This Is America’s Biggest Financial Fear

More than 60 percent of Americans are losing sleep at night because of financial concerns, and the biggest concern is that they’re not saving enough for retirement, according to a new report from CreditCards.com.

The second-biggest worry is about the cost of education, with half of those between the ages of 18 and 29 saying that concern keeps them up at night.

The percentage of Americans worried about education costs has been growing for the past eight years and is the only category that has become a bigger problem since the Great Recession. “Unless something slows the rapid rise in college costs, this could soon be Americans’ biggest financial fear,” CreditCards.com senior analyst Matt Schultz said in a statement.

Related: 12 Smart Money Moves Millennials Should Make Right Now

That echoes a Gallup poll released in April, which found that 73 percent of parents with kids under age 18 ranked paying for college as a financial worry, more than were concerned about saving for retirement or covering medical expenses.

Nearly one in three Americans are losing sleep because of medical bills, 27 percent are worried about their mortgage or rent payment, and 21 percent fret over credit card debt.

Older Americans and those with higher incomes seem to have fewer financial anxieties than younger generations. Less than half of those age 65 or older are losing sleep over their finances, versus more than two thirds of adults 64 or younger. Of those making less than $75,000 per year, 69 percent had financial worries, compared to just 51 percent of those making more than $75,000.

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

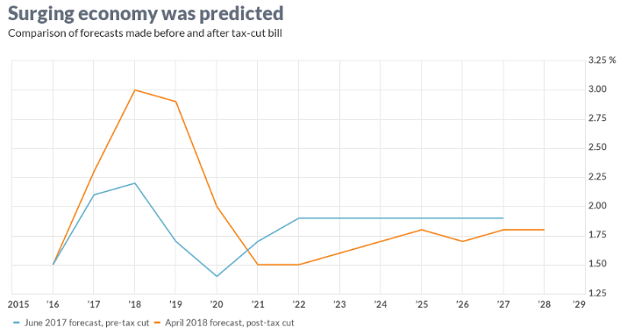

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

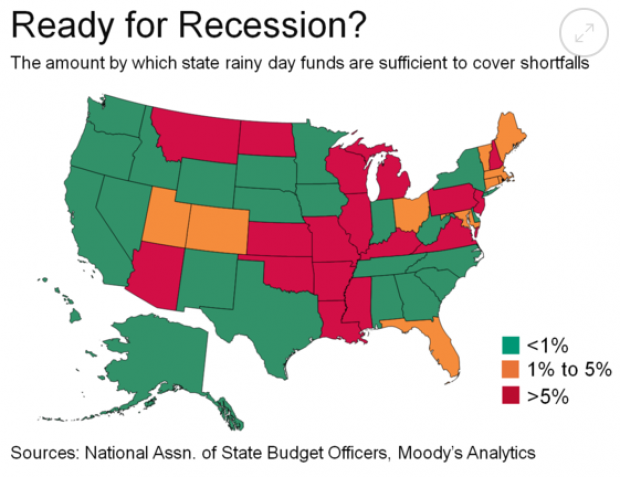

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

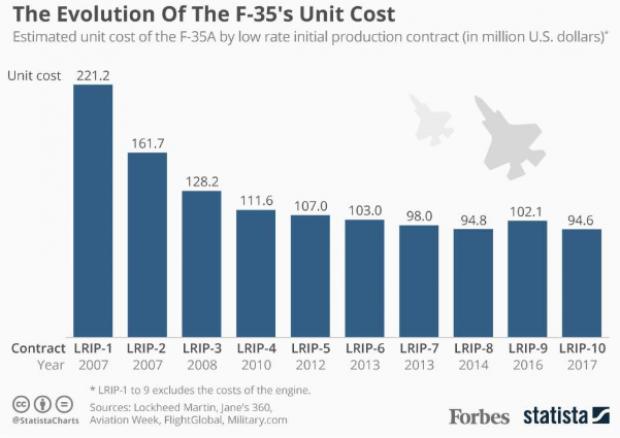

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.