Now 16-Year-Olds Can Double Your Car Insurance

As if you don’t have enough to worry about when your 16-year-old hits the road for the first time, get ready to see your insurance bill nearly double.

The average insurance premium for a married couple goes up 80 percent on average when adding a teen, but it spikes a full 16 percent more for adding a 16-year-old, according to a new report by InsuranceQuotes.com.

Requesting a “good student” discount is one way to offset the premium hike. “I’ve seen discounts as high as 25 percent for students who maintain at least a B average in high school or college,” InsuranceQuotes.com senior analyst Laura Adams said in a statement.

Related: The Best Time to Buy Car Insurance

And once a teen hits the ripe old age of 19, insurance increases by just 60 percent.

It’s much more expensive to insure teenage boys, with premiums increasing 92 percent for teen males versus just 67 percent for girls.

The analysis found that teenagers cost the most to insure in New Hampshire (115 percent increase), but parents will also see premiums double in Wyoming, Illinois, Maine and Rhode Island.

Hawaii is the only state that prohibits insurance companies from basing insurance quotes on age or length of driving experience, so it has the lowest increase in the nation (17 percent). Other states where parents won’t take as big a hit are New York (53 percent) and Michigan (57 percent).

Parents may be able to nab better car insurance rates by shopping around with several insurers.

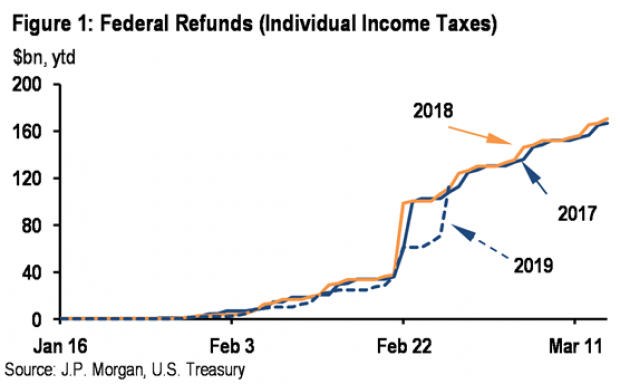

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

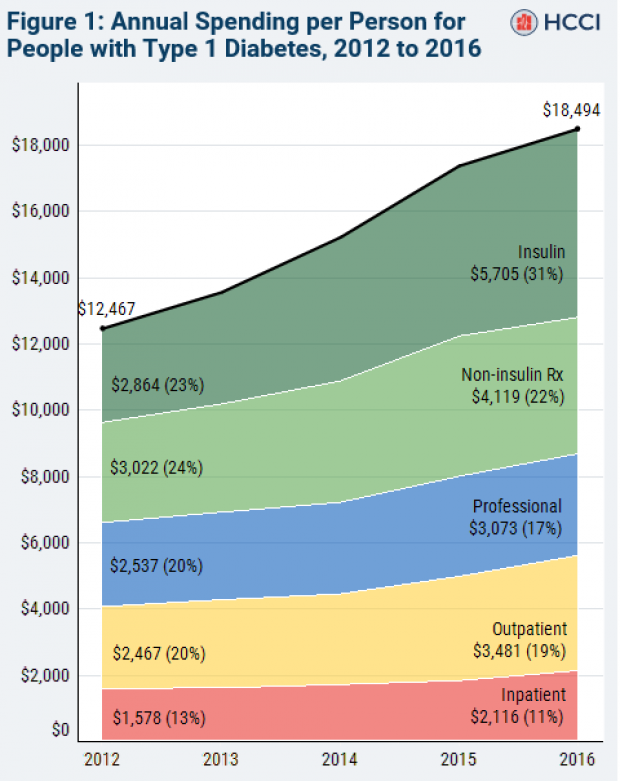

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

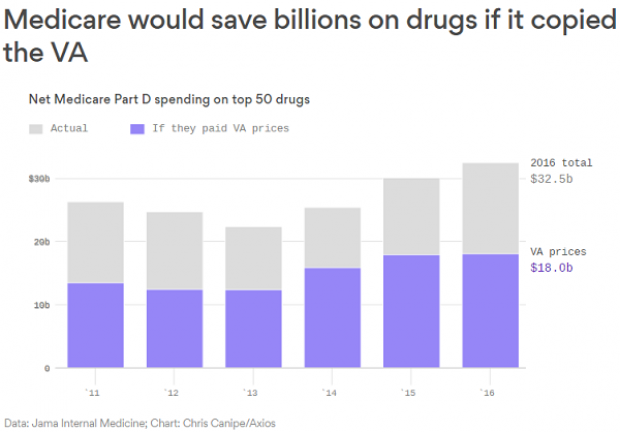

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.