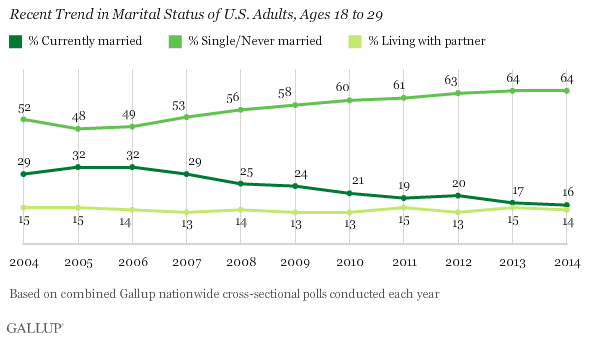

Marriage?? Young Americans Aren't Even Shacking Up

You’ve probably heard that marriage among young adults has been on the decline, but a new Gallup poll finds that the percentage of 18-to-29-year-olds living with a partner has flatlined in recent years.

“This means that not only are fewer young adults married, but also that fewer are in committed relationships,” Gallup’s Lydia Saad wrote Monday. “As a result, the percentage of young adults who report being single and not living with someone has risen dramatically in the past decade.”

Related: The Bad News About All the Singles in America

That percentage has risen from 52 percent in 2004 to 64 percent last year, Gallup says. The data doesn’t necessarily mean young adults are avoiding relationships entirely. Young people are just less likely to make a serious commitment associated with moving in together.

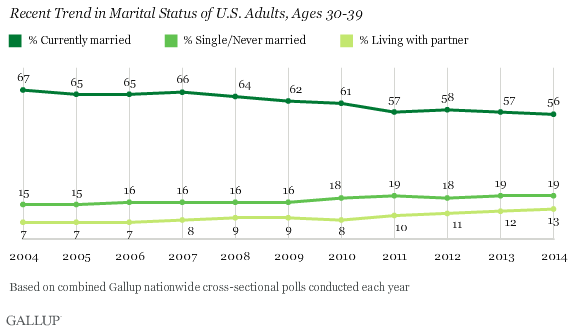

The trend hasn’t carried through to Americans in their 30s, who are only a bit more likely to be single than they were a decade ago. Marriage among people in this age group has also declined in popularity, but the percentage of 30-somethings living with a partner has jumped from 7 percent to 13 percent.

The new data suggests that, if young people don’t feel ready for marriage, they may not feel up for long-term commitment yet, either. (In some cases, that may be because they’re still living with their parents.) “This doesn't necessarily mean young adults are staying out of relationships, just that they are less likely to be making the more serious commitment associated with moving in together — whether in marriage or not,” Saad wrote.

The societal question, she said, is whether those single 20-somethings stay that way into their 30s. A Gallup poll from 2013 suggests that young adults may not be avoiding marriage altogether, but are just pushing it back. In that survey, 56 percent of Americans aged 18 to 34 said they were unmarried but did want to tie the knot at some point. Only 9 percent in the same age group said they were unmarried and wanted to stay that way. The most common reasons people listed for not being married yet included having not found the right person, being too young or not ready to get married and money concerns.

In other words, they might someday say “I do,” but for now they definitely don’t.

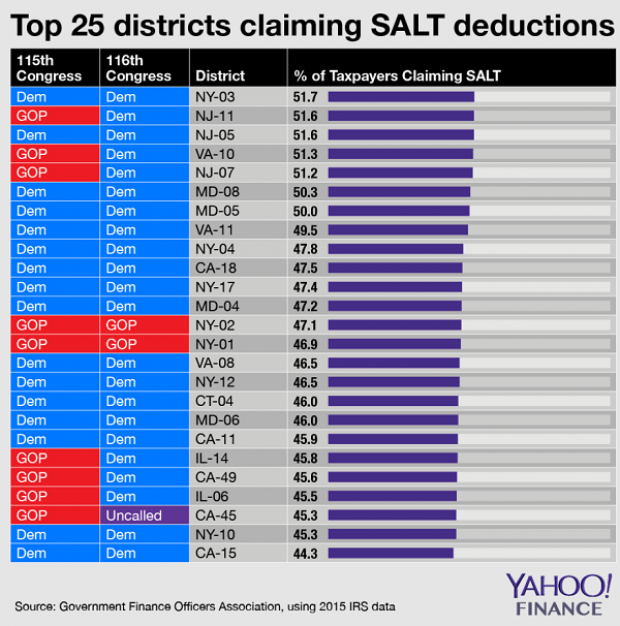

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

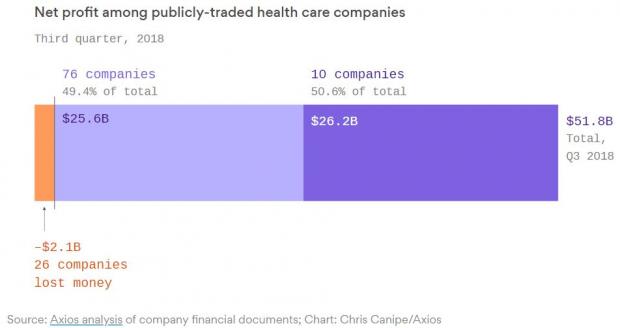

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

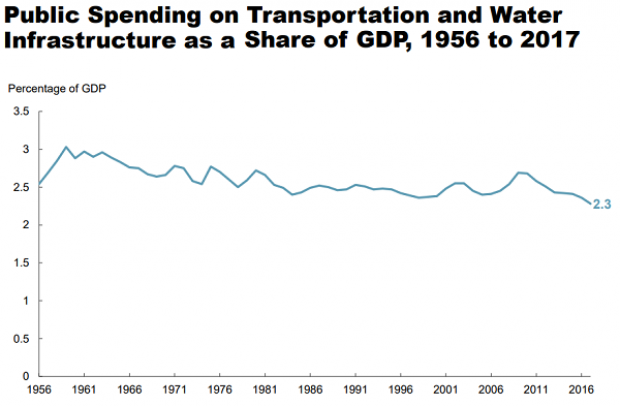

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.