Diane von Furstenberg Will Sell a Purse that Charges Your Phone

Fashion mogul Diane von Furstenberg said she will launch a high-tech purse that automatically—and cordlessly—charges smartphones.

The purse, which does not yet have a price tag, will go on sale in limited edition this holiday season, before rolling out broadly next year. The designer is working with an undisclosed technology partner on the handbag.

"My role in fashion is really solution driven," von Furstenberg said. "I'm always on the go, so [it's important] you have everything at the right time."

The idea of creating a handbag that charges a smartphone isn't entirely new. Kate Spade recently announced that it will launch a similar product line this fall.

Related: 16 Must-Have Products to Make Your Home Smarter Right Now

Von Furstenberg, a regular in Sun Valley, Idaho, took the stage at this year's Allen & Co. conference for a panel on the future of fashion, along with Spanx founder Sara Blakely.

She's there to meet with technology companies as she works to bring fashion into the future.

"Technology is the biggest revolution," von Furstenberg said. "It's such a big part of our lives, we do everything with technology, so it's not even separate anymore. It just is."

Related: 10 Biggest Tech Flops of the Century

Though she doesn't wear an Apple Watch, the designer said she's also interested in wearable technology. At her New York Fashion Week show in September 2012, she sent models down the runway wearing Google Glass.

But von Furstenberg cautions the term "wearable tech" will soon become obsolete.

"Wearable technology won't even be a word anymore, because everything you do will have technology," she said.

Von Furstenberg added that technology isn't just important for the future of fashion products—it's already crucial to their marketing.

"If you're interested in millennials, everyone is on social media and everyone is a brand," she said. "It's very interesting to brands to see how they can work with a generation, who each of them is [their own] brand."

This article originally appeared on CNBC.

Read more from CNBC:

For an airline upgrade, miles aren't the best

How movie theaters are striking back against Netflix

14 retailers shaking up the industry

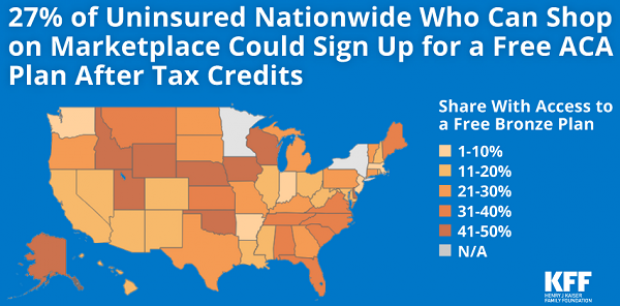

4.2 Million Uninsured People Could Get Free Obamacare Plans

About 4.2 million uninsured people could sign up for a bronze-level Obamacare health plan and pay nothing for it after tax credits are applied, the Kaiser Family Foundation said Tuesday. That means that 27 percent of the country’s 15.9 million uninsured people could get covered for free. The chart below breaks down the eligible population by state.

Takedown of the Day: Ezra Klein on Paul Ryan's Legacy of Debt

Vox’s Ezra Klein says that retiring House Speaker Paul Ryan’s legacy can be summed up in one number: $343 billion. “That’s the increase between the deficit for fiscal year 2015 and fiscal year 2018— that is, the difference between the fiscal year before Ryan became speaker of the House and the fiscal year in which he retired.”

Klein writes that Ryan’s choices while in office — especially the 2017 tax cuts and the $1.3 trillion spending bill he helped pass and the expansion of the earned income tax credit he talked up but never acted on — should be what define his legacy:

“[N]ow, as Ryan prepares to leave Congress, it is clear that his critics were correct and a credulous Washington press corps — including me — that took him at his word was wrong. In the trillions of long-term debt he racked up as speaker, in the anti-poverty proposals he promised but never passed, and in the many lies he told to sell unpopular policies, Ryan proved as much a practitioner of post-truth politics as Donald Trump. …

“Ultimately, Ryan put himself forward as a test of a simple, but important, proposition: Is fiscal responsibility something Republicans believe in or something they simply weaponize against Democrats to win back power so they can pass tax cuts and defense spending? Over the past three years, he provided a clear answer. That is his legacy, and it will haunt his successors.”

Number of the Day: $300 Million

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, wants the agency to be known as the Bureau of Consumer Financial Protection, the name under which it was established by Title X of the 2010 Dodd-Frank Wall Street reform law. Mulvaney even had new signage put up in the lobby of the bureau. But the rebranding could cost the banks and other financial businesses regulated by the bureau more than $300 million, according to an internal agency analysis reported by The Hill’s Sylvan Lane. The costs would arise from having to update internal databases, regulatory filings and disclosure forms with the new name. The rebranding would cost the agency itself between $9 million and $19 million, the analysis estimated. Lane adds that it’s not clear whether Kathy Kraninger, President Trump’s nominee to serve as the bureau’s full-time director, would follow through on Mulvaney’s name change once she is confirmed by the Senate.

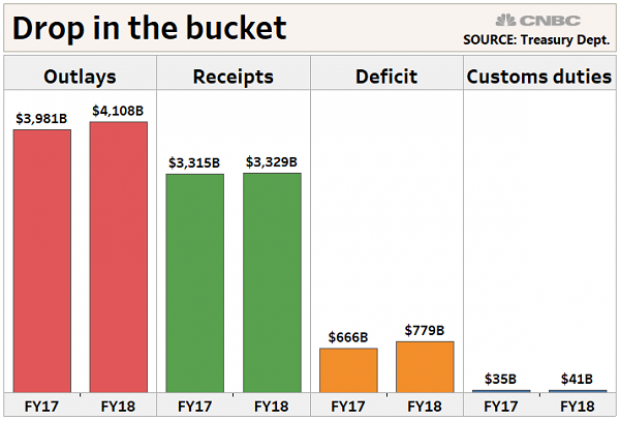

Why Trump's Tariffs Are Just a Drop in the Bucket

President Trump said this week that tariff increases by his administration are producing "billions of dollars" in revenues, thereby improving the country’s fiscal situation. But CNBC’s John Schoen points out that while tariff revenues are indeed higher by several billion dollars this year, the total revenue is a drop in the bucket compared to the sheer size of government outlays and receipts – and the growing annual deficit.

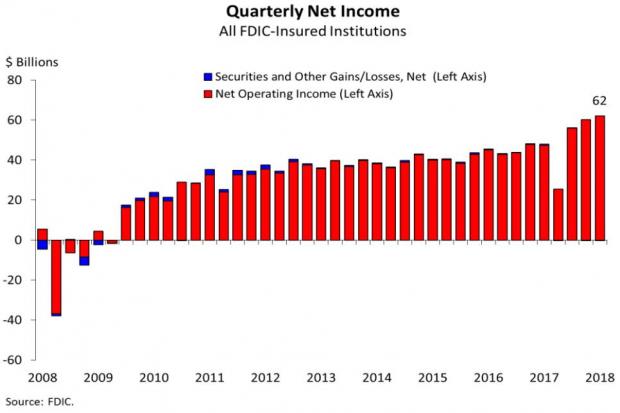

Bank Profits Hit New Record Thanks to 2017 Tax Law

Bank profits reached a record $62 billion in the third quarter, up $14 billion, or 29.3 percent, from the same period last year, according to data from the Federal Deposit Insurance Corporation. The FDIC said that about half of the increase in net income was attributable to last year’s tax cuts. The FDIC estimated that, with the effective tax rates from before the new law, bank profits for the quarter would have risen by about 14 percent, to $54.6 billion.