Diane von Furstenberg Will Sell a Purse that Charges Your Phone

Fashion mogul Diane von Furstenberg said she will launch a high-tech purse that automatically—and cordlessly—charges smartphones.

The purse, which does not yet have a price tag, will go on sale in limited edition this holiday season, before rolling out broadly next year. The designer is working with an undisclosed technology partner on the handbag.

"My role in fashion is really solution driven," von Furstenberg said. "I'm always on the go, so [it's important] you have everything at the right time."

The idea of creating a handbag that charges a smartphone isn't entirely new. Kate Spade recently announced that it will launch a similar product line this fall.

Related: 16 Must-Have Products to Make Your Home Smarter Right Now

Von Furstenberg, a regular in Sun Valley, Idaho, took the stage at this year's Allen & Co. conference for a panel on the future of fashion, along with Spanx founder Sara Blakely.

She's there to meet with technology companies as she works to bring fashion into the future.

"Technology is the biggest revolution," von Furstenberg said. "It's such a big part of our lives, we do everything with technology, so it's not even separate anymore. It just is."

Related: 10 Biggest Tech Flops of the Century

Though she doesn't wear an Apple Watch, the designer said she's also interested in wearable technology. At her New York Fashion Week show in September 2012, she sent models down the runway wearing Google Glass.

But von Furstenberg cautions the term "wearable tech" will soon become obsolete.

"Wearable technology won't even be a word anymore, because everything you do will have technology," she said.

Von Furstenberg added that technology isn't just important for the future of fashion products—it's already crucial to their marketing.

"If you're interested in millennials, everyone is on social media and everyone is a brand," she said. "It's very interesting to brands to see how they can work with a generation, who each of them is [their own] brand."

This article originally appeared on CNBC.

Read more from CNBC:

For an airline upgrade, miles aren't the best

How movie theaters are striking back against Netflix

14 retailers shaking up the industry

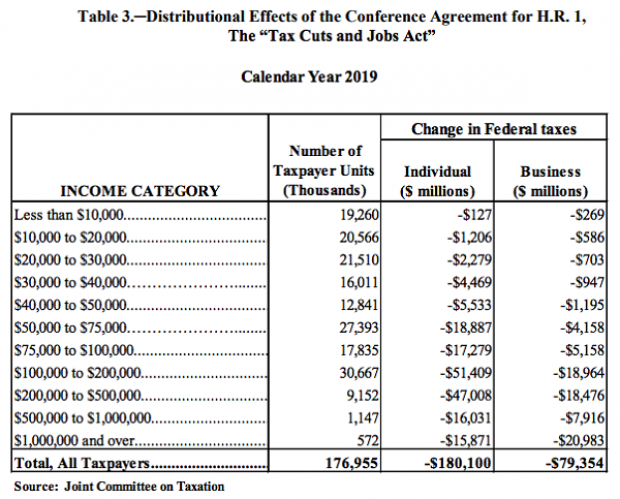

Majority of Tax Cuts Going to Filers Earning More Than $100K: JCT

Ahead of a House Ways and Means Committee hearing scheduled for Wednesday, the Joint Committee on Taxation prepared an analysis of the distributional effects of the 2017 Republican tax bill. The New York Times’ Jim Tankersley highlighted the fact that according to the JCT analysis, about 75 percent of the individual and business benefits of the tax cuts will go to filers earning more than $100,000 in 2019. And nearly half of the benefits will flow to filers earning over $200,000.

The Trump Budget's $1.2 Trillion in 'Phantom Revenues'

President Trump’s 2020 budget includes up to $1.2 trillion in “potentially phantom revenues” — money that comes from taxes the administration opposes or from tax hikes that face strong opposition from businesses, The Wall Street Journal’s Richard Rubin reports, citing data from the Committee for a Responsible Federal Budget. That total, covering 2020 through 2029, includes as much as $390 billion in taxes created under the Affordable Care Act, which the president wants to repeal.

The $1.2 trillion in questionable revenue projections is in addition to the White House budget’s projected deficits of $7.3 trillion for the 10-year period. That total is itself questionable, given that the president’s budget relies on optimistic assumptions about economic growth and some unrealistic spending cuts, meaning that the deficits could be significantly higher than projected.

Republicans Push Ahead on Medicaid Restrictions

The Trump administration on Friday approved Ohio’s request to impose work requirements on Medicaid recipients. Starting in 2021, the state will require most able-bodied adults aged 19 to 49 to either work, go to school, be in job training or volunteer for 80 hours a month in order to receive Medicaid benefits. Those who fail to meet the requirements over 60 days will be removed from the system, although they can reapply immediately.

The new work requirements include exemptions for pregnant women, caretakers and those living in counties with high unemployment rates and will apply only to those covered through the expansion of Medicaid under the Affordable Care Act. There are currently about 540,000 people on Medicaid in Ohio who receive coverage through the expansion, according to Kaitlin Schroeder of The Dayton Daily News, compared to roughly 2.6 million Medicaid recipients in the state overall.

Once implemented, the work requirements are expected to result in 36,000 people losing their Medicaid eligibility, according to state officials, though critics say the reductions could be significantly larger. Similar work requirements in Arkansas pushed 18,000 people off the Medicaid rolls in six months.

A larger GOP project: The creation of new work requirements is part of a larger effort by Republicans to limit the expansion of Medicaid, says The Wall Street Journal’s Stephanie Armour. Since the Affordable Care Act passed in 2010, 36 states have expanded their Medicaid programs under the ACA and the number of people in the program has grown by 50 percent, from roughly 50 million to about 75 million. But many red-state governors have expressed concerns about the cost of Medicaid expansion and worries about a lack of self-sufficiency among the able-bodied poor, and are embracing new limitations on the program for both fiscal and political reasons.

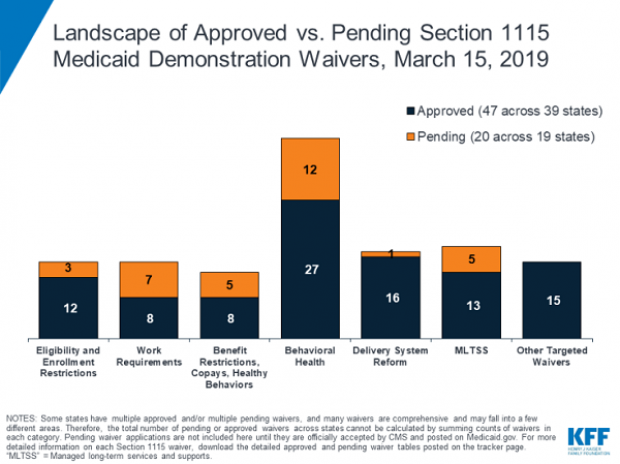

In 2017, the White House in 2017 gave states the green light to explore ways to limit the reach and expense of their Medicaid programs. Governors have proposed a variety of new rules, which require waivers from the federal government to enact. Kentucky, for example, wants to drug-test Medicaid recipients, and Utah wants a partial expansion and a cap on payments. Kaiser Health News summarizes the variety of waivers states have requested, which are governed by Section 1115 of the Social Security Act, in the chart below.

Legal challenges: Efforts to restrict Medicaid have received legal challenges, and U.S. District Judge James Boasberg blocked work requirements in Kentucky last year. The same judge, who has expressed doubts about the administration’s approach to Medicaid, will rule on the legality of work requirements in both Kentucky and Arkansas by April 1.

The bottom line: The Trump administration is seeking fundamental changes in how Medicaid works. Even if Boasberg rules against work requirements, expect the White House and Republican governors to continue to push for new limitations on the program.

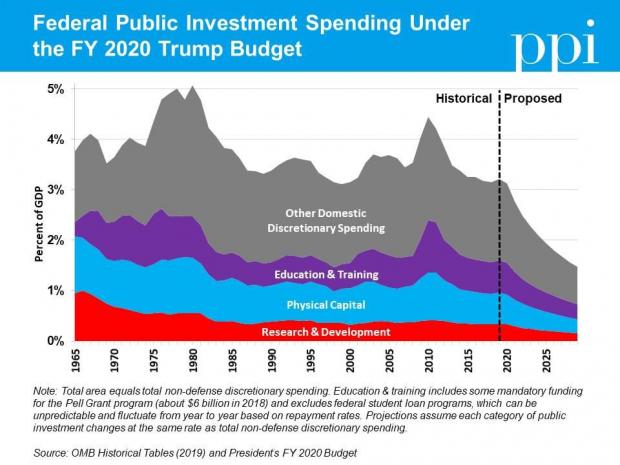

Chart of the Day: Trump's Huge Proposed Cuts to Public Investment

Ben Ritz of the Progressive Policy Institute slams President Trump’s new budget:

“It would dismantle public investments that lay the foundation for economic growth, resulting in less innovation. It would shred the social safety net, resulting in more poverty. It would rip away access to affordable health care, resulting in more disease. It would cut taxes for the rich, resulting in more income inequality. It would bloat the defense budget, resulting in more wasteful spending. And all this would add up to a higher national debt than the policies in President Obama’s final budget proposal.”

Here’s Ritz’s breakdown of Trump’s proposed spending cuts to public investment in areas such as infrastructure, education and scientific research:

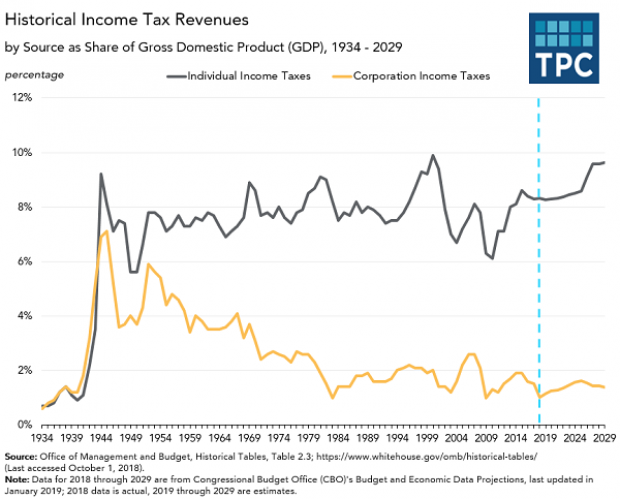

Chart of the Day: The Decline in Corporate Taxes

Since roughly the end of World War Two, individual income taxes in the U.S. have equaled about 8 percent of GDP. By contrast, the Tax Policy Center says, “corporate income tax revenues declined from 6% of GDP in 1950s to under 2% in the 1980s through the Great Recession, and have averaged 1.4% of GDP since then.”