Memo to Michelle Obama: Americans Still Aren’t Eating Their Greens

Maybe First Lady Michelle Obama should refocus her healthy eating campaign more on adults than children. Fewer than 20 percent of American adults are eating enough fruits and vegetables, newly released data from a Centers for Disease Control and Prevention survey.

The United States Department of Agriculture’s nutrition guidelines recommend that Americans have two to three cups of vegetables every day, along with 1.5 to two cups of fruit. Based on those criteria, only 13 percent of adults in the survey ate enough fruit and a meager 9 percent of individuals ate enough vegetables. These numbers are worse than in years past. Between 2007 and 2010, 76 percent of Americans didn’t consume the recommended amount of fruit and 87 percent failed to eat enough vegetables.

Related Link: The 11 Worst Fast Food Restaurants in America

What’s more, while consumption of fruits and vegetables varies substantially from place to place, the residents of each and every state in the union fell short of the USDA recommendations. In Tennessee, 7.5 percent of residents consume enough fruit, while in Mississippi, a mere 5.5 percent of individuals eat enough vegetables. California ranked highest for eating both fruits and vegetables, but even there, just about 18 percent eat enough fruit and 13 percent eat enough veggies.

“Substantial new efforts are needed to build consumer demand for fruits and vegetables through competitive pricing, placement, and promotion in child care, schools, grocery stores, communities, and worksites,” the CDC report says.

The report comes out after a study published in last month’s JAMA Internal Medicine found that fewer than one-third of Americans are currently at a healthy weight. The majority of individuals are either overweight or obese.

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

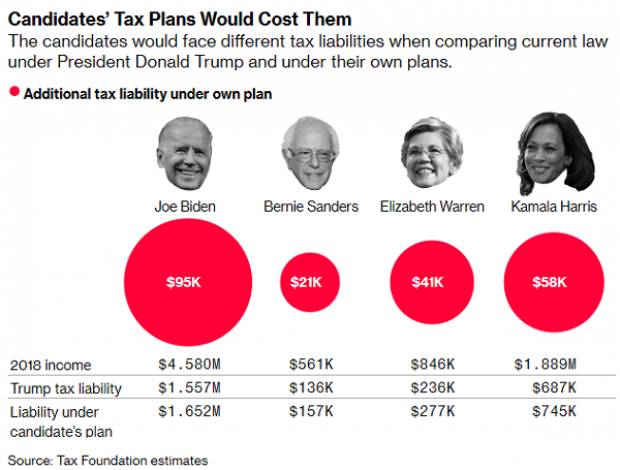

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.