When Will the Consumer Spending Surge Finally Happen?

Economists have been waiting for a surge in consumer spending fueled by savings at the gas pump and a stronger job market boosting personal incomes. They’re going to have to keep waiting.

The Commerce Department on Monday said personal spending was essentially flat in April —it fell less than 0.1 percent — even as personal income rose a better-than-expected 0.4 percent. Americans made more money in April but they didn’t spend more. Instead, they socked it away, raising the savings rate — personal savings as a percentage of disposable income — from 5.2 percent in March to 5.6 percent in April.

Related: How Obamacare Could Be Squeezing Consumer Spending

The April spending picture was the reverse of that from March, when incomes growth stalled but spending rose. Overall, though, Americans still look to be hesitant about opening up their wallets.

“This report clearly indicates that the bounce back in March did not continue into April,” Chris G. Christopher, Jr., director of consumer economics at HIS Global Insight, said in a note to clients. “It is becoming blatantly obvious that the so-called consumer gasoline price dividend is not motivating the average American household to increase their discretionary spending in any meaningful manner.”

Energy prices have risen lately, but they are still down 20 percent from where they were a year ago, notes PNC Senior Macroeconomist Gus Faucher. Eventually, that should still translate to more spending as long as the job market recovery continues apace.

“Clearly, consumption is hardly booming, but the lag between declines in gas prices and the response in the spending numbers is long, typically six or seven months,” Ian Shepherdson, chief economist at Pantheon Macroeconomcs, said in a note to clients. “Gas prices did begin to fall rapidly until November, with the biggest single drop in January, so we don't expect to see consumption accelerate properly until the summer.”

For now, the economists — and the economy — keep waiting.

Top Reads from The Fiscal Times:

- What's Next for Oil Prices? Look Out Below!

- We Just Went Through the Worst Month Since the Great Recession

- Boomers, It's Time to Cash Out of This Bubble

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

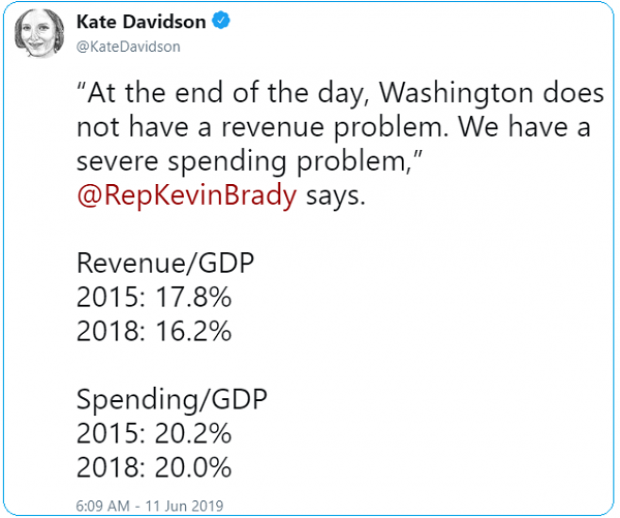

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

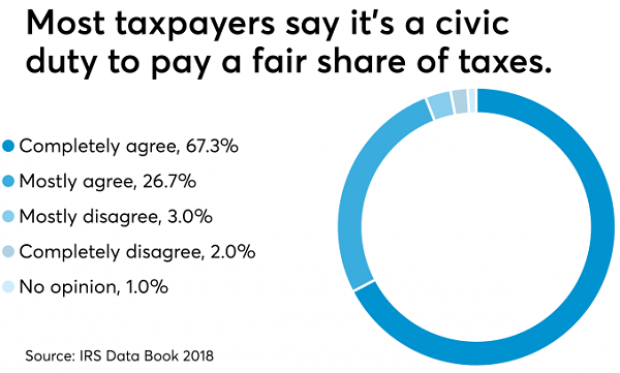

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.