Here’s How Much Boomers Are Giving Their Kids

Money has always tended to flow from parents or grandparents to children and grandchildren, whether it’s as outright gifts, help with living expenses or paying for things like school. But the pace of that inter-generational transfer of wealth has picked up in recent years — and it could be threatening the retirement prospects of some baby boomers, according to a new report from the Employee Benefit Research Institute.

The report finds that the number of cash transfers going from older households to younger family members increased from 1998 to 2010. High-income households are more likely to provide support to their adult children, but middle- and low-income families are also providing cash to younger family members. Overall, from 2008 to 2010, households of adults aged 50 to 64 gave an average of $8,350 to younger family members, and households age 85 and older gave $4,787 to younger family members.

“For older households, cash transfers can reduce their retirement assets, raising concerns about retirement security, particularly for low-income groups,” EBRI research associate Sudipto Banerjee said in a statement.

Related: Sandwich Generation Squeezed Once Again

In just 5 percent of families, wealth is passed from the younger generation to the older, and the amounts are far smaller. During the same period, households age 85 and older received an average of $359 from those in younger generations.

The EBRI numbers confirm a trend highlighted in other recent reports. A 2013 Pew study found that about half of adults ages 40 to 59 have provided some financial support to at least one grown child in the past year, with more than a quarter of them providing the primary support.

Obviously, the economic climate of recent years may be a big reason for the increased cash flowing from parents to their grown children. More than half of parents of millennials think that it is harder for today’s young adults to live within their means than it was for them, according to an April Bank of America survey.

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

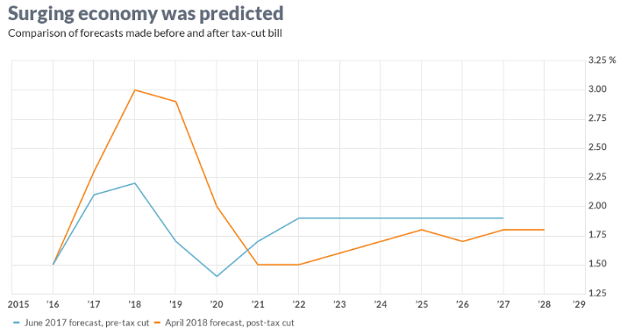

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

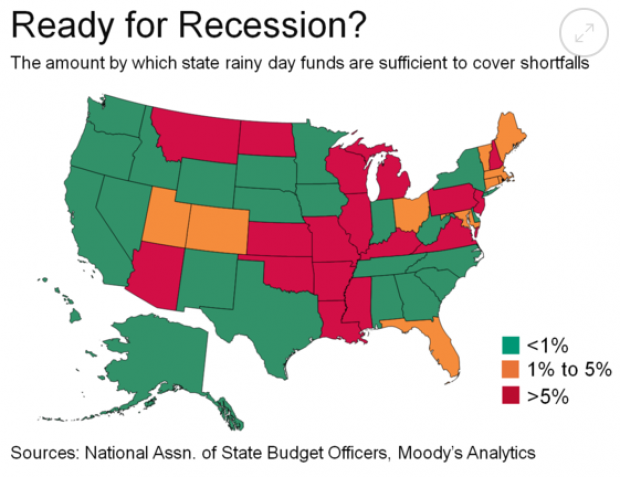

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

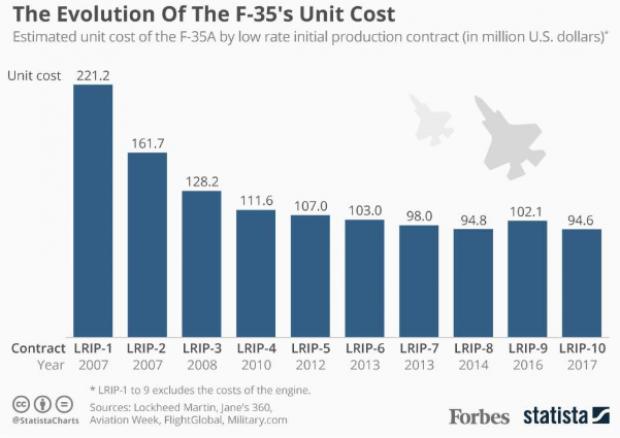

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.