Why You Might Want to Cancel That Restaurant Reservation

The cost of dining out rose 3 percent in May year-over-year, while the amount paid to eat at home inched up just 0.6 percent. The growing disparity in prices could prompt consumers to abandon restaurants for home-cooked meals, according to a report today by Bloomberg.

“Eating in hasn’t been this attractive compared to dining out since 2010,” Bloomberg reports. That’s good news for consumers worried about their budgets, but could be a problem for restaurants’ bottom lines.

So far, consumers aren’t making the shift. This spring, spending at restaurants and bars totaled more than sales at grocery stores for the first time.

Related: The 11 Worst Fast Food Restaurants in America

Part of the reason consumers are sticking with restaurants could be that wages are starting to slowly increase, so consumers have a little more money to spend on meals.

They may also be dining out because it’s often an easier option. Shopping and preparing meals takes time – time that people simply don’t have these days. A quarter of employees say that they are working after the standard work day has ended, and about 40 percent work at least one weekend a month, according to Staples Advantage. That leaves little time for food prep.

Supermarkets have responded to the time-pressed consumer by increasingly offering prepared meals that require little more than reheating at home. The prices for such meals tend to be higher than the cost of their ingredients but less than the price of eating out or ordering in.

Quote of the Day: A Big Hurdle for the Tax Cuts

“He goes in and campaigns on an issue, and the challenge is he then talks about executing drug dealers. Why do you think the press is going to cover the tax cuts if you’ve given them the much more exciting issue?”

-- Grover Norquist, president of tax-cutting advocacy group Americans for Tax Reform, on President Trump’s failure to sell the tax law.

The Obamacare Mandate That Could Produce $12 Billion in Fines in 2018

Republicans effectively eliminated the individual Obamacare mandate in the tax package signed late last year. Although the new regulation reducing the mandate penalty to zero doesn’t take effect until 2019, President Trump has cited the rule change as a victory over the health law so many conservatives oppose. “Essentially, we are getting rid of Obamacare. Some people would say, essentially, we have gotten rid of it," Trump told a crowd in Michigan two weeks ago.

However, many parts of the Affordable Care Act are still in effect and will continue to operate even after the individual mandate is eliminated in 2019.

In particular, the employer mandate, which requires companies with more than 50 employees to offer health benefits or face fine of roughly $2,000 per worker, will continue to play a significant role in the Obamacare system. The Congressional Budget Office estimates that the mandate will produce more than $12 billion in fines in 2018 alone.

Some conservative groups are pushing lawmakers to stop enforcing the employer mandate, but the IRS is still working to enforce the law. According to The New York Times Monday, the IRS is sending out notices to more than 30,000 businesses that have failed to comply.

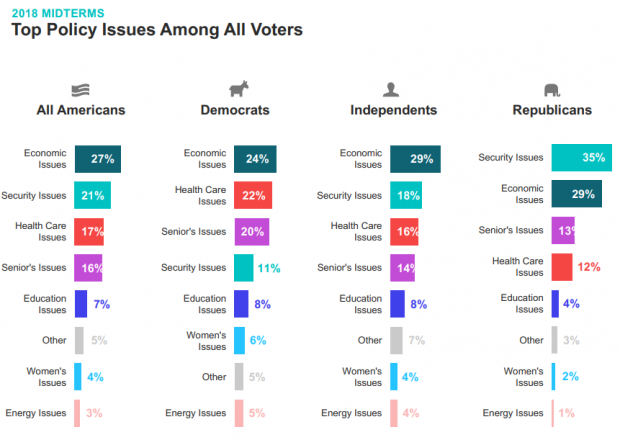

Chart of the Day: It’s Still the Economy, Stupid

Security may be the top policy issue for Republican voters, but the economy is the top concern for Democrats, independents and voters overall, according to Morning Consult’s latest polling on the midterm elections. Health care is third on the list, followed by “seniors’ issues.” The results are based on surveys with more than 275,000 registered U.S. voters from February 1 to April 30.

Number of the Day: $13 Billion

An analysis by Bloomberg finds that the roughly 180 companies in the S&P 500 that have reported earnings for the first three months of the year saved almost $13 billion thanks to the corporate tax cut enacted late last year. Those companies’ effective tax rate dropped by more than 6 percentage points on average. About a third of the tax savings went to 44 financial firms.

How a Florida Doctor with Social Ties to Trump Delayed a $16B Billion VA Project

A West Palm Beach doctor who is friends with Ike Perlmutter, the chairman of Marvel Entertainment and an informal adviser to President Trump on veterans’ issues, has held up “the biggest health information technology project in history — the transformation of the VA’s digital records system,” Politico’s Arthur Allen reports. Dr. Bruce Moskowitz “objected to the $16 billion Department of Veterans Affairs project because he doesn’t like the Cerner Corp. software he uses at two Florida hospitals, according to four former and current senior VA officials. Cerner technology is a cornerstone of the VA project. … Moskowitz’s concerns effectively delayed the agreement for months, the sources said.” Read the full story.