Marriage?? Young Americans Aren't Even Shacking Up

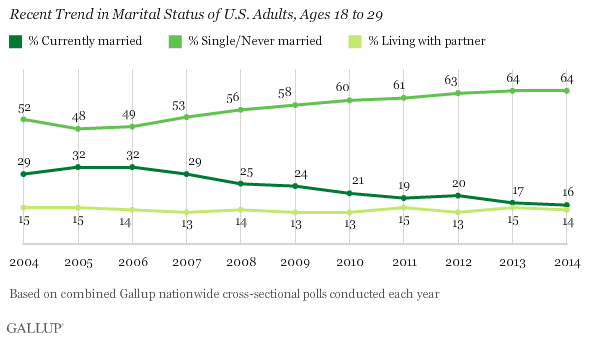

You’ve probably heard that marriage among young adults has been on the decline, but a new Gallup poll finds that the percentage of 18-to-29-year-olds living with a partner has flatlined in recent years.

“This means that not only are fewer young adults married, but also that fewer are in committed relationships,” Gallup’s Lydia Saad wrote Monday. “As a result, the percentage of young adults who report being single and not living with someone has risen dramatically in the past decade.”

Related: The Bad News About All the Singles in America

That percentage has risen from 52 percent in 2004 to 64 percent last year, Gallup says. The data doesn’t necessarily mean young adults are avoiding relationships entirely. Young people are just less likely to make a serious commitment associated with moving in together.

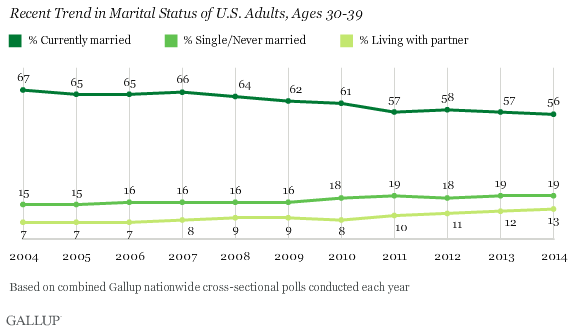

The trend hasn’t carried through to Americans in their 30s, who are only a bit more likely to be single than they were a decade ago. Marriage among people in this age group has also declined in popularity, but the percentage of 30-somethings living with a partner has jumped from 7 percent to 13 percent.

The new data suggests that, if young people don’t feel ready for marriage, they may not feel up for long-term commitment yet, either. (In some cases, that may be because they’re still living with their parents.) “This doesn't necessarily mean young adults are staying out of relationships, just that they are less likely to be making the more serious commitment associated with moving in together — whether in marriage or not,” Saad wrote.

The societal question, she said, is whether those single 20-somethings stay that way into their 30s. A Gallup poll from 2013 suggests that young adults may not be avoiding marriage altogether, but are just pushing it back. In that survey, 56 percent of Americans aged 18 to 34 said they were unmarried but did want to tie the knot at some point. Only 9 percent in the same age group said they were unmarried and wanted to stay that way. The most common reasons people listed for not being married yet included having not found the right person, being too young or not ready to get married and money concerns.

In other words, they might someday say “I do,” but for now they definitely don’t.

Number of the Day: 51%

More than half of registered voters polled by Morning Consult and Politico said they support work requirements for Medicaid recipients. Thirty-seven percent oppose such eligibility rules.

Martin Feldstein Is Optimistic About Tax Cuts, and Long-Term Deficits

In a new piece published at Project Syndicate, the conservative economist, who led President Reagan’s Council of Economic Advisers from 1982 to 1984, writes that pro-growth tax individual and corporate reform will get done — and that any resulting spike in the budget deficit will be temporary:

“Although the net tax changes may widen the budget deficit in the short term, the incentive effects of lower tax rates and the increased accumulation of capital will mean faster economic growth and higher real incomes, both of which will cause rising taxable incomes and lower long-term deficits.”

Doing tax reform through reconciliation — allowing it to be passed by a simple majority in the Senate, as long as it doesn’t add to the deficit after 10 years — is another key. “By designing the tax and spending rules accordingly and phasing in future revenue increases, the Republicans can achieve the needed long-term surpluses,” Feldstein argues.

Of course, the big questions remain whether tax and spending changes are really designed as Feldstein describes — and whether “future revenue increases” ever come to fruition. Otherwise, those “long-term surpluses” Feldstein says we need won’t ever materialize.

JP Morgan: Don’t Expect Tax Reform This Year

Gary Cohn, President Trump’s top economic adviser, seems pretty confident that Congress can produce a tax bill in a hurry. He told the Financial Times (paywall) last week that the Ways and Means Committee should be write a bill “in the next three of four weeks.” But most experts doubt that such a complicated undertaking can be accomplished so quickly. In a note to clients this week, J.P. Morgan analysts said they don’t expect to see a tax bill passed until mid-2018, following months of political wrangling:

“There will likely be months of committee hearings, lobbying by affected groups, and behind-the-scenes horse trading before final tax legislation emerges. Our baseline forecast continues to pencil in a modest, temporary, deficit-financed tax cut to be passed in 2Q2018 through the reconciliation process, avoiding the need to attract 60 votes in the Senate.”

Trump Still Has No Tax Reform Plan to Pitch

Bloomberg’s Sahil Kapur writes that, even as President Trump prepares to push tax reform thus week, basic questions about the plan have no answers: “Will the changes be permanent or temporary? How will individual tax brackets be set? What rate will corporations and small businesses pay?”

“They’re nowhere. They’re just nowhere,” Henrietta Treyz, a tax analyst with Veda Partners and former Senate tax staffer, tells Kapur. “I see them putting these ideas out as though they’re making progress, but they are the same regurgitated ideas we’ve been talking about for 20 years that have never gotten past the white-paper stage.”

The Fiscal Times Newsletter - August 28, 2017

|