How to Save Greece? Try a Fundraiser

With Greece facing a loan payment of 1.6 billion euros to the International Monetary Fund on Tuesday, a man in London named Thom Feeney took it upon himself to launch a fundraising campaign for the financially strapped country on Indiegogo, an international crowdfunding site. As of late Monday afternoon, more than 400 people have pledged about 7,000 euros to the “Greek Bailout Fund,” and those numbers are climbing steadily.

Feeney says on Indiegogo that he is frustrated with European ministers and “all this dithering over Greece.” As Feeney states, “The European Union is home to 503 million people, if we all just chip in a few Euro then we can get Greece sorted and hopefully get them back on track soon. Easy."

He says he can clear the whole mess up with a contribution of just over three euros from each European. “That’s about the same as half a pint in London or everyone in the EU just having a Feta and Olive salad for lunch.”

Incentives for donors include a postcard with an image Alex Tsipras, the Greek Prime Minister, for a donation of three euros, and a Greek feta and olive salad for six euros. Ten euros gets you a small bottle of ouzo, and a pledge of 25 euros will earn you a bottle of Greek wine.

So far at least 90 donors will be expecting postcards, 35 can look forward to a salad, 40 have signed up to receive a bottle of ouzo, and 30 can expect a bottle of wine. But whether anyone will actually receive their rewards remains to be seen. Like the Greek creditors, the donors will have to wait and see if their payments ever arrive.

Update: As of Tuesday morning, more than 10,000 people have donated about 170,000 euros, and the numbers continue to rise. Feeney has stated that all the money will be returned if the fundraiser fails to reach its target.

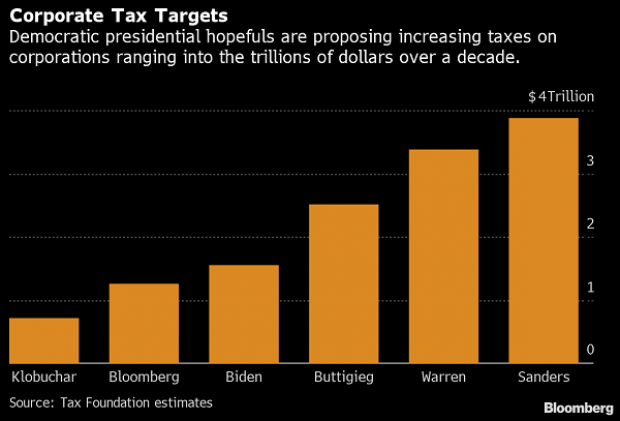

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

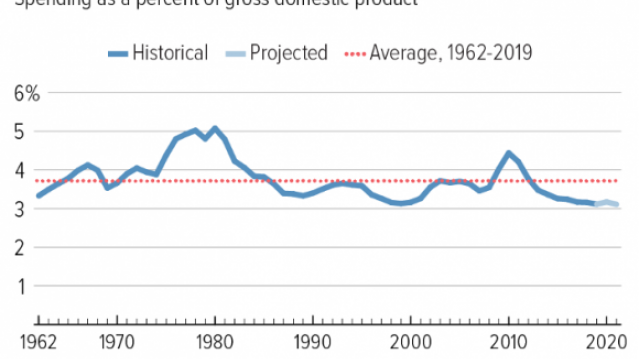

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

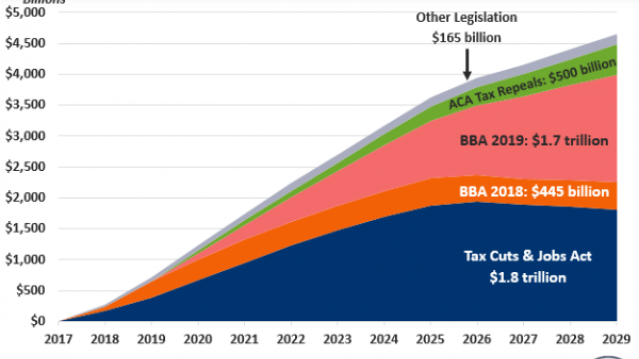

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

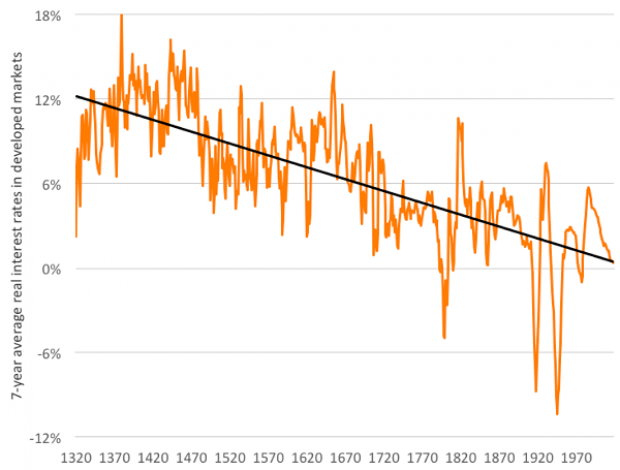

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

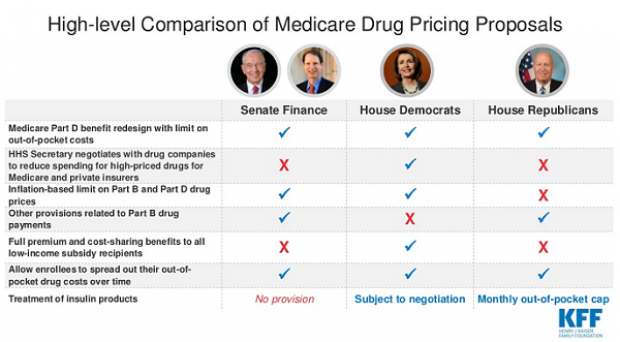

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.