Millions of Samsung Galaxy Phones May Be Vulnerable to Hackers

If you’re one of the millions of users of a Samsung Galaxy phone, you might be a potential target for a malicious hacker.

A report released today by NowSecure, a security firm located in Chicago, found that a glitch in Swift, the keyboard software used by default on all Samsung Galaxy devices could allow a remote attacker to compromise your phone.

This particular bug makes the phone vulnerable to what is known as a “man in the middle” attack. The Swift software consistently sends requests to a server, checking for updates. To someone with the right knowhow, though, it’s possible to impersonate Swift’s server and send through software that can be used to gain control of the device.

The main problem with this vulnerability is that there’s no real solution. The Swift keyboard is so integrated into Samsung’s software that it cannot be removed or disabled — even if it is switched out with a different keyboard app. Steering clear of unsecured Wi-Fi networks will make you less likely to be targeted, but it won’t render you invulnerable.

Related: 10 Biggest Tech Flops of the Century

Swift runs with elevated permissions, giving it pretty much free rein around the phone. This means that a hacker that worms his way into it can also access the Galaxy’s microphone and camera, track the user’s location or listen to their calls. They can even install apps.

NowSecure claims to have made Samsung and Google’s Android team aware of this vulnerability in late 2014, and Samsung reportedly has made a patch available to network providers. It’s not clear, though, whether providers have pushed out the patch to users yet. Many networks have a record of being notoriously slow to push through updates and security patches, and NowSecure’s tests found a number of Galaxy phones on different carriers were still vulnerable as of Tuesday.

If you’re of a more technical bent, you may be interested in seeing the details of NowSecure’s report on their blog. If you’re of a less technical bent, you might want to check with your carrier and try to avoid insecure Wi-Fi networks.

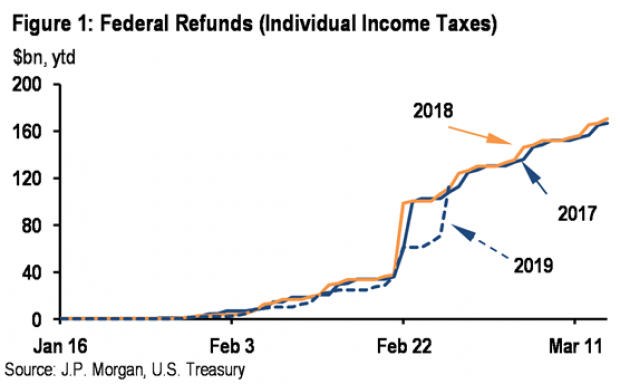

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

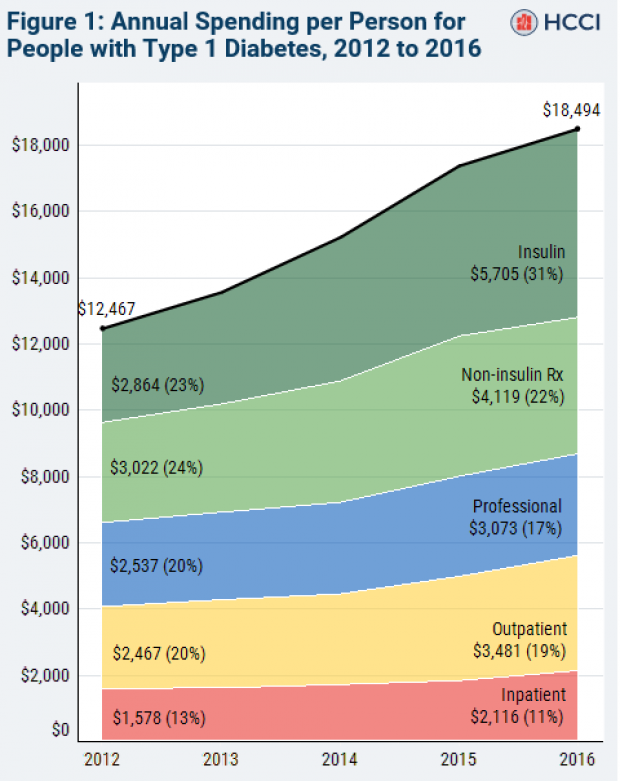

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

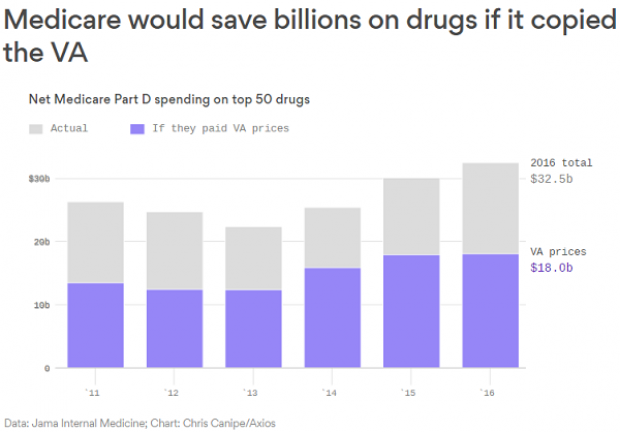

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.