The Biggest Apple Hit You've Never Heard Of

Even some of the most diehard Apple fanatics missed one of the company’s biggest rollouts. About a year ago, Apple launched a new computer language, Swift, that is rapidly becoming one of the most popular software languages among programmers, according to Bloomberg.

In rankings of programming languages by developer industry analysts at a firm called RedMonk, Swift placed 22nd early this year, up from 68th in the third quarter of last year.

Apple’s new language now finds itself just one spot behind Coffeescript and one spot ahead of Lua, which might not mean much to you but apparently has developers quite excited.

“The growth that Swift experienced is essentially unprecedented in the history of these rankings,” the RedMonk analysis explains.

Previously, Apple developers could only use Objective C, a language built in the 1980s. Responding to complaints that the language was old fashioned and slow, Apple unveiled Swift, which it had been working on since 2010. Developers have responded to Swift’s safety, modernity and "expressiveness," meaning fewer lines of code are required to get the computer to do specific things.

The ride-hailing service Lyft reportedly rewrote its entire app about six months ago using Swift after finding that updates to the code took much less time. Another early user of the code is SlideShare, a document-sharing service owned by LinkedIn.

Still, as Swift is still undergoing rapid evolution, most developers are choosing to wait before adopting it. As of now, Objective C is still Apple developer’s number one choice, but a fully developed Swift could swiftly change that.

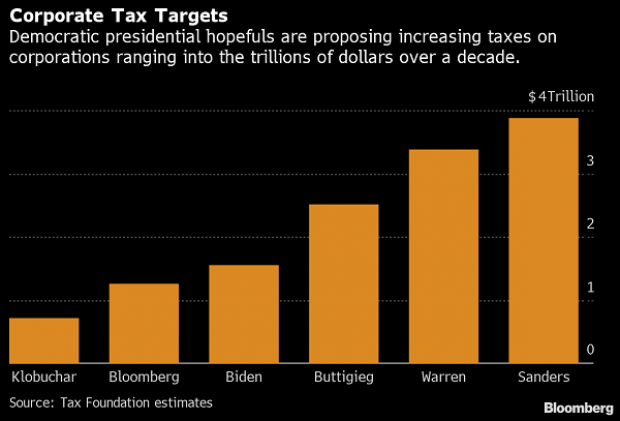

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

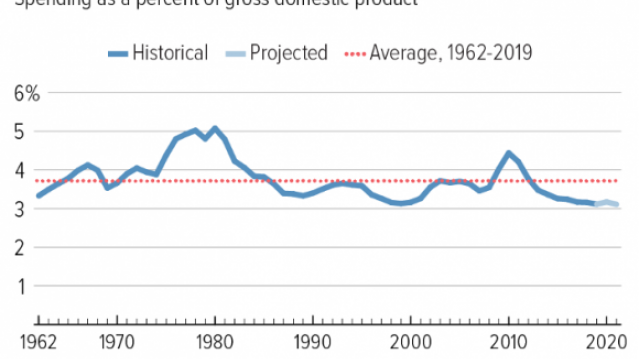

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

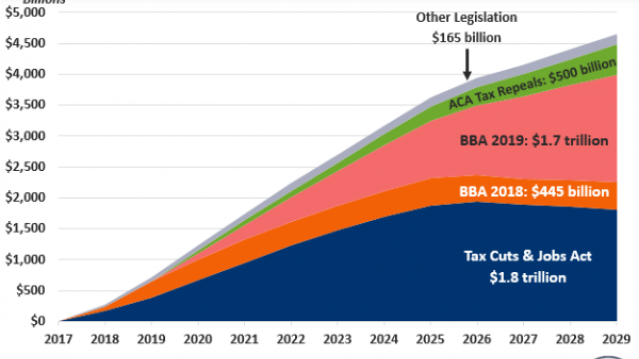

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

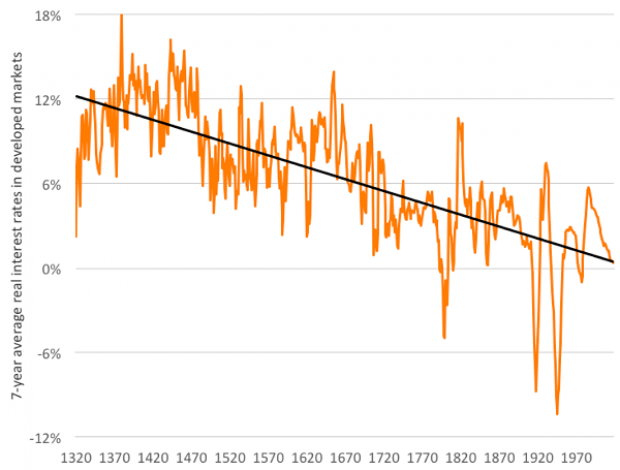

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

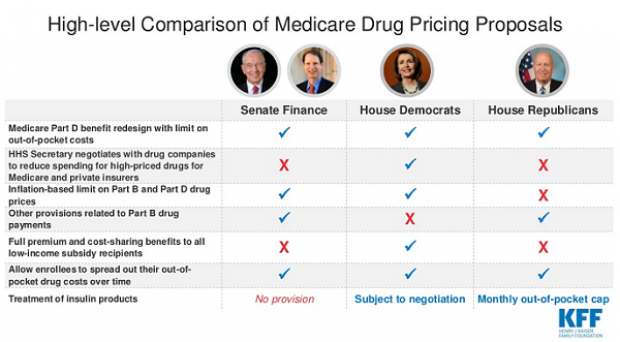

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.