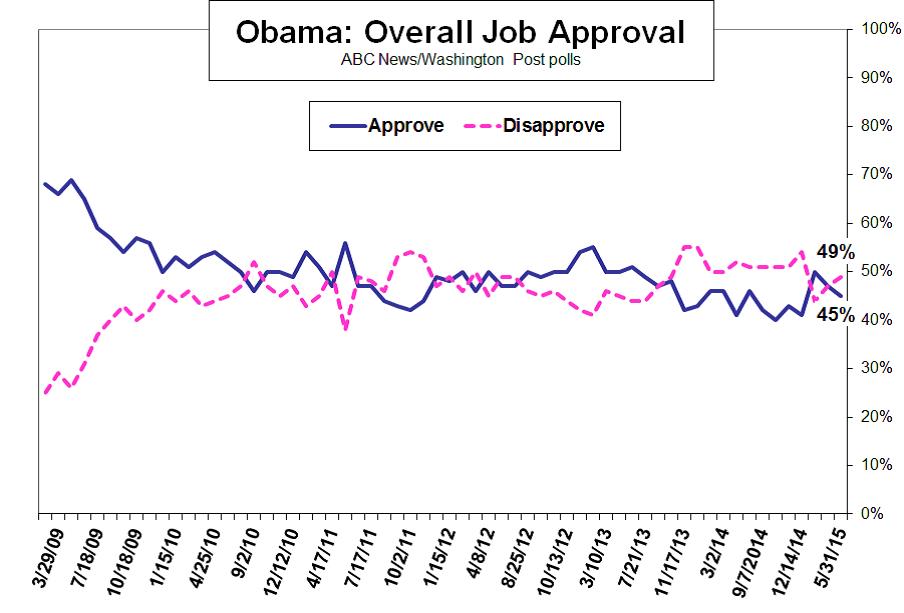

Obama’s Approval Tanks Over the Economy and ISIS

For a while, President Obama enjoyed a revival in popularity after years of public unease and displeasure with his stewardship of the economy and foreign policy. His approval rating jumped as high as 49 percent in mid-January, according to Gallup, and then tapered off a little amid renewed uncertainty about the economic recovery.

In the latest Washington Post/ABC News poll, however, 45 percent of Americans say they approve of Obama’s job performance, while 49 percent disapprove. That is his weakest rating in the survey since late 2014. The president effectively lost five points in approval since January and he hasn’t seen majority support since May 2013, according to survey analysis.

Analysts blame the decline in the president’s approval on continued economic anxiety at home – despite a drop in the unemployment rate to 5.4 percent in April and other signs of economic revival – and the advance of ISIS and other Islamic extremists in Iraq and Syria.

The condition of the economy consistently has topped the list of voters’ concerns heading into the 2016 campaign. The economic gains touted by the administration since the end of the Great Recession in June 2009 apparently haven’t been enough to calm fears, analysts say.

Seventy-three percent of those surveyed recently remain worried about the economy’s direction, and among them Obama’s approval drops to 35 percent, according to the survey. What’s more, Obama gets only a 31 percent approval rating specifically for handling the advance of ISIS militants, with 55 percent disapproving. Public approval of the president’s handling of the war against ISIS is 16 percentage points worse than his rating on handling the economy.

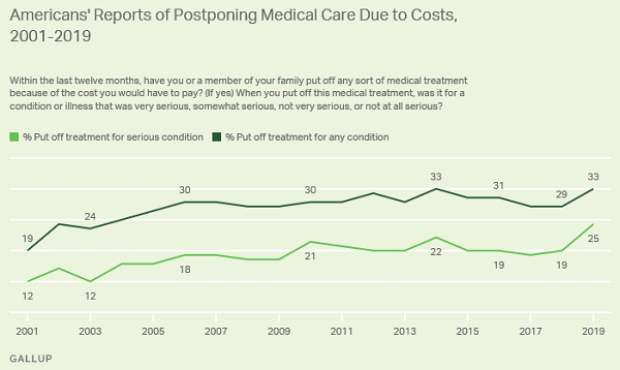

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

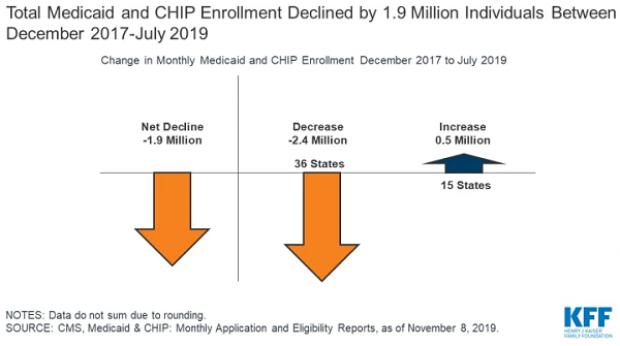

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.