Now 16-Year-Olds Can Double Your Car Insurance

As if you don’t have enough to worry about when your 16-year-old hits the road for the first time, get ready to see your insurance bill nearly double.

The average insurance premium for a married couple goes up 80 percent on average when adding a teen, but it spikes a full 16 percent more for adding a 16-year-old, according to a new report by InsuranceQuotes.com.

Requesting a “good student” discount is one way to offset the premium hike. “I’ve seen discounts as high as 25 percent for students who maintain at least a B average in high school or college,” InsuranceQuotes.com senior analyst Laura Adams said in a statement.

Related: The Best Time to Buy Car Insurance

And once a teen hits the ripe old age of 19, insurance increases by just 60 percent.

It’s much more expensive to insure teenage boys, with premiums increasing 92 percent for teen males versus just 67 percent for girls.

The analysis found that teenagers cost the most to insure in New Hampshire (115 percent increase), but parents will also see premiums double in Wyoming, Illinois, Maine and Rhode Island.

Hawaii is the only state that prohibits insurance companies from basing insurance quotes on age or length of driving experience, so it has the lowest increase in the nation (17 percent). Other states where parents won’t take as big a hit are New York (53 percent) and Michigan (57 percent).

Parents may be able to nab better car insurance rates by shopping around with several insurers.

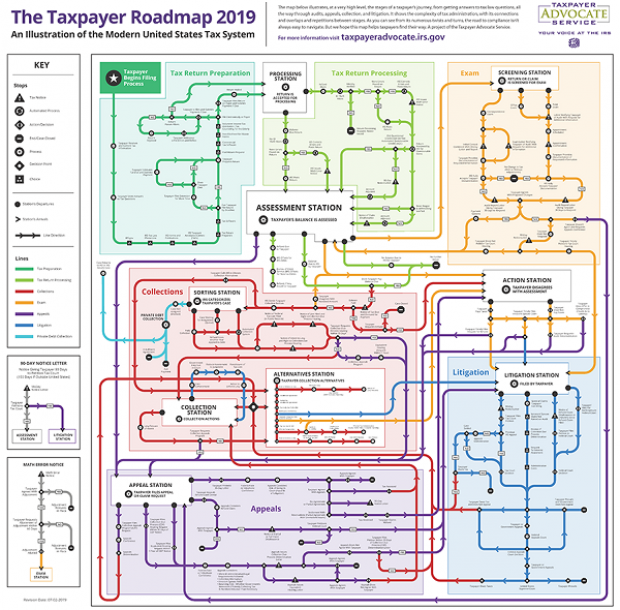

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

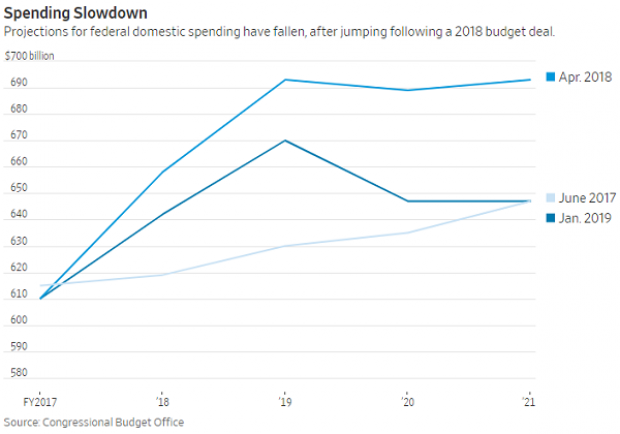

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

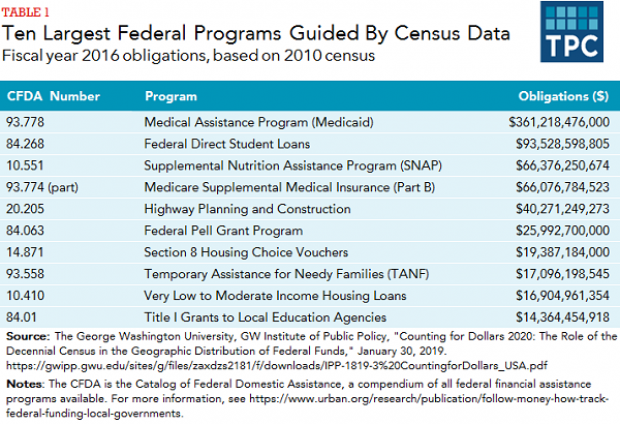

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

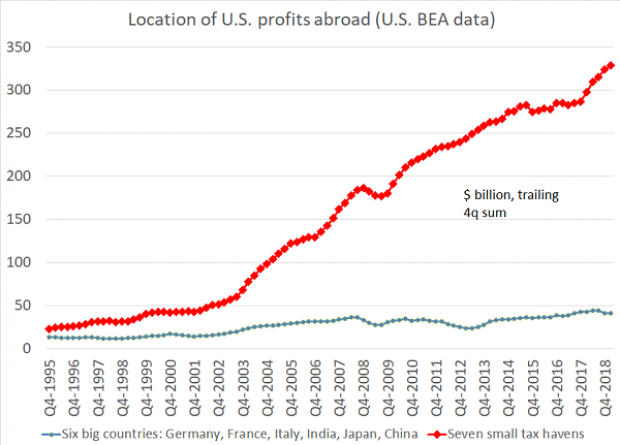

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”