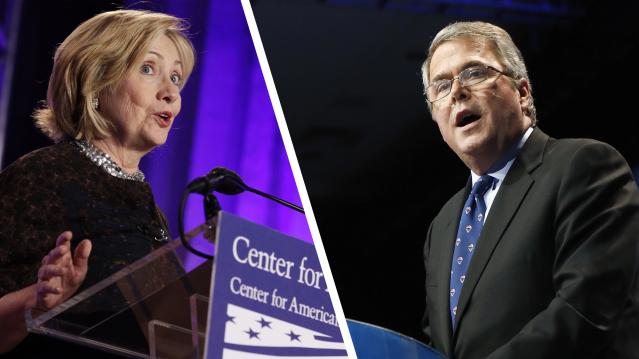

Presidential Candidates Respond to SCOTUS Obamacare Ruling

The Supreme Court’s 6-3 ruling Thursday may have kept the health care law and its insurance subsidies in place, but that doesn’t mean Republican efforts to “repeal and replace” the law are done. Major GOP presidential candidates took to Twitter following the Supreme Court’s announcement to blast the high court’s decision. Here are their responses and those from the Democratic candidates.

I am disappointed in the Burwell decision, but this is not the end of the fight against ObamaCare. http://t.co/3yaEVF1TaW

— Jeb Bush (@JebBush) June 25, 2015

Yes! SCOTUS affirms what we know is true in our hearts & under the law: Health insurance should be affordable & available to all. -H

— Hillary Clinton (@HillaryClinton) June 25, 2015

Despite the Court’s decision, ObamaCare is still a bad law that is having a negative impact on our country and on millions of Americans.

— Marco Rubio (@marcorubio) June 25, 2015

Justice Scalia got it right! "Words no longer have meaning if an Exchange that is not established by a State is "established by the State."

— Dr. Rand Paul (@RandPaul) June 25, 2015

I remain fully committed to the repeal of Obamacare—every single word of it. And, in 2017, we will do exactly that https://t.co/6i4WzLFzKR

— Ted Cruz (@tedcruz) June 25, 2015

#ObamaCare ruling is judicial tyranny. http://t.co/Di6WjxOc3y

— Gov. Mike Huckabee (@GovMikeHuckabee) June 25, 2015

Now that this ideological attempt to stop #ACA failed, we must redouble our efforts to bring health care to every person in this nation.

— Martin O'Malley (@MartinOMalley) June 25, 2015

Americans deserve better than what we’re getting with Obamacare. It’s time we repealed and replaced it! http://t.co/1EHfbVKBMa

— Rick Perry (@GovernorPerry) June 25, 2015

It is outrageous that the Supreme Court once again rewrote ObamaCare to save this deeply flawed law https://t.co/NBAnohFTW7

— Carly Fiorina (@CarlyFiorina) June 25, 2015

RT If you agree. We need real leadership in Washington, and Congress needs to repeal and replace #ObamaCare. #SCOTUScare - SKW

— Scott Walker (@ScottWalker) June 25, 2015

NEWS: Sen. Bernie Sanders' statement on Supreme Court decision upholding #ACA http://t.co/AUQgEHqUsi pic.twitter.com/PjyEillVBa

— Bernie Sanders (@SenSanders) June 25, 2015

Deeply disappointed by #SCOTUS ruling. Fundamental increase of govt control. I'm working to ensure next Pres repeals and replaces #Obamacare

— Dr. Ben Carson (@RealBenCarson) June 25, 2015

Today's Supreme Court ruling is another reminder that if we want to get rid of #Obamacare, we must elect a conservative President #RICK2016

— Rick Santorum (@RickSantorum) June 25, 2015Goldman Sachs and JP Morgan See Small GDP Boost from Tax Bill

Goldman Sachs economists see the tax bill adding 0.3 percentage points to GDP growth in 2018 and 2019 while JP Morgan forecasts a similar gain of 0.3 percentage points next year and 0.2 percentage points the year after.

Goldman’s analysts add that federal spending, which is likely to grow more quickly next year than it has recently, will bring the total fiscal boost to around 0.6 percentage points for 2018 and 0.4 percentage points in 2019.

Both banks see deficits likely rising above $1 trillion, or about 5 percent of GDP, in 2019.

Congress Sends Tax Bill to the White House

The Republican-controlled U.S. House of Representatives gave final approval on Wednesday to the biggest overhaul of the U.S. tax code in 30 years, sending a sweeping $1.5 trillion bill to President Donald Trump for his signature.

In sealing Trump’s first major legislative victory, Republicans steamrolled opposition from Democrats to pass a bill that slashes taxes for corporations and the wealthy while giving mixed, temporary tax relief to middle-class Americans.

The House approved the measure, 224-201, passing it for the second time in two days after a procedural foul-up forced another vote on Wednesday. The Senate had passed it 51-48 in the early hours of Wednesday.

Trump had emphasized a tax cut for middle-class Americans during his 2016 campaign. At the beginning of a Cabinet meeting on Wednesday, he said lowering the corporate tax rate from 35 percent to 21 percent was “probably the biggest factor in this plan.”

Trump planned a tax-related celebration with U.S. lawmakers at the White House in the afternoon but will not sign the legislation immediately. The timing of the signing was still up in the air.

After Trump repeatedly urged Republicans to get it to him to sign before the end of the year, White House economic adviser Gary Cohn said the timing of signing the bill depends on whether automatic spending cuts triggered by the legislation could be waived. If so, the president will sign it before the end of the year, he said.

The debt-financed legislation cuts the U.S. corporate income tax rate to 21 percent, gives other business owners a new 20 percent deduction on business income and reshapes how the government taxes multinational corporations along the lines the country’s largest businesses have recommended for years.

Millions of Americans would stop itemizing deductions under the bill, putting tax breaks that incentivize home ownership and charitable donations out of their reach, but also making tax returns somewhat simpler and shorter.

The bill keeps the present number of tax brackets but adjusts many of the rates and income levels for each one. The top tax rate for high earners is reduced. The estate tax on inheritances is changed so far fewer people will pay.

Once signed, taxpayers likely would see the first changes to their paycheck tax withholdings in February. Most households will not see the full effect of the tax plan on their income until they file their 2018 taxes in early 2019.

In two provisions added to secure needed Republican votes, the legislation also allows oil drilling in Alaska’s Arctic National Wildlife Refuge and repeals the key portion of the Obamacare health system that fined people who did not have healthcare insurance.

“We have essentially repealed Obamacare and we’ll come up with something that will be much better,” Trump said on Wednesday.

“Pillaging”

Democrats have called the tax legislation a giveaway to the wealthy that will widen the income gap between rich and poor, while adding $1.5 trillion over the next decade to the $20 trillion national debt, which Trump promised in 2016 he would eliminate as president.

“Today the Republicans take their victory lap for successfully pillaging the American middle class to benefit the powerful and the privileged,” said House Democratic leader Nancy Pelosi.

few Republicans, whose party was once defined by its fiscal hawkishness, have protested the deficit-spending encompassed in the bill. But most of them have voted for it anyway, saying it would help businesses and individuals, while boosting an already expanding economy they see as not growing fast enough.

“We’ve had two quarters in a row of 3 percent growth,” Senate Republican leader Mitch McConnell said after the Senate vote. “The stock market is up. Optimism is high. Coupled with this tax reform, America is ready to start performing as it should have for a number of years.”

Despite Trump administration promises that the tax overhaul would focus on the middle class and not cut taxes for the rich, the nonpartisan Tax Policy Center, a think tank in Washington, estimated middle-income households would see an average tax cut of $900 next year under the bill, while the wealthiest 1 percent of Americans would see an average cut of $51,000.

The House was forced to vote again after the Senate parliamentarian ruled three minor provisions violated arcane Senate rules. To proceed, the Senate deleted the three provisions and then approved the bill.

Because the House and Senate must approve the same legislation before Trump can sign it into law, the Senate’s late Tuesday vote sent the bill back to the House.

Democrats complained the bill was a product of a hurried, often secretive process that ignored them and much of the Republican rank-and-file. No public hearings were held and numerous narrow amendments favored by lobbyists were added late in the process, tilting the package more toward businesses and the wealthy.

U.S. House Speaker Paul Ryan defended the bill in television interviews on Wednesday morning, saying support would grow for after it passes and Americans felt relief.

“I think minds are going to change,” Ryan said on ABC’s “Good Morning America” program.

Reporting by David Morgan and Amanda Becker; Additional reporting by Richard Cowan, Roberta Rampton, Gina Chon and Susan Heavey; Editing by Jeffrey Benkoe and Bill Trott.

Does Paul Ryan Have ‘His Eyes on the Exits’?

Politico’s Tim Alberta and Rachael Bade drop a blockbuster: “Despite several landmark legislative wins this year, and a better-than-expected relationship with President Donald Trump, Ryan has made it known to some of his closest confidants that this will be his final term as speaker. … He would like to serve through Election Day 2018 and retire ahead of the next Congress. This would give Ryan a final legislative year to chase his second white whale, entitlement reform, while using his unrivaled fundraising prowess to help protect the House majority—all with the benefit of averting an ugly internecine power struggle during election season.”

Speculation has been swirling that Ryan could step down once “he’s harpooned his personal white whale of tax reform,” as HuffPost put it.

When asked at his weekly press conference whether he’ll be quitting anytime soon, Ryan chuckled and said, “I’m not, no.”

EU Finance Ministers Warn Mnuchin About Tax Plan

The finance ministers of Europe’s five largest economies — Germany, France, the U.K., Italy and Spain — warned that the Republican tax plan could have “a major distortive impact” on international trade and may violate international treaties. "The inclusion of certain less conventional international tax provisions could contravene the U.S.'s double taxation treaties and may risk having a major distortive impact on international trade," the ministers wrote in a letter to Mnuchin.

Trump’s Plans for Welfare Reform Will Hit Health Care, Housing and Veterans

Politico reports: “The White House is quietly preparing a sweeping executive order that would mandate a top-to-bottom review of the federal programs on which millions of poor Americans rely. And GOP lawmakers are in the early stages of crafting legislation that could make it more difficult to qualify for those programs. … The president is expected to sign the welfare executive order as soon as January, according to multiple administration officials, with an eye toward making changes to health care, food stamps, housing and veterans programs, not just traditional welfare payments.”