More Money Coming Out of 401(k)s Than In

The amount of money withdrawn from 401(k) plans exceeded the amount contributed to the retirement funds for the first time in 2013, according to a report in The Wall Street Journal.

The shift reflects demographic changes as more Baby Boomer retire from the workforce and begin tapping their savings, and young millennial workers put smaller amounts in.

Consumers may benefit from the trend as fund managers begin cutting fees and changing services in order to entice young workers to sock away more. “It changes the dynamic of the business itself,” J.P. Morgan Chase analyst Ken Worthington told The Journal.

Related: Here Are 7 Ways People Screw Up Their 401(k)s

Company-sponsored 401(k) plans had $4.6 trillion in assets last year, according to the Investment Company Institute.

The average 401(k) balance at the end of the first quarter was $91,800, up 0.5 percent from the fourth quarter of 2014 and up 3.6 year-over-year, according to Fidelity. For employees in a plan for 10 years or more, the average balance was $251,600, up 12 percent year-over-year.

Workers can contribute up to $18,000 in pre-tax dollars to their 401(k) plans in 2015, but most workers—especially younger ones—save far less each year. There are lots of reasons millennials are lagging in retirement savings: large numbers of them are still unemployed or underemployed in jobs that don’t have retirement benefits, and they’re diverting all their extra cash to student loans. Plus, retirement may not be top-of-mind for 20-somethings, no matter how many times they hear about the benefits of compound interest.

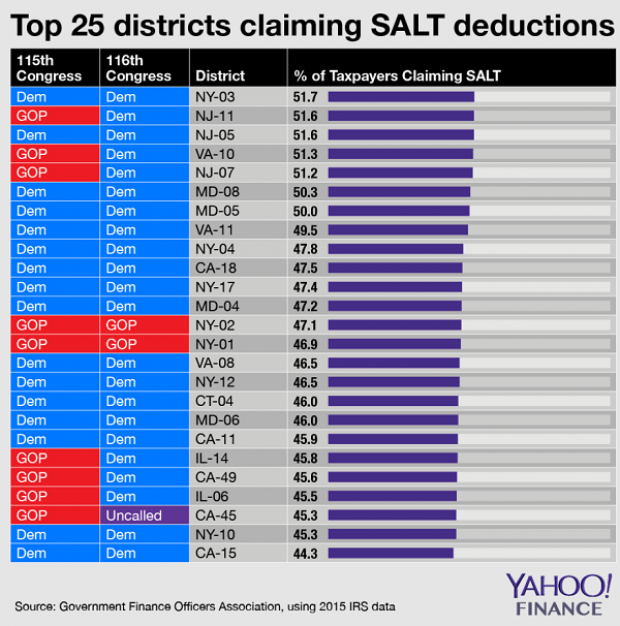

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

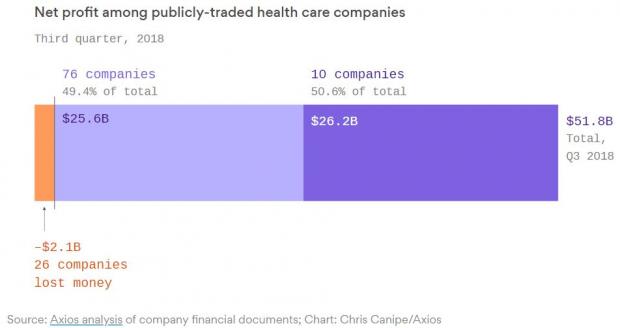

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

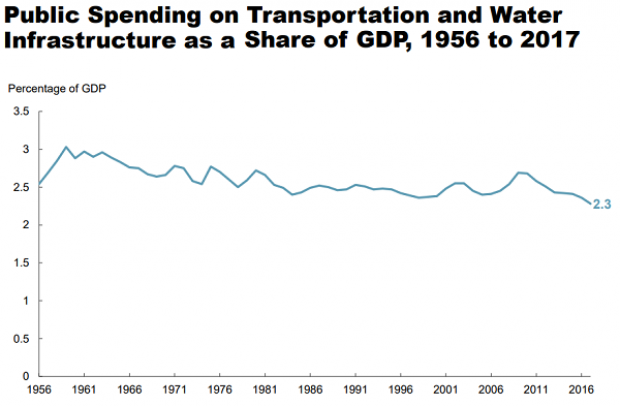

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.