Love Selfies? Now They Can Keep Your Credit Card Safe

MasterCard is appealing to America’s obsession with selfies in an effort to reduce credit card identity theft.

The credit card company is launching a new program that will allow consumers to approve online purchases with a facial scan. At the checkout page, you’ll be asked to take a picture of yourself using your phone instead of entering a password.

Currently, customers can stop hackers from using their credit card on the Web by setting up a “SecureCode,” which requires a password when shopping online. The password system was used in 3 billion transactions last year.

This fall MasterCard will launch a small pilot program involving 500 customers using fingerprints and facial scans. If the test is a success, the company plans on rolling it out publicly afterward. The company is also looking ahead to one day apply voice recognition technology.

To use the new selfie system, customers need to download the MasterCard phone app. Once you pay for something, a pop-up will appear asking for your authorization with either a fingerprint or facial recognition. Using facial recognition, customers stare at the phone, blink once — and bam! All done. The blink is a security measure so thieves can’t just hold up a photo of you. A fingerprint only requires a touch.

Passwords are easily forgotten, stolen or cracked, so the new system is a way to prove your identity using biometrics. Critics of the new system are uncomfortable that the photo or fingerprint a customer puts into his or her phone will transmit to the company’s computer servers. Cybersecurity experts worry the transfer of such information across devices is too big of a privacy risk.

MasterCard wasn’t the first company to develop a facial recognition app — Chinese shopping brand Alibaba demonstrated one in March, but had to postpone the technology’s launch because of security risks found by China’s central bank and police ministry.

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

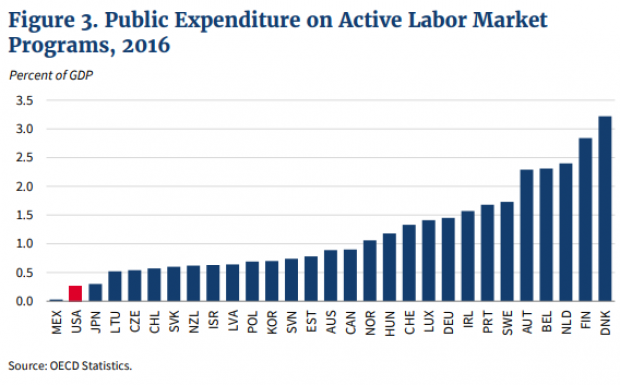

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.