Here’s What Consumers Were and Weren’t Buying in June

Retail sales were disappointingly soft in June, continuing a zig-zag pattern of strength and weakness this year. Sales fell 0.3 percent, falling shy of economists’ expectations for a 0.3 percent gain after a 1 percent jump in May. The only spending categories to post decent gains were electronics and appliance stores sales, gas station sales and discount stores.

“In May, retail gains signaled that consumers may have started using their so-called pump price dividend toward purchases of discretionary items,” Chris G. Christopher, Jr., the director of consumer economics at IHS Global Insight, wrote in an email to clients. Now, he added, the retail data “are pointing to a consumer that spends their paycheck in fits and starts.”

Related: What the U.S. Must Do to Avoid Another Financial Crisis

Those fits and starts averaged out to a fairly healthy 2.6 percent annualized increase over April, May and June. “The glass half-full take on consumers is that 2.6 percent is still somewhat better than the 2.3 percent consumption growth we've averaged since the beginning of the current expansion,” J.P. Morgan economist Michael Feroli said in a research note. “The glass half-empty view is that there is now even less evidence of a sharp snapback in spending after an unambiguously disappointing Q1.”

Here’s a breakdown from the Bespoke Investment Group of how different retail categories fared:

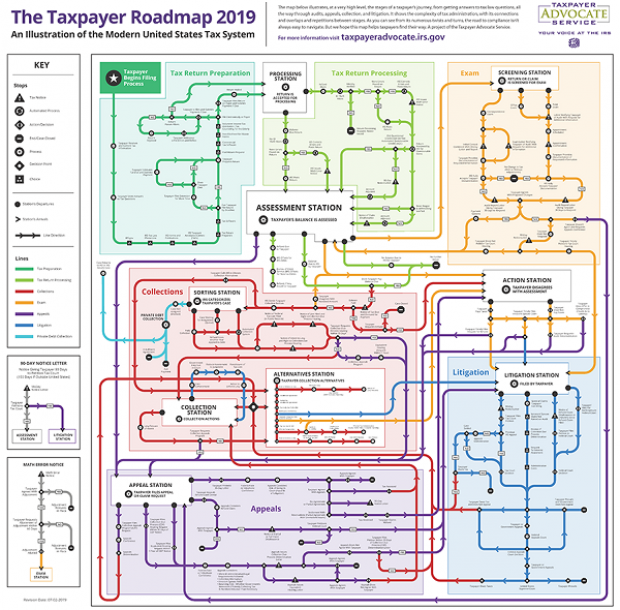

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

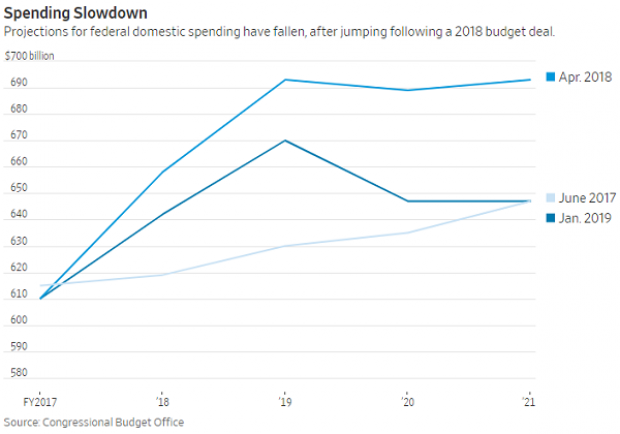

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

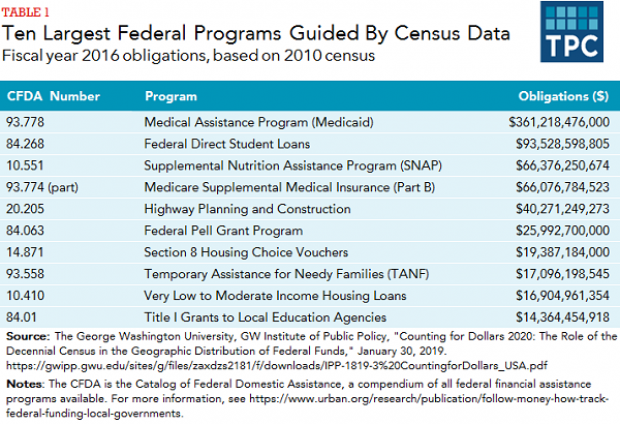

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

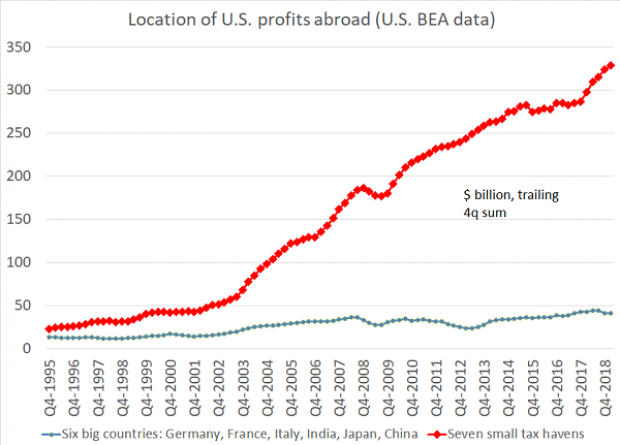

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”