Your Airplane Carry-on Bag Is About to Shrink

Are you one of those people who likes to brag about how you can fit a week’s worth of stuff into your carry-on suitcase? If so, your job is about to get harder.

The International Air Transport Association, a trade group representing some 250 airlines, has introduced a proposal to reduce the maximum allowable carry-on suitcase size. Under the proposed rule change, carry-on bags would have to be less than 21.5 x 13.5 x 7.5 inches. Current rules for carry-on size vary by airline, but they’re generally larger than that.

The organization claims that this would allow all passengers on a plane to store their bags in the cabin. “The development of an agreed optimal cabin bag size will bring common sense and order to the problem of differing sizes for carry-on bags,” IATA Senior Vice President for Airport, Passenger and Cargo Security said in a statement. “We know the current situation can be frustrating for passengers.

Related: 6 Sneaky Fees That Are Making Airlines a Bundle

Several major airlines have signaled interest in introducing the guidelines, according to IATA. Luggage manufacturers will start labeling bags that meet the new criteria as “IATA Cabin OK.”

The rule change may force more consumers to check luggage and pay the checked-bag fees many airlines have introduced in the past few years. Airlines typically charge $25 for the first bag, $35 for the second, and more than $100 for a third bag.

Some airlines, including Spirit, Allegiant and Frontier, also charge passengers for carry-on bags.

Coming Soon: Deductible Relief Day!

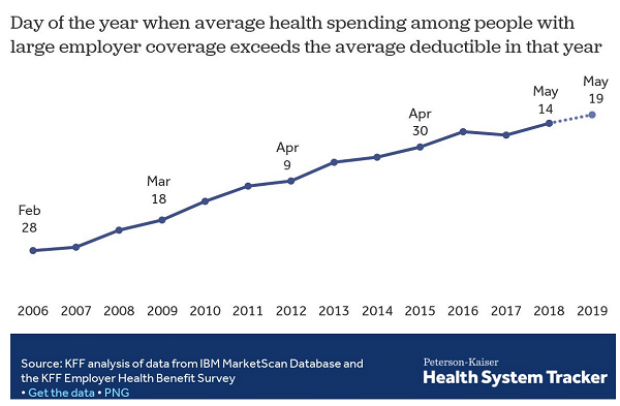

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

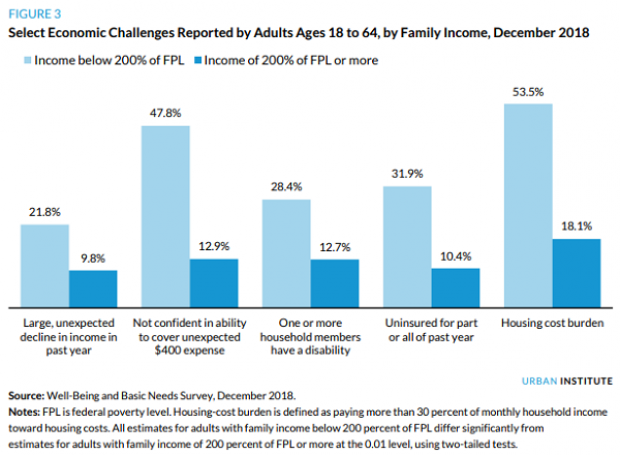

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

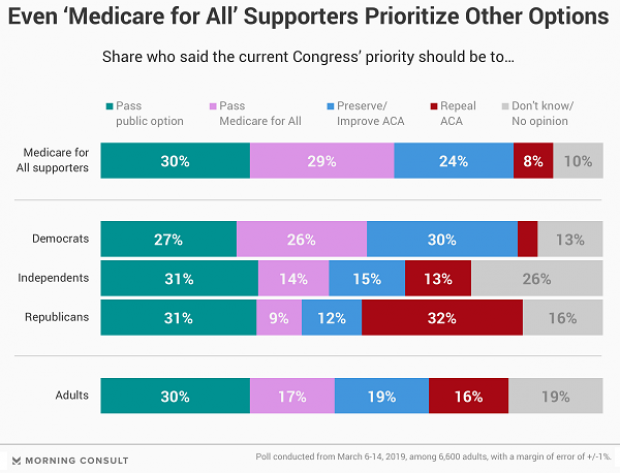

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

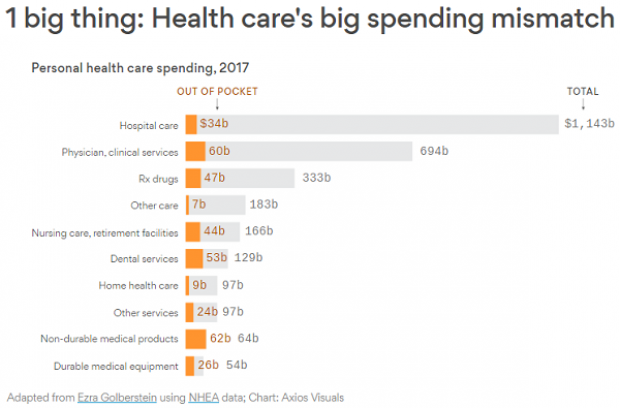

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.