Why a Woman Will be on the $10 Bill and Not the $20

The announcement that the Bureau of Engraving and Printing will add a woman to the portrait of Alexander Hamilton on the $10 bill has stirred a lot of conversation as to why the Treasury was not redesigning the $20 bill instead.

It turns out there is a very simple explanation: The move is based on recommendations from the Advanced Counterfeit Deterrence (ACD) Steering Committee.

Related: The Best Bank in Every Region Across America

"Currency is redesigned to stay ahead of counterfeiting," the US Treasury says. "The ACD Steering Committee recommended a redesign of the $10 note next. The ACD will make its next recommendation based on current and potential security threats to currency notes."

The ACD bases those recommendations on the "current and potential security threats to currency notes," and it turns out that the $10 bill is at a greater threat of being counterfeit than the $20 bill.

Secretary of the Treasury Jack Lew announced the change in a statement on YouTube: "I'm proud to announce today that the new $10 bill will be the first bill in more than a century to feature the portrait of a woman.”

Hamilton will share the note with a woman who Lew is expected to choose by the end of the year. The new bill will enter circulation after 2020.

This article originally appeared on Business Insider.

Read more from Business Insider:

Fitbit opens up 52%

Why people are angry about the $10 bill change

The 'Tesla of scooters' is finally available and it looks incredible

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

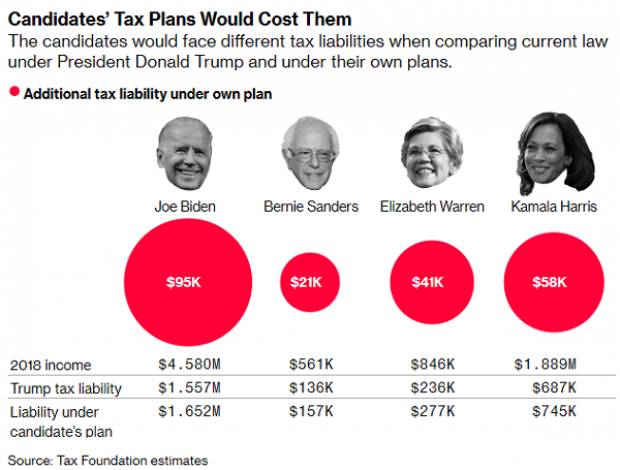

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.