Presidential Candidates Respond to SCOTUS Obamacare Ruling

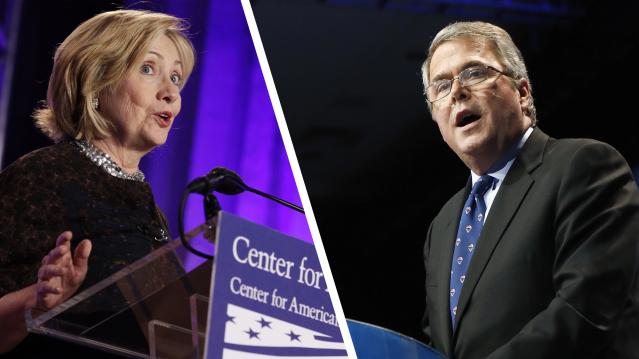

The Supreme Court’s 6-3 ruling Thursday may have kept the health care law and its insurance subsidies in place, but that doesn’t mean Republican efforts to “repeal and replace” the law are done. Major GOP presidential candidates took to Twitter following the Supreme Court’s announcement to blast the high court’s decision. Here are their responses and those from the Democratic candidates.

I am disappointed in the Burwell decision, but this is not the end of the fight against ObamaCare. http://t.co/3yaEVF1TaW

— Jeb Bush (@JebBush) June 25, 2015

Yes! SCOTUS affirms what we know is true in our hearts & under the law: Health insurance should be affordable & available to all. -H

— Hillary Clinton (@HillaryClinton) June 25, 2015

Despite the Court’s decision, ObamaCare is still a bad law that is having a negative impact on our country and on millions of Americans.

— Marco Rubio (@marcorubio) June 25, 2015

Justice Scalia got it right! "Words no longer have meaning if an Exchange that is not established by a State is "established by the State."

— Dr. Rand Paul (@RandPaul) June 25, 2015

I remain fully committed to the repeal of Obamacare—every single word of it. And, in 2017, we will do exactly that https://t.co/6i4WzLFzKR

— Ted Cruz (@tedcruz) June 25, 2015

#ObamaCare ruling is judicial tyranny. http://t.co/Di6WjxOc3y

— Gov. Mike Huckabee (@GovMikeHuckabee) June 25, 2015

Now that this ideological attempt to stop #ACA failed, we must redouble our efforts to bring health care to every person in this nation.

— Martin O'Malley (@MartinOMalley) June 25, 2015

Americans deserve better than what we’re getting with Obamacare. It’s time we repealed and replaced it! http://t.co/1EHfbVKBMa

— Rick Perry (@GovernorPerry) June 25, 2015

It is outrageous that the Supreme Court once again rewrote ObamaCare to save this deeply flawed law https://t.co/NBAnohFTW7

— Carly Fiorina (@CarlyFiorina) June 25, 2015

RT If you agree. We need real leadership in Washington, and Congress needs to repeal and replace #ObamaCare. #SCOTUScare - SKW

— Scott Walker (@ScottWalker) June 25, 2015

NEWS: Sen. Bernie Sanders' statement on Supreme Court decision upholding #ACA http://t.co/AUQgEHqUsi pic.twitter.com/PjyEillVBa

— Bernie Sanders (@SenSanders) June 25, 2015

Deeply disappointed by #SCOTUS ruling. Fundamental increase of govt control. I'm working to ensure next Pres repeals and replaces #Obamacare

— Dr. Ben Carson (@RealBenCarson) June 25, 2015

Today's Supreme Court ruling is another reminder that if we want to get rid of #Obamacare, we must elect a conservative President #RICK2016

— Rick Santorum (@RickSantorum) June 25, 2015Can Trump Bring Democrats Along on Taxes?

Although Republicans are prepared to go it alone on tax reform, President Trump suggested creating a bipartisan working group on the topic during a Wednesday meeting with senators from both parties. Some senators were open to the idea, but it doesn’t look like Republicans have much interest in slowing down the process with in-depth negotiations. “I don’t really personally see the benefit of creating additional structure. I think we’ve got all the tools we need,” said Sen. John Cornyn (R-TX), who attended the meeting, according to Politico. Democrats appear skeptical, too. Sen. Ron Wyden (D-OR) said he told Trump that the distance between what Republicans were saying about their plan and what it actually does is a serious problem.

Where Trump Will Compromise on Tax Reform

White House officials tell USA Today’s Heidi Przybyla that President Trump will include a number of compromises to limit his tax plan’s benefits for the wealthy when he promotes the blueprint next month:

“The compromises will include ending a 23.8% preferential tax rate for hedge-fund managers, or the so-called carried interest rate, White House legislative affairs director Marc Short told USA TODAY. … Retaining parts of a state and local tax deduction that benefits many middle-class families in blue states is also an area where Trump is expecting compromise.”

Trump campaigned on raising the carried interest rate, saying its beneficiaries are “getting away with murder.” But changes to the carried interest rate may run into opposition from House Republicans, and the tweaks appear unlikely to win any Democratic support.

Larry Summers Savages Trump Tax Plan Analysis

Former Treasury Secretary Larry Summers made his distaste for the Trump administration’s tax framework clear last week when he said Republicans were using “made-up” claims about the plan and its effects. Summers expanded his criticism on Tuesday in a blog post that took aim at the report released Monday by the Council of Economic Advisers and chair Kevin Hassett, which seeks to justify the administration’s claim that its tax plan will result in a $4,000 pay raise for the average American family.

Never one to mince words, Summers says the CEA analysis is “some combination of dishonest, incompetent and absurd.” The pay raise figure is indefensible, since “there is no peer-reviewed support for his central claim that cutting the corporate tax rate from 35 to 20 percent would raise wages by $4000 per worker.” In the end, Summers says that “if a Ph.D student submitted the CEA analysis as a term paper in public finance, I would be hard pressed to give it a passing grade.”

One of the authors cited in the CEA paper also has some concerns. Harvard Business School professor Mihir Desai tweeted Tuesday that the CEA analysis “misinterprets” a 2007 paper he co-wrote on the dynamics of the corporate tax burden. Desai’s research has found a connection between business tax cuts and wage growth, but not as large as the CEA paper claims. “Cutting corporate taxes will help wages but exaggeration only serves to undercut the reasonableness of the core argument,” Desai wrote.

For Tax Reform, It May Be 2017 or Bust

National Economic Council Director Gary Cohn said Monday that tax reform has to happen this year, even if it means Congress has to stay in session longer. "I think we have a unique window in time right now, but unfortunately we keep losing days to this window,” he said. “The opportunity is now." House Speaker Paul Ryan said last week he’d keep members over Christmas if that’s what it takes. And Ryan predicted Monday that tax reform would pass the House by early next month and then get through the Senate to reach the president’s desk by the end of the year. But there are plenty of skeptics out there, given the hurdles. Issac Boltansky, an analyst at the investment bank Compass Point, told Business Insider, "The idea of getting tax reform done this year is a farcical fantasy. Lawmakers have neither the time nor the capacity to formulate and clear a tax reform package in 2017."

Do Republicans Have the Votes for the Next Step Toward Tax Reform?

Passing a budget resolution for 2018 through the Senate will open a procedural door to a $1.5 trillion tax cut over 10 years. The resolution is expected to reach the Senate floor this week, although there are questions about whether Republicans have the 50 votes they need to pass it. Sens. Susan Collins (R-ME) said this weekend that she would vote for it and Lisa Murkowski (R-AK) is likely a “yes” as well, but Sen. Rand Paul (R-TN) is reportedly a likely “no” and John McCain (R-AZ) appears questionable. Now it looks like Sen. Thad Cochran (R-MI) won't be back in Washington this week to vote on the resolution due to health problems. The Hill says Cochran’s absence puts tax reform “on knife’s edge.”