Most Americans Are Still ‘Woefully Under-Saved’

Five years after the Great Recession, most Americans still haven’t established firm financial footing.

Only 22 percent of Americans have enough emergency savings to cover the recommended six months’ worth of expenses, according to a new report from Bankrate.com.

Of those surveyed, 21 percent had less than three months’ expenses saved.

Related: Americans Low Savings Rate a Bad Sign for Good Economy

“These results are further evidence that Americans remain woefully under-saved for unplanned expenses, and rather than progressing, are moving in the wrong direction,” Bankrate chief financial analyst Greg McBride said in a statement.

The number of Americans without any emergency savings reached a five-year high of 29 percent, up from 26 percent last year. Nearly a quarter of Americans said their savings had deteriorated in the past year.

Six months of emergency savings is the minimum amount recommended by many planners. Those with children or who have poor health or poor job security may need to an even larger emergency fund.

When an emergency hits those without an emergency fund, they often use credit cards or dip into retirement savings, both pricey options that can lead to further financial hardship.

A separate study released last month by BMO Harris Premier Services found that three quarters of consumers had dipped into their rainy day fund, with unexpected car and home repairs the most common reason cited.

Of those who had used emergency funds, about half replenished their savings within six months, while 20 percent never replaced the savings they had used.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

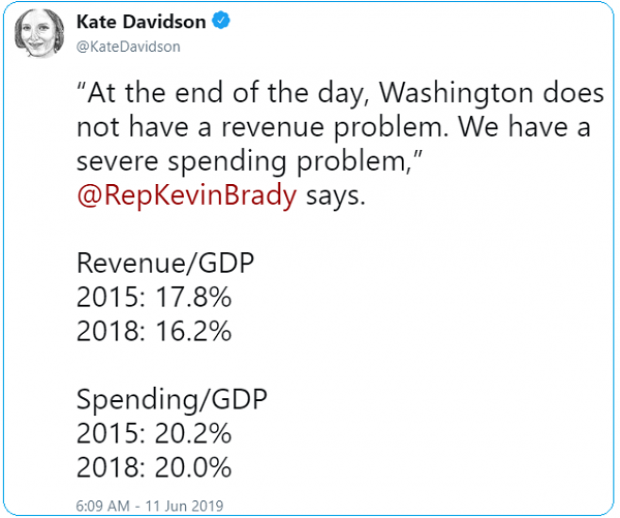

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

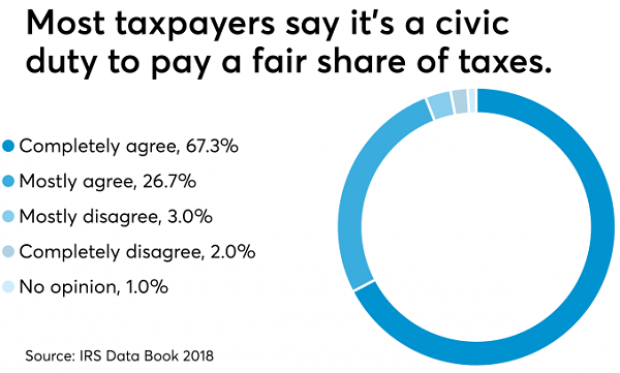

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.