3 Dumb Moves That Can Hurt Your Career

What's the most common way to breach workplace etiquette and curb your career growth, if not derail it altogether?

AccountTemps says employers and staffers don't always see office etiquette the same. But bosses certainly have more leverage in the matter, since they can fire employees who buck the rules, and a company survey finds U.S. chief financial officers are most often bugged by workers "being distracted" on the job (27% of CFOs say so) and "gossiping about colleagues" (18%).

Other top offenses cited by CFOs:

- Not responding to calls or emails.

- Being late to meetings, or missing them.

- Not crediting other staffers when appropriate.

Employers and workers may not see the top etiquette breaches equally, but they agree on professional decorum more than they disagree, and the shared message is easy to sum up: "Most jobs today require teamwork and strong collaboration skills, and that means following the unwritten rules of office protocol," says Bill Driscoll, a district president of Accountemps. "Poor workplace etiquette demonstrates a lack of consideration for coworkers."

Related: Modern Etiquette: Outclassing the Competition

Of course, the list of workplace professional breaches exceeds the AccountTemps list.

"I've seen it all," notes Nicole Williams, a workplace consultant and a career contributor to NBC's The Today Show. "Employees who lie on expense reports; who badmouth the company or boss on social media or to clients; proofreading mistakes; missing deadlines. Just to name a few."

If you do trip up on the job, it's best to be accountable. "If you really screw up, you have to suffer the consequences in silence," Williams says. "Don't protest, don't try and get out of it, and don't put the blame on someone or something else. People will respect you more for owning your mistakes."

This article originally appeared on Main Street

Read More from Main Street

- 10 Ways to Blow a Job Interview

- The 10 Worst Cities to Enjoy a Summer 'Staycation'

- 12 Universities with the Biggest Endowments

Read more from Main Street: - See more at: http://www.thefiscaltimes.com/2015/05/19/Why-Even-Rich-Millennials-Are-F...

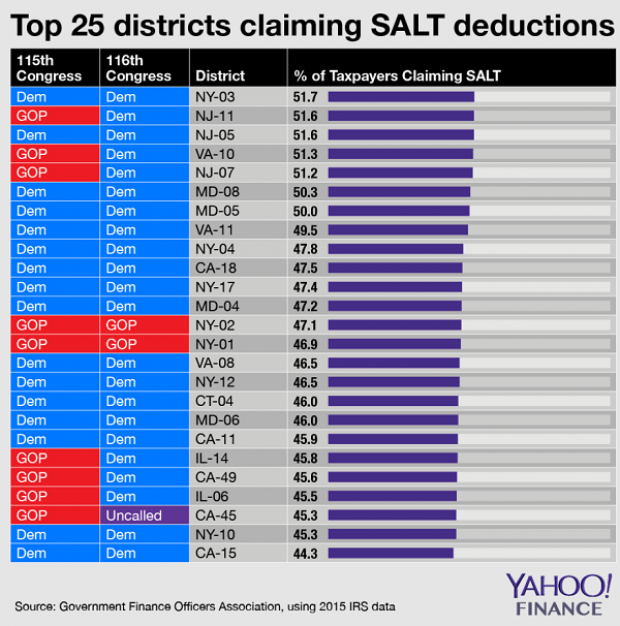

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

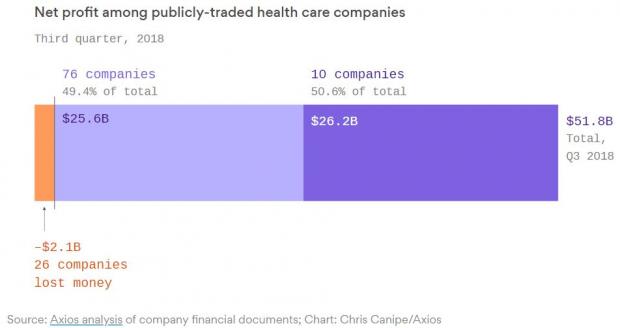

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

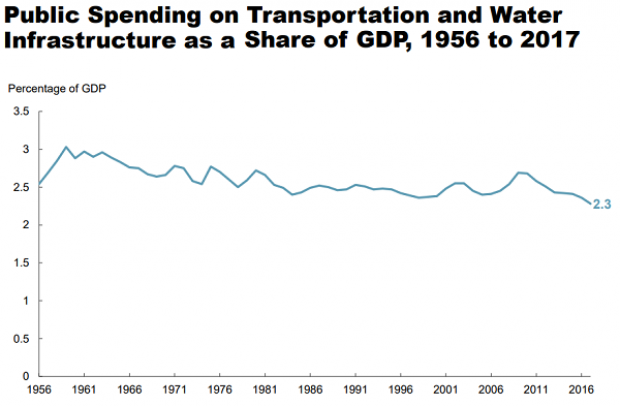

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.