Former CBO Chief: Congress Never Meant to Limit Obamacare Subsidies

A Supreme Court ruling expected this summer will determine whether the federal government can subsidize the insurance costs of individuals in states that did not establish their own health care exchanges under the Affordable Care Act.

Douglas Elmendorf was the director of the Congressional Budget Office when Congress debated the bill, and on Tuesday he provided some ammunition to backers of the law who insist that that Congress did not intend to prevent payments of subsidies to consumers in states using the federal exchange.

Related: How Obamacare Could Be Squeezing Consumer Spending

In an interview with CNBC’s John Harwood at the Peter G. Peterson Foundation’s 2015 Fiscal Summit*, Elmendorf said that before the ACA passed, the CBO analyzed the bill for members of Congress, many of whom were powerfully opposed to it. At the time, he said, there was a common understanding on Capitol Hill that the subsidies would be available to states regardless of the status of their exchanges.

“That analysis was subject to a lot of very intense scrutiny and a lot of questions,” he said. “My colleagues and I can remember no occasion on which anybody asked why we were expecting subsidies to be paid in all states regardless of whether they established exchanges or not. And if people had not had this common understanding…then I’m sure we would have had a lot of questions about that.”

Pressed by Harwood, Elmendorf added, “My colleagues and I talked to a lot of people, with a lot of questions about nearly every aspect of the analysis that we did…and we could not remember anybody asking us any questions about what would happen in the federal exchange different from what would happen in the state exchanges.”

Even so, the language of the law states that the subsidies would apply to exchanges “established by the State” and the Supreme Court will decide how literally those words must be interpreted.

*Pete Peterson also funds The Fiscal Times.

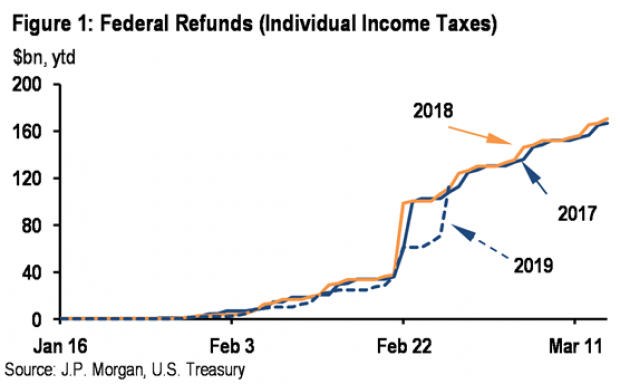

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

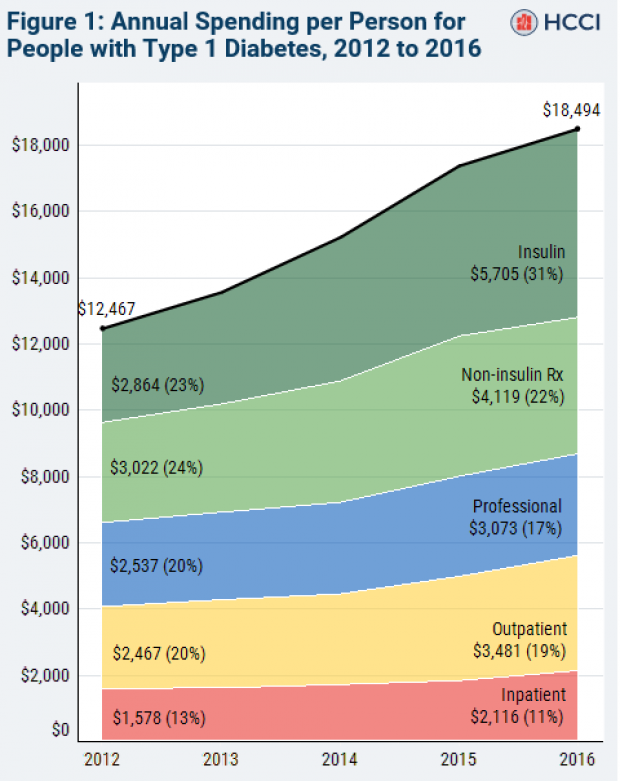

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

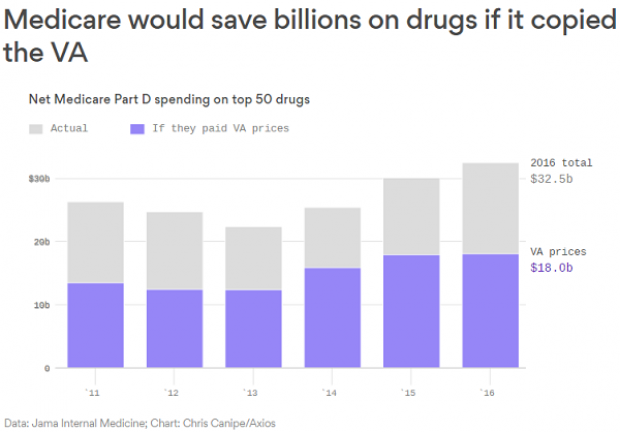

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.