Wrist Slap for CEO Who Defrauded USAID out of Hundreds of Millions

Former CEO Derish Wolff of Louis Berger Group, one of the country’s largest engineer contracting firms will be confined to his home for a year and have to pay a $4.5 million fine for helping to defraud the federal government out of hundreds of millions of dollars over 20 years. The fine represents a tiny fraction of the amount the company collected from the government.

Wolff, 70, was sentenced by U.S. District Court Judge Anne Thompson for leading a “conspiracy to defraud USAID by billing the agency on so-called ‘cost-reimbursable’ contracts—including hundreds of millions of dollars of contracts for reconstructive work in Iraq and Afghanistan” and for inflating overhead costs.

Related: U.S. Blew $500k on Melting Afghan Buildings

Federal prosecutors said the company, tasked with building roads and bridges in Afghanistan and Iraq, charged the government 140 percent of the actual cost for every project it did. That means that for every one dollar of work the contractor did, it received $1.40 extra. Louis Berger was paid more than $2 billon by the U.S. government for its infrastructure work in war zones.

Prosecutors said that between 1990 and 2009, Wolff and his colleagues inflated the costs of their work for USAID by telling accountants to “pad time sheets with hours ostensibly devoted to federal government projects when it had not actually worked on such projects.”

Related: Pentagon Won’t Verify $300 Million a Year in Afghanistan is Spent Properly

Beyond logging false work hours, the prosecutor said Wolff routinely instructed his subordinates to bill USAID for all of their overhead expenses—like rent at Louis Berger’s Washington office even though the D.C. office worked on other projects that had nothing to do with the federal government.

After two other company executives pleaded guilty to conspiring to defraud the federal government in 2010, Louis Berger Group agreed to make full restitution to USAID. It settled civil and criminal charges and had to pay $18.7 million in criminal fines and an additional $50.6 million to resolve allegations that it violated the False Claims Act by significantly overbilling USAID.

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

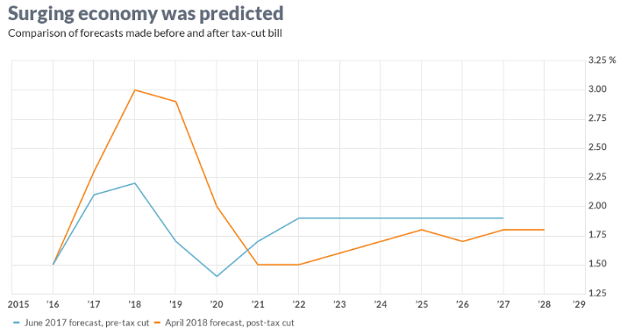

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

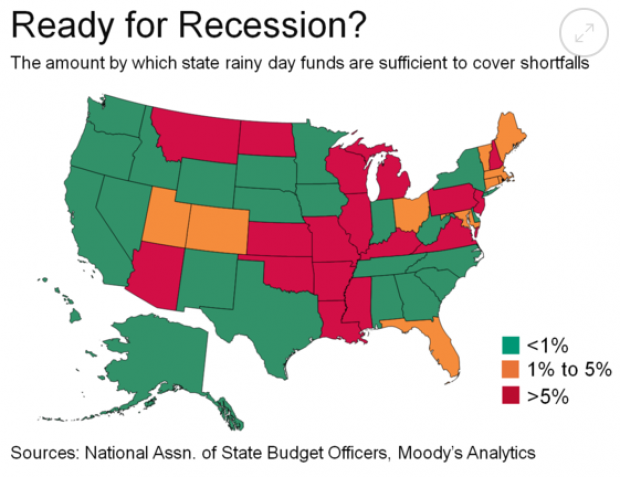

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

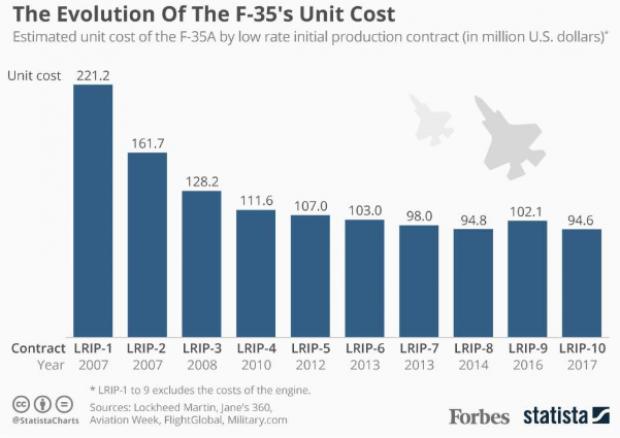

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.