6.6M Homes at Risk of Hurricane Damage This Year. Here’s Which States They’re In

As hurricane season gets underway, real estate analytics firm CoreLogic is warning that there are more than 6.6 million U.S. homes at risk of being hit by a storm surge. That could lead to as much at $1.5 trillion in damage.

The homes are in 19 states and the District of Columbia along the Atlantic and Gulf Coasts. Six states account for more than three-quarters of all at-risk homes, with Florida having the most (2.5 million), followed by Louisiana (760,000), New York (465,000), New Jersey (446,148), Texas (441,304) and Virginia (420,052).

Related: How Climate Change Costs Could Soar to the Billions

“The number of hurricanes each year is less important than the location of where the next hurricane will come ashore,” CoreLogic’s senior hazard risk analyst said in a statement. “It only takes one hurricane that pushes storm surge into a major metropolitan area for the damage to tally in the billions of dollars. With new home construction, and any amount of sea-level rise, the number of homes at risk of storm surge damage will continue to increase.”

The District of Columbia has the lowest number of properties at risk (3,700), followed by New Hampshire (12,400) and Maine (22,500

State Table (Ranked by Number of Homes at Risk)

|

Rank |

State |

Extreme |

Very High |

High |

Moderate |

Low* |

Total |

|

1 |

Florida |

793,204 |

461,632 |

524,923 |

352,102 |

377,951 |

2,509,812 |

|

2 |

Louisiana |

97,760 |

104,059 |

337,495 |

138,762 |

82,196 |

760,272 |

|

3 |

New York |

127,325 |

114,876 |

131,039 |

91,294 |

N/A |

464,534 |

|

4 |

New Jersey |

116,581 |

178,668 |

73,303 |

77,596 |

N/A |

446,148 |

|

5 |

Texas |

45,800 |

70,894 |

112,189 |

116,168 |

96,253 |

441,304 |

|

6 |

Virginia |

94,260 |

115,770 |

98,463 |

84,015 |

27,544 |

420,052 |

|

7 |

South Carolina |

107,443 |

57,327 |

65,885 |

46,799 |

30,961 |

308,415 |

|

8 |

North Carolina |

73,463 |

51,927 |

48,595 |

40,155 |

37,347 |

251,487 |

|

9 |

Massachusetts |

31,420 |

65,279 |

74,413 |

49,325 |

N/A |

220,437 |

|

10 |

Maryland |

47,990 |

39,966 |

27,591 |

28,975 |

N/A |

144,522 |

|

11 |

Georgia |

41,970 |

52,281 |

28,852 |

19,190 |

8,465 |

150,758 |

|

12 |

Pennsylvania |

1,467 |

45,776 |

37,983 |

32,426 |

N/A |

117,652 |

|

13 |

Mississippi |

14,809 |

20,643 |

29,387 |

27,507 |

10,588 |

102,934 |

|

14 |

Connecticut |

25,292 |

23,656 |

22,230 |

26,529 |

N/A |

97,707 |

|

15 |

Alabama |

7,403 |

12,707 |

10,182 |

13,749 |

14,086 |

58,127 |

|

16 |

Delaware |

11,523 |

10,854 |

13,528 |

13,811 |

N/A |

49,716 |

|

17 |

Rhode Island |

6,595 |

5,988 |

6,720 |

7,187 |

N/A |

26,490 |

|

18 |

Maine |

5,159 |

2,753 |

7,368 |

7,211 |

N/A |

22,491 |

|

19 |

New Hampshire |

2,514 |

3,470 |

4,234 |

2,272 |

N/A |

12,490 |

|

20 |

District of Columbia |

N/A** |

N/A** |

545 |

3,123 |

N/A |

3,668 |

|

Total |

1,651,978 |

1,438,526 |

1,654,925 |

1,178,196 |

685,391 |

6,609,016 |

* The "Low" risk category is based on Category 5 hurricanes, which are not likely along the northeastern Atlantic coast. States in that area have N/A designated for the Low category due to the extremely low probability of a Category 5 storm affecting that area.

** Washington, D.C. has no Atlantic coastal properties, but can be affected by larger hurricanes that push storm surge into the Potomac River. Category 1 and 2 storms will likely not generate sufficient storm surge to affect properties in Washington, D.C.

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

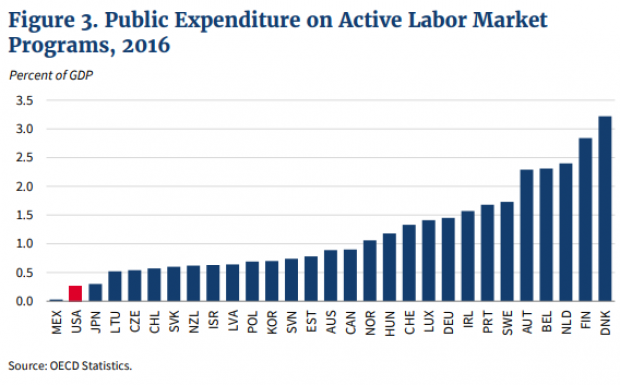

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.