When Will the Consumer Spending Surge Finally Happen?

Economists have been waiting for a surge in consumer spending fueled by savings at the gas pump and a stronger job market boosting personal incomes. They’re going to have to keep waiting.

The Commerce Department on Monday said personal spending was essentially flat in April —it fell less than 0.1 percent — even as personal income rose a better-than-expected 0.4 percent. Americans made more money in April but they didn’t spend more. Instead, they socked it away, raising the savings rate — personal savings as a percentage of disposable income — from 5.2 percent in March to 5.6 percent in April.

Related: How Obamacare Could Be Squeezing Consumer Spending

The April spending picture was the reverse of that from March, when incomes growth stalled but spending rose. Overall, though, Americans still look to be hesitant about opening up their wallets.

“This report clearly indicates that the bounce back in March did not continue into April,” Chris G. Christopher, Jr., director of consumer economics at HIS Global Insight, said in a note to clients. “It is becoming blatantly obvious that the so-called consumer gasoline price dividend is not motivating the average American household to increase their discretionary spending in any meaningful manner.”

Energy prices have risen lately, but they are still down 20 percent from where they were a year ago, notes PNC Senior Macroeconomist Gus Faucher. Eventually, that should still translate to more spending as long as the job market recovery continues apace.

“Clearly, consumption is hardly booming, but the lag between declines in gas prices and the response in the spending numbers is long, typically six or seven months,” Ian Shepherdson, chief economist at Pantheon Macroeconomcs, said in a note to clients. “Gas prices did begin to fall rapidly until November, with the biggest single drop in January, so we don't expect to see consumption accelerate properly until the summer.”

For now, the economists — and the economy — keep waiting.

Top Reads from The Fiscal Times:

- What's Next for Oil Prices? Look Out Below!

- We Just Went Through the Worst Month Since the Great Recession

- Boomers, It's Time to Cash Out of This Bubble

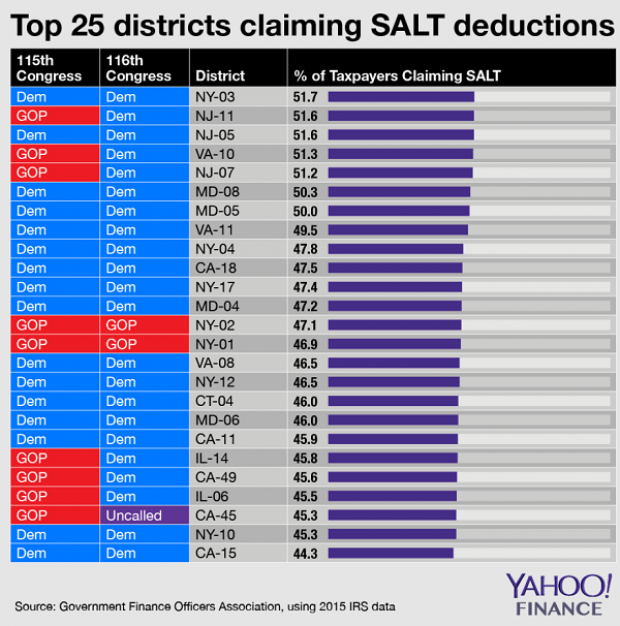

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

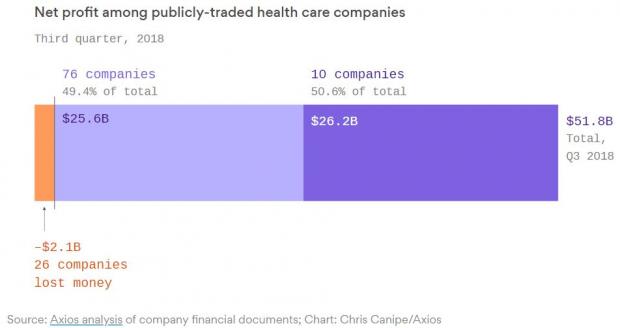

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

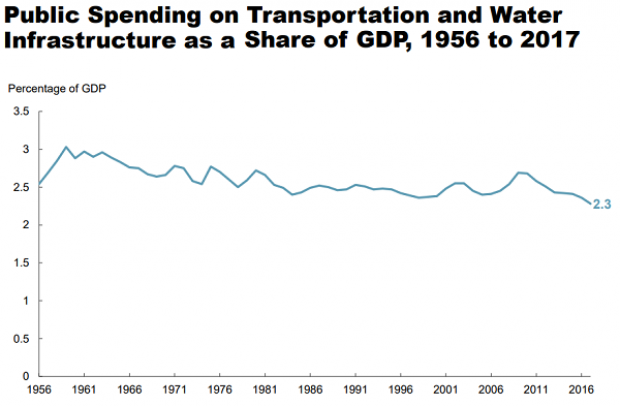

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.