Here’s How Much Boomers Are Giving Their Kids

Money has always tended to flow from parents or grandparents to children and grandchildren, whether it’s as outright gifts, help with living expenses or paying for things like school. But the pace of that inter-generational transfer of wealth has picked up in recent years — and it could be threatening the retirement prospects of some baby boomers, according to a new report from the Employee Benefit Research Institute.

The report finds that the number of cash transfers going from older households to younger family members increased from 1998 to 2010. High-income households are more likely to provide support to their adult children, but middle- and low-income families are also providing cash to younger family members. Overall, from 2008 to 2010, households of adults aged 50 to 64 gave an average of $8,350 to younger family members, and households age 85 and older gave $4,787 to younger family members.

“For older households, cash transfers can reduce their retirement assets, raising concerns about retirement security, particularly for low-income groups,” EBRI research associate Sudipto Banerjee said in a statement.

Related: Sandwich Generation Squeezed Once Again

In just 5 percent of families, wealth is passed from the younger generation to the older, and the amounts are far smaller. During the same period, households age 85 and older received an average of $359 from those in younger generations.

The EBRI numbers confirm a trend highlighted in other recent reports. A 2013 Pew study found that about half of adults ages 40 to 59 have provided some financial support to at least one grown child in the past year, with more than a quarter of them providing the primary support.

Obviously, the economic climate of recent years may be a big reason for the increased cash flowing from parents to their grown children. More than half of parents of millennials think that it is harder for today’s young adults to live within their means than it was for them, according to an April Bank of America survey.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

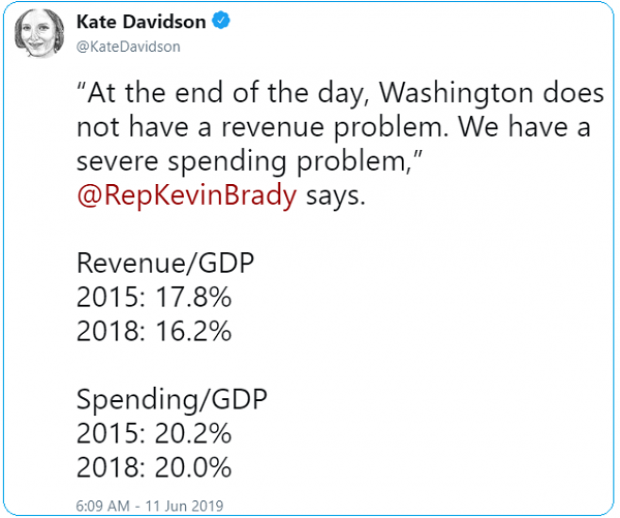

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

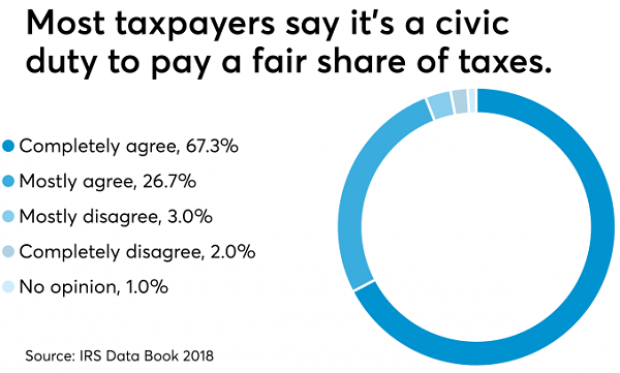

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.