data from the Chronicle of Higher Education cited by Bloomberg, there were 12 presidents of public universities who received compensation of at least $1 million in 2017, with James Ramsey of the University of Louisville topping the list at $4.3 million. Endowment managers could also get hit with the tax, as could football coaches, some of whom earn substantially more than the presidents of their institutions.

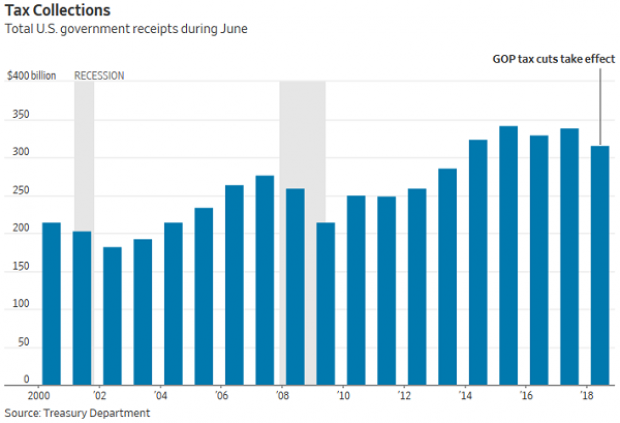

Government Revenues Drop as Tax Cuts Kick In

Corporate tax receipts in June were 33 percent lower than a year ago, according to data released by the Treasury Department Thursday, as companies made smaller estimated payments due to the reduction in their tax rates. Total receipts were down 7 percent, while payroll taxes were 5 percent lower compared to June 2017.

“June receipts to US government were our first mostly-clear look at the revenue effects of the new tax law, with lots of estimated payments and little noise from the 2017 tax year,” The Wall Street Journal’s Richard Rubin tweeted Friday.

Surprisingly, the deficit was smaller in June compared to a year ago, narrowing to $74.86 billion from $90.23 billion last year. The drop was driven by a 9 percent reduction in government outlays that reflected accounting changes rather than any real changes in spending, Rubin said in the Journal.

“More broadly, the federal deficit is swelling as government spending outpaces revenues,” Rubin wrote. “The budget gap totaled $607.1 billion in the first nine months of the 2018 fiscal year, 16% larger than the same point a year earlier.”

Kyle Pomerleau of the Tax Foundation pointed out that the drop in corporate tax receipts is a permanent feature of the Republican tax cuts, tweeting: “Even in a Trump dream world in which these cuts paid for themselves, corporate tax collections would remain below baseline forever. It would be higher income and payroll receipts that made up the difference.”

Deficit Jumps in Trump’s First Fiscal Year

The federal budget deficit rose by 16 percent in the first nine months of the 2018 fiscal year, which began last October. The shortfall came to $607 billion, compared to $523 billion in the same period the year before, according to a U.S. Treasury report released Thursday and reported by Bloomberg. Both revenue and spending rose, but spending rose faster. Revenues came to $2.54 trillion, up 1.3 percent from the same nine-month period in 2017, while spending came to $3.15 trillion, up 3.9 percent.

Where’s the Obamacare Navigator Funding for 2019, PA Insurance Commissioner Asks

Pennsylvania’s insurance commissioner sent a letter this week to Health and Human Services Secretary Alex Azar and Centers for Medicare and Medicaid Services (CMS) Administrator Seema Verma requesting that they “immediately release the funding details for the Navigator program for the upcoming open enrollment period for 2019.” Navigators are the state and local groups that help people sign up for Affordable Care Act plans.

“In years past, grant applications and new funding opportunities were released by CMS in April, CMS required Navigator organizations to apply by June and approved applications and new funding by late August,” Pennsylvania’s Jessica Altman wrote. “The current lack of guidance has put Navigator organizations – and states - far behind in their planning and creates an inability for the Navigator organizations to design a successful plan for helping people enroll during the 2019 open enrollment period.”