Most Americans Are Still ‘Woefully Under-Saved’

Five years after the Great Recession, most Americans still haven’t established firm financial footing.

Only 22 percent of Americans have enough emergency savings to cover the recommended six months’ worth of expenses, according to a new report from Bankrate.com.

Of those surveyed, 21 percent had less than three months’ expenses saved.

Related: Americans Low Savings Rate a Bad Sign for Good Economy

“These results are further evidence that Americans remain woefully under-saved for unplanned expenses, and rather than progressing, are moving in the wrong direction,” Bankrate chief financial analyst Greg McBride said in a statement.

The number of Americans without any emergency savings reached a five-year high of 29 percent, up from 26 percent last year. Nearly a quarter of Americans said their savings had deteriorated in the past year.

Six months of emergency savings is the minimum amount recommended by many planners. Those with children or who have poor health or poor job security may need to an even larger emergency fund.

When an emergency hits those without an emergency fund, they often use credit cards or dip into retirement savings, both pricey options that can lead to further financial hardship.

A separate study released last month by BMO Harris Premier Services found that three quarters of consumers had dipped into their rainy day fund, with unexpected car and home repairs the most common reason cited.

Of those who had used emergency funds, about half replenished their savings within six months, while 20 percent never replaced the savings they had used.

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

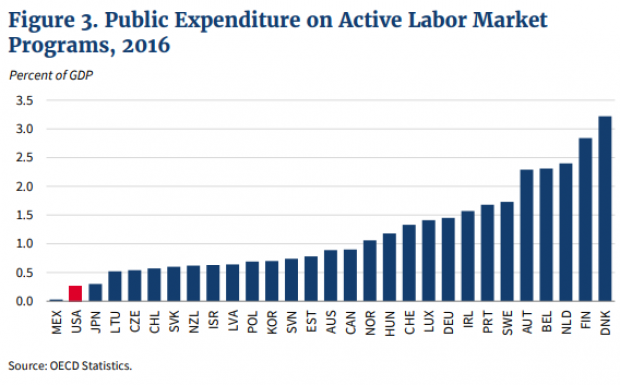

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.