The Waldorf’s Presidential Suite Isn’t Very Presidential Anymore

Months after the Waldorf Astoria was sold to a Chinese company, the State Department is abandoning a decades-long tradition of putting up U.S. diplomats at the storied hotel on New York’s Park Avenue.

This fall President Obama and state department officials will not be staying at the Waldorf for the opening of the U.N. General Assembly and will check into the New York Palace Hotel instead.

According to the New York Post, “every U.S. president since Herbert Hoover” has stayed in the presidential suite at the Waldorf when visiting New York, including President Obama. Presidential artifacts in the suite include President Jimmy Carter’s eagle desk set, one of President John F. Kennedy’s rocking chairs, a gold oval mirror from Ronald Reagan, and the personal desk of General Douglas MacArthur. The hotel is the site of Chinese history as well. On his first historic trip to the U.S. in 1974, Chinese leader Deng Xiaoping stayed at the Waldorf and attended a banquet given in his honor by then Secretary of State Henry Kissinger.

Related: U.S. Reviews Waldorf Astoria Sale to Chinese Firm

The $1.95 billion sale of the 47-story tower to the Beijing-based Anbang Insurance Group first raised eyebrows in Washington last October. Even though the previous owner, Hilton Worldwide Holdings, will continue to manage the hotel for the next 100 years, news of a “major renovation” sparked fears of possible Chinese cyber-espionage and surveillance.

Those fears were further heightened earlier this month when U.S. officials blamed Chinese hackers for a massive cyberattack targeting the U.S. Office of Personnel Management, exposing sensitive information about 4 million current and former federal workers. China has denied any involvement.

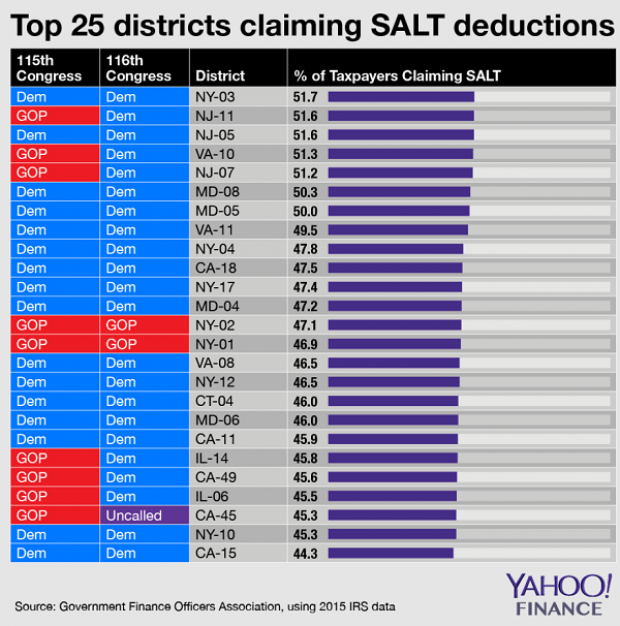

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

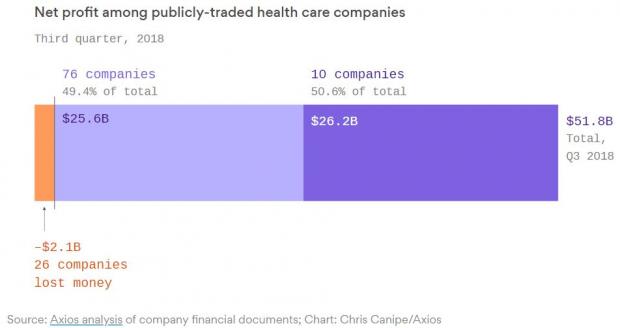

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

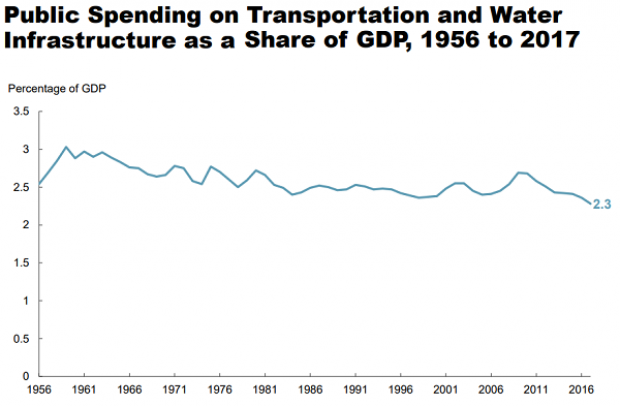

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.