Get Ready for Your 'Daily Glitch'—The NYSE, WSJ and United Were Just the Beginning

“Glitch” is clearly the word of the moment, after a series of pesky little technical problems forced United Airlines to ground flights, halted New York Stock Exchange trading and took down The Wall Street Journal website homepage all on the same day. If that wasn’t enough technical trouble, Seattle’s 911 system went down briefly. And a couple of NASA spacecraft also suffered “glitches” in recent days.

We deal routinely with glitches these days — a Wi-Fi connection goes down, an app freezes, a plug-in (usually Shockwave) stops responding, an email doesn’t load properly — which may help explain why, aside from lots of grumbling from delayed airline passengers, the reaction to Wednesday’s glitches was rather muted. The NYSE problems were reportedly caused by a “configuration issue” after a software update and United blamed its problem on “degraded network connectivity.” We see those issues every day, just not on as large a scale.

But that’s the problem.

At the risk of sounding like a high school term paper, let us note that the Merriam-Webster definition of glitch is “an unexpected and usually minor problem; especially: a minor problem with a machine or device (such as a computer).” The full definition describes it as a minor problem that causes a temporary setback.

Sure, Wednesday’s setbacks were all temporary. The Wall Street Journal site came back up quickly. Seattle’s 911 service was restored. Action on the NYSE itself was stopped for nearly four hours, but even then traders were still able to buy and sell NYSE-listed stocks on other exchanges. United grounded about 3,500 flights, which meant some people missed a wedding or a crucial business meeting. That will take time to sort out, but it will get sorted out.

In aggregate, though, the problems add up — and the word “glitch” only minimizes what can be much bigger, more serious issues..

Stock exchanges have suffered from a series of stoppage-causing glitches in recent years, pointing to the value of having trading spread across numerous exchanges. United’s tech breakdown “marked the latest in a series of airline delays and cancellations in the last few years that experts blame on massive, interconnected computer systems that lack sufficient staff and financial backing,” the Los Angeles Times reports. Just ask any of the roughly 400,000 United passengers whose travel plans were messed up if this was a little glitch. Or maybe check with the engineers who had to troubleshoot and rebuild the HealthCare.gov site after its glitch-laden launch.

It may be some relief that these latest outages weren’t the result of external attacks, but as sociologist Zeynep Tufecki, an assistant professor at the School of Information at the University of North Carolina, writes at The Message, “The big problem we face isn’t coordinated cyber-terrorism, it’s that software sucks. Software sucks for many reasons, all of which go deep, are entangled, and expensive to fix.”

These foul-ups are now mundane, and to some extent they may be inevitable as we rely more and more on complicated computer systems in every aspect of our lives. That’s the real issue, and it’s a lot bigger than a glitch.

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

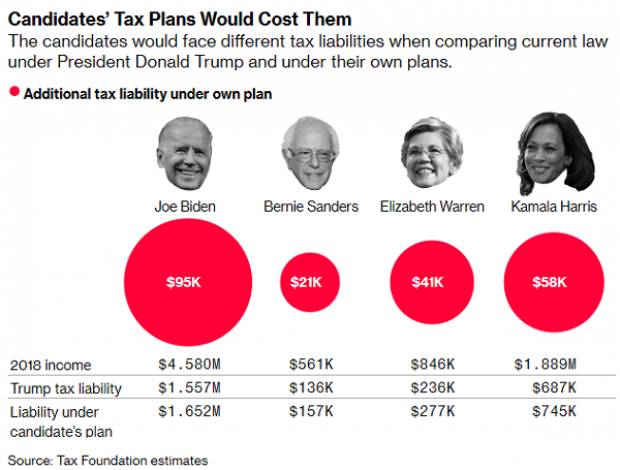

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.