Marriage?? Young Americans Aren't Even Shacking Up

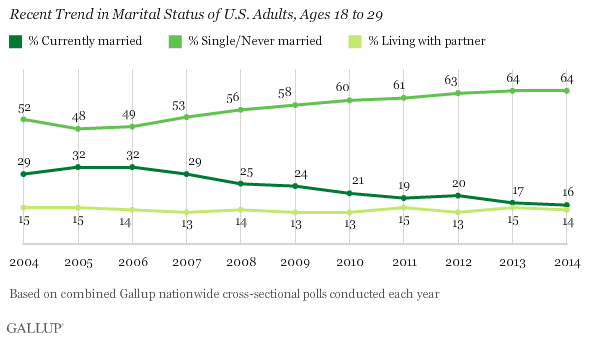

You’ve probably heard that marriage among young adults has been on the decline, but a new Gallup poll finds that the percentage of 18-to-29-year-olds living with a partner has flatlined in recent years.

“This means that not only are fewer young adults married, but also that fewer are in committed relationships,” Gallup’s Lydia Saad wrote Monday. “As a result, the percentage of young adults who report being single and not living with someone has risen dramatically in the past decade.”

Related: The Bad News About All the Singles in America

That percentage has risen from 52 percent in 2004 to 64 percent last year, Gallup says. The data doesn’t necessarily mean young adults are avoiding relationships entirely. Young people are just less likely to make a serious commitment associated with moving in together.

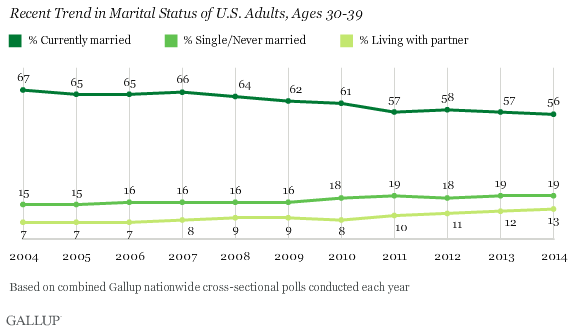

The trend hasn’t carried through to Americans in their 30s, who are only a bit more likely to be single than they were a decade ago. Marriage among people in this age group has also declined in popularity, but the percentage of 30-somethings living with a partner has jumped from 7 percent to 13 percent.

The new data suggests that, if young people don’t feel ready for marriage, they may not feel up for long-term commitment yet, either. (In some cases, that may be because they’re still living with their parents.) “This doesn't necessarily mean young adults are staying out of relationships, just that they are less likely to be making the more serious commitment associated with moving in together — whether in marriage or not,” Saad wrote.

The societal question, she said, is whether those single 20-somethings stay that way into their 30s. A Gallup poll from 2013 suggests that young adults may not be avoiding marriage altogether, but are just pushing it back. In that survey, 56 percent of Americans aged 18 to 34 said they were unmarried but did want to tie the knot at some point. Only 9 percent in the same age group said they were unmarried and wanted to stay that way. The most common reasons people listed for not being married yet included having not found the right person, being too young or not ready to get married and money concerns.

In other words, they might someday say “I do,” but for now they definitely don’t.

Marco Rubio Says There’s No Proof Tax Cuts Are Helping American Workers

Sen. Marco Rubio (R-FL) told The Economist that his party’s defense of the massive tax cuts passed last year may be off base: “There is still a lot of thinking on the right that if big corporations are happy, they’re going to take the money they’re saving and reinvest it in American workers,” Rubio said. “In fact they bought back shares, a few gave out bonuses; there’s no evidence whatsoever that the money’s been massively poured back into the American worker.”

For Richer or Poorer: An Updated Marriage Bonus and Penalty Calculator

The Tax Policy Center has updated its Marriage Bonus and Penalty Calculator for 2018, including the new GOP-passed tax law. The tool lets users calculate the difference in income taxes a couple would owe if filing as married or separately. “Most couples will pay lower income taxes after they are married than they would as two separate taxpayers (a marriage bonus), but some will pay a marriage penalty," TPC’s Daniel Berger writes. “Typically, couples with similar incomes will be hit with a penalty while those where one spouse earns significantly more than the other will almost always get a bonus for walking down the aisle.”

Trump Administration Wants to Raise the Rent

Housing and Urban Development Secretary Ben Carson will propose increasing the rent obligation for low-income households receiving federal housing subsidies, as well as creating new work requirements for subsidy recipients. Some details via The Washington Post: “Currently, tenants generally pay 30 percent of their adjusted income toward rent or a public housing agency minimum rent not to exceed $50. The administration’s legislative proposal sets the family monthly rent contribution at 35 percent of gross income or 35 percent of their earnings by working 15 hours a week at the federal minimum wage -- or approximately $150 a month, three times higher than the current minimum.” (The Washington Post)

New Push for Capital Gains Tax Cut

Anti-tax activists in Washington are renewing their pressure on lawmakers to pass new legislation indexing capital gains taxes to inflation. The Hill provided an example of such indexing that Grover Norquist recently sent to Treasury Secretary Steven Mnuchin: “Under current policy, someone who made an investment of $1,000 in 2000 and sold it for $2,000 in 2017 would pay capital gains taxes on the $1,000 difference. But if capital gains were indexed, the investor would only pay taxes on $579, since $1,000 in 2000 would be equivalent to $1,421 in 2017 after adjusting for inflation.” Proponents of indexing say it’s just a matter of fairness, but critics claim that it would be just another regressive tax cut for the wealthy. Indexing would cost an estimated $10 billion a year in lost revenues. (The Hill)

Bernie Sanders to Propose Plan Guaranteeing a Job for Every American

Sen. Bernie Sanders (I-VT) is preparing to announce a plan for the federal government to guarantee a job paying $15 an hour and providing health-care benefits to every American “who wants one or needs one.” The jobs would be on government projects in areas such as infrastructure, care giving, the environment and education. The proposal is still being crafted, and Sanders’ representative said his office had not yet come up with a cost estimate or funding plan. Sen. Kirsten Gillibrand (D-NY) last week tweeted support for a federal jobs guarantee, but Republicans have long opposed such proposals, saying they would cost too much. (Washington Post)