Garage or Backyard? Here’s What First-Time House Buyers Want

More than two-thirds of potential first-time homebuyers want a house in move-in condition, and 43 percent are looking for a place in the burbs.

Beyond that, first-time buyers are most interested in a home with a backyard or pool, striking design, and smart or energy efficient technology, according to the TD Bank First-Time Home Buyer Pulse.

“It’s encouraging to see interest from the first-time homebuyers who have been cautious for much of the housing recovery,” TD Bank Head of Pricing and Secondary Markets Scott Haymore said in a statement. “Consumers are gaining confidence in the economy and many are looking to enter the housing market within the next two years.”

Related: Why First-Time Home Buyers Are Flocking to Tennessee

Last year, first-time homebuyers comprised 38 percent of the market, according to the National Association of Realtors.

Among those surveyed, 62 percent want to make a down payment of at least 20 percent, but nearly two-thirds said they were still saving up for it. Almost half said they needed to pay down debt before they could buy a house.

The average down payment in the first quarter of 2015 was $57,710, reports RealtyTrac. Entry-level buyers usually put down less money than repeat buyers, and are more likely to take advantage of Federal Housing Administration loans, which allow down payments of as little as 3 percent for those who qualify.

Those who can’t get an FHA loan can still put down less than 20 percent by buying private mortgage insurance, with annual premiums of between 0.5 percent and 1 percent of the loan amount.

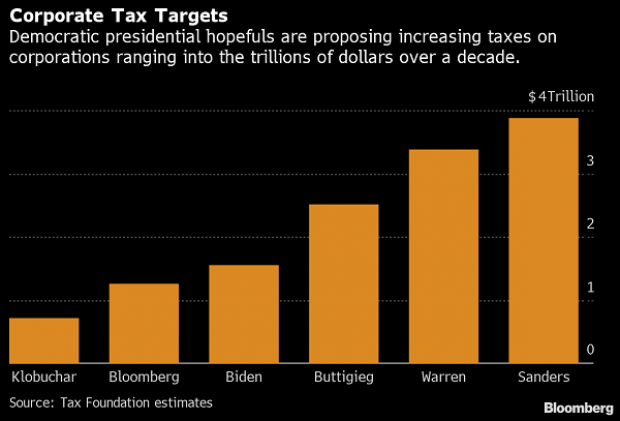

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

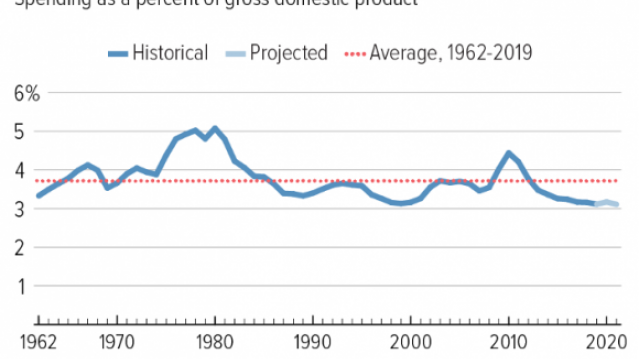

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

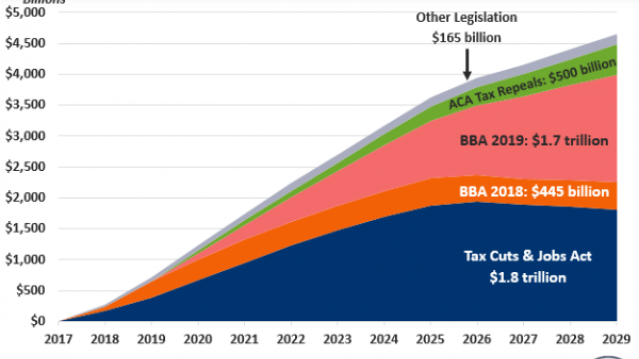

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

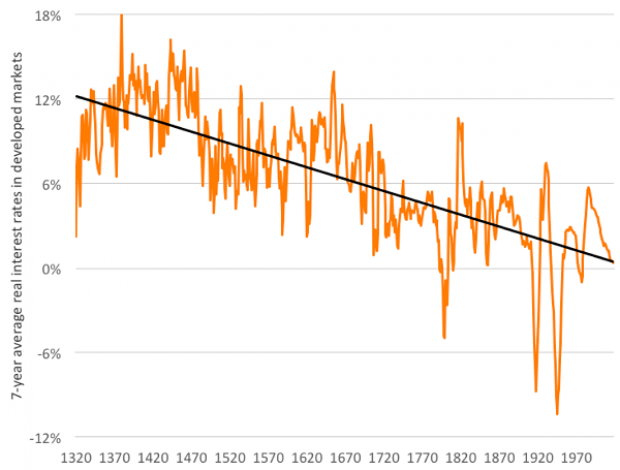

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

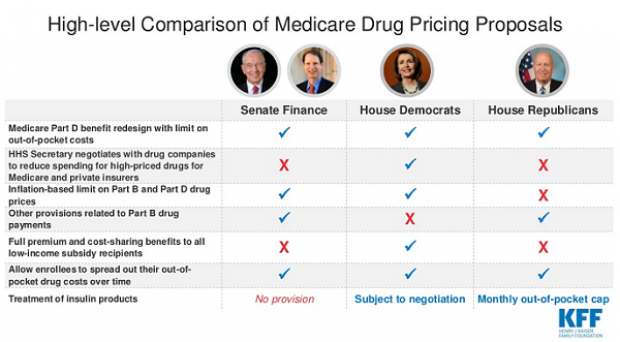

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.